Question: Please do the calculation for each alternative. Explain each calculation in depth and describe each formula used Cost Basis Analysis Apartment B 15 $305,000 $500/monthly

Please do the calculation for each alternative. Explain each calculation in depth and describe each formula used

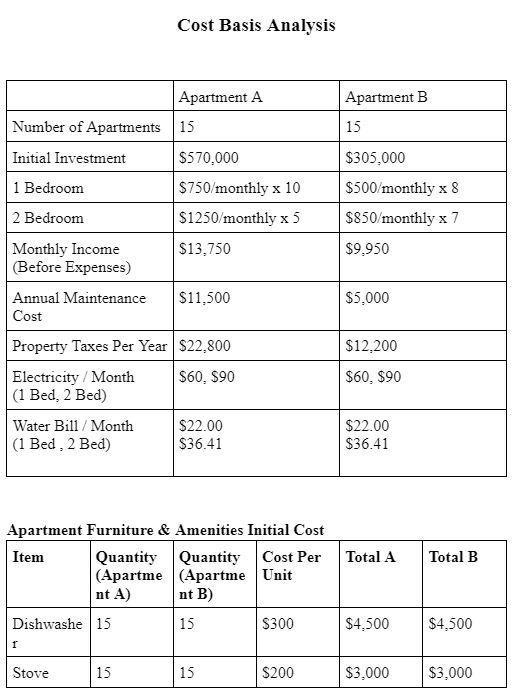

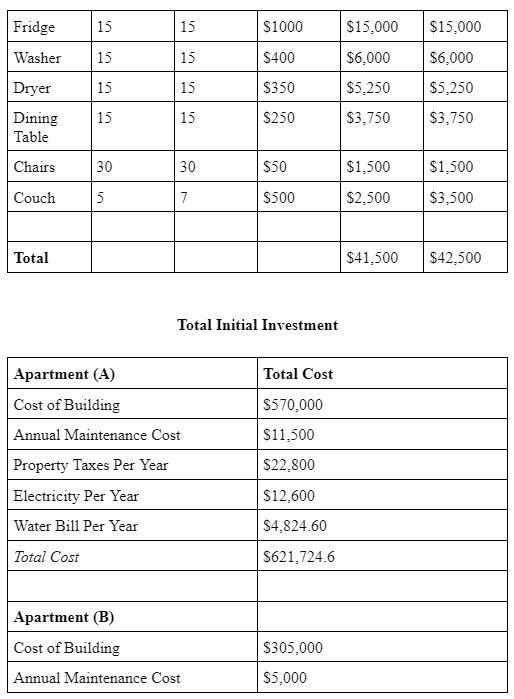

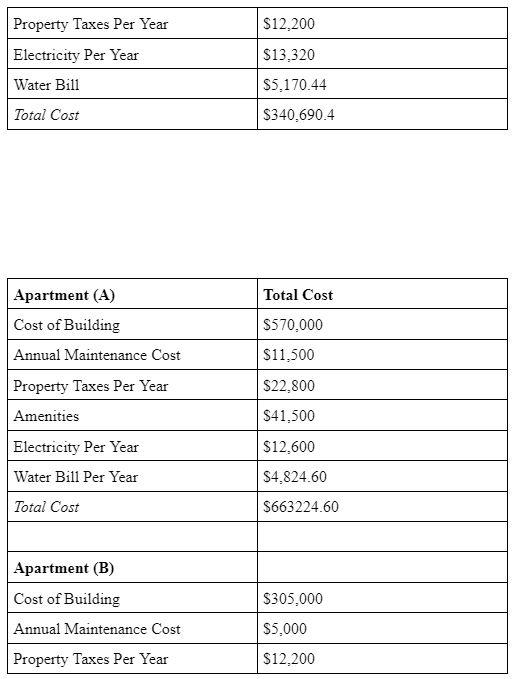

Cost Basis Analysis Apartment B 15 $305,000 $500/monthly x 8 $850/monthly x 7 $9.950 Apartment A Number of Apartments 15 Initial Investment $570,000 1 Bedroom $750/monthly x 10 2 Bedroom $1250/monthly x 5 Monthly Income $13,750 (Before Expenses) Annual Maintenance $11,500 Cost Property Taxes Per Year $22.800 Electricity / Month S60, $90 (1 Bed, 2 Bed) Water Bill/Month $22.00 (1 Bed, 2 Bed) $36.41 $5,000 $12,200 $60, $90 $22.00 $36.41 Total A Total B Apartment Furniture & Amenities Initial Cost Item Quantity Quantity Cost Per (Apartme (Apartme Unit nt A) nt B) Dishwashe 15 15 $300 $4.500 $4,500 1 Stove 15 15 $200 $3.000 $3,000 Fridge 15 15 $1000 $15,000 $15,000 Washer 15 15 $400 $6,000 $6,000 $5,250 15 15 $350 $5,250 Dryer Dining Table 15 15 $250 $3,750 $3,750 Chairs 30 30 $50 $1,500 $1,500 Couch 5 7 $500 $2,500 $3,500 Total $41,500 $42,500 Total Initial Investment Total Cost $570,000 $11,500 Apartment (A) Cost of Building Annual Maintenance Cost Property Taxes Per Year Electricity Per Year Water Bill Per Year Total Cost $22.800 $12.600 $4,824.60 5621,724.6 Apartment (B) Cost of Building $305,000 Annual Maintenance Cost $5,000 $12,200 Property Taxes Per Year Electricity Per Year Water Bill $13,320 $5.170.44 Total Cost $340,690.4 Total Cost $570,000 $11,500 Apartment (A) Cost of Building Annual Maintenance Cost Property Taxes Per Year Amenities Electricity Per Year Water Bill Per Year $22.800 $41,500 $12,600 S4.824.60 Total Cost S663224.60 Apartment (B) Cost of Building Annual Maintenance Cost $305,000 $5,000 Property Taxes Per Year $12.200 Alternative 1 Net Profit in 10, 20, 30 years for both complexes A and B if loan is paid off in 5 years with an MARR of 8%. For both complexes the annual costs will include the annual maintenance. property taxes per year, annual electricity payments, and annual water payments. For Example, Alternative A involves paying off the initial investment in 5 years using capital recovery to determine how much the initial investment costs per pay period. Calculate these values. Alternative 2 Calculate the Net Profit in 10, 20, 30 years for both complexes A and B if loan is paid off in 15 years with an MARR of 8%. For both complexes the annual costs will include the annual maintenance, property taxes per year, annual electricity payments, and annual water payments. Alternative 3 Calculate the Net Profit in 10. 20.30 years for both complexes A and B if the loan is paid off in 10 years with an MARR of 8%, however the company will pay for amenities and have tenants pay for electricity and water. Cost Basis Analysis Apartment B 15 $305,000 $500/monthly x 8 $850/monthly x 7 $9.950 Apartment A Number of Apartments 15 Initial Investment $570,000 1 Bedroom $750/monthly x 10 2 Bedroom $1250/monthly x 5 Monthly Income $13,750 (Before Expenses) Annual Maintenance $11,500 Cost Property Taxes Per Year $22.800 Electricity / Month S60, $90 (1 Bed, 2 Bed) Water Bill/Month $22.00 (1 Bed, 2 Bed) $36.41 $5,000 $12,200 $60, $90 $22.00 $36.41 Total A Total B Apartment Furniture & Amenities Initial Cost Item Quantity Quantity Cost Per (Apartme (Apartme Unit nt A) nt B) Dishwashe 15 15 $300 $4.500 $4,500 1 Stove 15 15 $200 $3.000 $3,000 Fridge 15 15 $1000 $15,000 $15,000 Washer 15 15 $400 $6,000 $6,000 $5,250 15 15 $350 $5,250 Dryer Dining Table 15 15 $250 $3,750 $3,750 Chairs 30 30 $50 $1,500 $1,500 Couch 5 7 $500 $2,500 $3,500 Total $41,500 $42,500 Total Initial Investment Total Cost $570,000 $11,500 Apartment (A) Cost of Building Annual Maintenance Cost Property Taxes Per Year Electricity Per Year Water Bill Per Year Total Cost $22.800 $12.600 $4,824.60 5621,724.6 Apartment (B) Cost of Building $305,000 Annual Maintenance Cost $5,000 $12,200 Property Taxes Per Year Electricity Per Year Water Bill $13,320 $5.170.44 Total Cost $340,690.4 Total Cost $570,000 $11,500 Apartment (A) Cost of Building Annual Maintenance Cost Property Taxes Per Year Amenities Electricity Per Year Water Bill Per Year $22.800 $41,500 $12,600 S4.824.60 Total Cost S663224.60 Apartment (B) Cost of Building Annual Maintenance Cost $305,000 $5,000 Property Taxes Per Year $12.200 Alternative 1 Net Profit in 10, 20, 30 years for both complexes A and B if loan is paid off in 5 years with an MARR of 8%. For both complexes the annual costs will include the annual maintenance. property taxes per year, annual electricity payments, and annual water payments. For Example, Alternative A involves paying off the initial investment in 5 years using capital recovery to determine how much the initial investment costs per pay period. Calculate these values. Alternative 2 Calculate the Net Profit in 10, 20, 30 years for both complexes A and B if loan is paid off in 15 years with an MARR of 8%. For both complexes the annual costs will include the annual maintenance, property taxes per year, annual electricity payments, and annual water payments. Alternative 3 Calculate the Net Profit in 10. 20.30 years for both complexes A and B if the loan is paid off in 10 years with an MARR of 8%, however the company will pay for amenities and have tenants pay for electricity and water

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts