Question: please do the entire question with shows working process included formula. Thank you. Qucfeston 6 To expand its business, Genting factory would like to issue

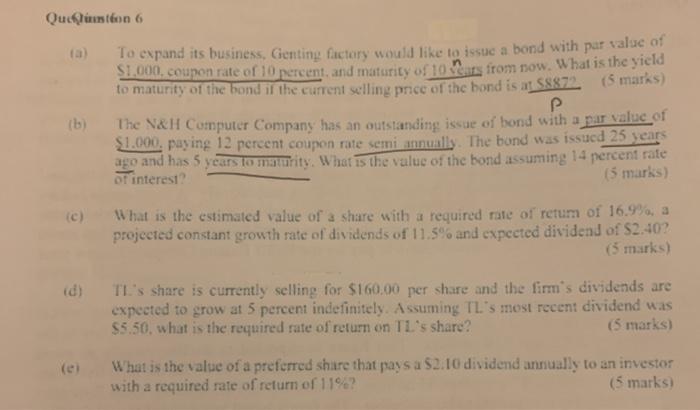

Qucfeston 6 To expand its business, Genting factory would like to issue a bond with par value of $1,000. coupon rate of 10 percent, and maturity of 10 us from now. What is the yield to maturity of the bond if the current selling price of the hond is at 88872 (5 marks) The V&H Computer Company has an outstanding issue of bond with a par value of $1.000 paying 12 percent coupon rate semi annually. The bond was issued 25 years ago and has 5 years to maturity. What is the value of the bond assuming 14 percent rate of interest (5 marks) 1b (c) What is the estimated value of a share with a required rate of retum of 16.9%, a projected constant growth rate of dividends of 11.5% and expected dividend of $2.40? 5 marks) id) TL's share is currently selling for $160,00 per share and the firm's dividends are expected to grow at 5 percent indefinitely. Assuming TL's most recent dividend was $5.50, what is the required rate of return on TL's share? (5 marks) (e What is the value of a preferred share that pays a $2.10 dividend annually to an investor with a required rate of return of 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts