Question: Please do the both questions as fast as possible. Thank you Exercise 10-14 Estimated warranties LO4 CHECK FIGURES: c. $15,470; d. $9,750 Shefford Cutlery extends

Please do the both questions as fast as possible. Thank you

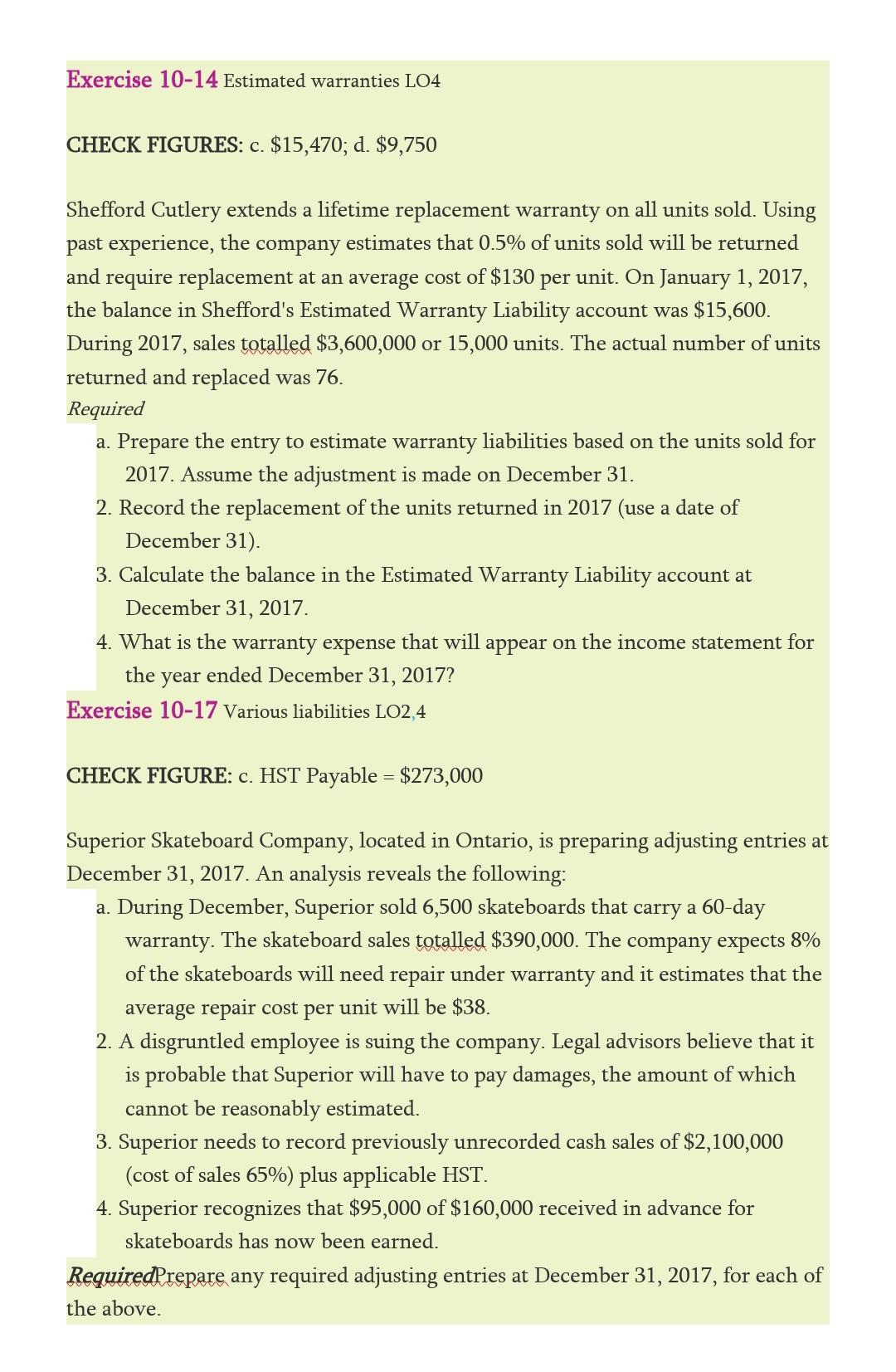

Exercise 10-14 Estimated warranties LO4 CHECK FIGURES: c. $15,470; d. $9,750 Shefford Cutlery extends a lifetime replacement warranty on all units sold. Using past experience, the company estimates that 0.5% of units sold will be returned and require replacement at an average cost of $130 per unit. On January 1, 2017, the balance in Shefford's Estimated Warranty Liability account was $15,600. During 2017, sales totalled $3,600,000 or 15,000 units. The actual number of units returned and replaced was 76. Required a. Prepare the entry to estimate warranty liabilities based on the units sold for 2017. Assume the adjustment is made on December 31. 2. Record the replacement of the units returned in 2017 (use a date of December 31). 3. Calculate the balance in the Estimated Warranty Liability account at December 31, 2017. 4. What is the warranty expense that will appear on the income statement for the year ended December 31, 2017? Exercise 10-17 Various liabilities LO2,4 CHECK FIGURE: c. HST Payable = $273,000 Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2017. An analysis reveals the following: a. During December, Superior sold 6,500 skateboards that carry a 60-day warranty. The skateboard sales totalled $390,000. The company expects 8% of the skateboards will need repair under warranty and it estimates that the average repair cost per unit will be $38. 2. A disgruntled employee is suing the company. Legal advisors believe that it is probable that Superior will have to pay damages, the amount of which cannot be reasonably estimated. 3. Superior needs to record previously unrecorded cash sales of $2,100,000 (cost of sales 65%) plus applicable HST. 4. Superior recognizes that $95,000 of $160,000 received in advance for skateboards has now been earned. RequiredPrepare any required adjusting entries at December 31, 2017, for each of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts