Question: please do the calculation by hand and explain briefly (do not use any software tool)! thanks The plant manager of a fiber optics company knows

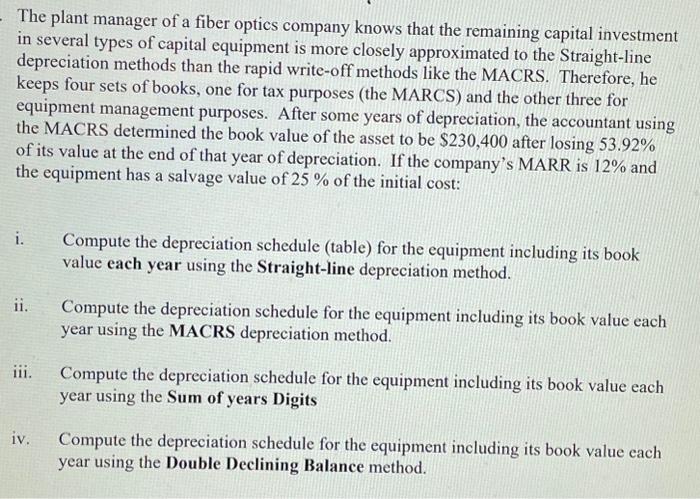

The plant manager of a fiber optics company knows that the remaining capital investment in several types of capital equipment is more closely approximated to the Straight-line depreciation methods than the rapid write-off methods like the MACRS. Therefore, he keeps four sets of books, one for tax purposes (the MARCS) and the other three for equipment management purposes. After some years of depreciation, the accountant using the MACRS determined the book value of the asset to be $230,400 after losing 53.92% of its value at the end of that year of depreciation. If the company's MARR is 12% and the equipment has a salvage value of 25% of the initial cost: i. Compute the depreciation schedule (table) for the equipment including its book value each year using the Straight-line depreciation method. ii. Compute the depreciation schedule for the equipment including its book value each year using the MACRS depreciation method. iii. Compute the depreciation schedule for the equipment including its book value each year using the Sum of years Digits iv. Compute the depreciation schedule for the equipment including its book value each year using the Double Declining Balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts