Question: please do the entry that i can put in Sage... 9 correct entried intoday for all the transactions Assignment #1 - Chapters 2 to 4

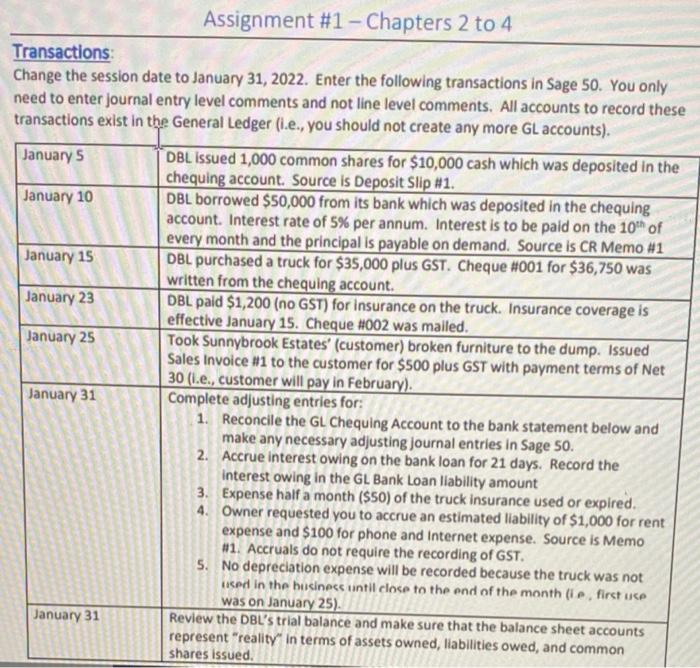

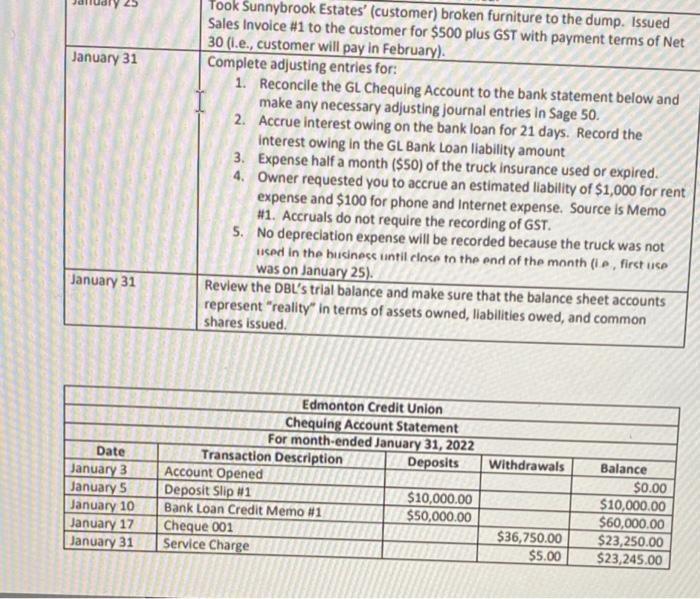

Assignment #1 - Chapters 2 to 4 Transactions Change the session date to January 31, 2022. Enter the following transactions in Sage 50. You only need to enter journal entry level comments and not line level comments. All accounts to record these transactions exist in the General Ledger (.e., you should not create any more GL accounts). January 5 DBL issued 1,000 common shares for $10,000 cash which was deposited in the chequing account. Source is Deposit Slip #1. January 10 DBL borrowed $50,000 from its bank which was deposited in the chequing account. Interest rate of 5% per annum. Interest is to be paid on the 10th of every month and the principal is payable on demand. Source is CR Memo #1 January 15 DBL purchased a truck for $35,000 plus GST. Cheque #001 for $36,750 was written from the chequing account. January 23 DBL paid $1,200 (no GST) for insurance on the truck. Insurance coverage is effective January 15. Cheque #002 was mailed. January 25 Took Sunnybrook Estates' (customer) broken furniture to the dump. Issued Sales Invoice #1 to the customer for $500 plus GST with payment terms of Net 30 (l.e., customer will pay in February). January 31 Complete adjusting entries for: 1. Reconcile the GL Chequing Account to the bank statement below and make any necessary adjusting journal entries in Sage 50. 2. Accrue interest owing on the bank loan for 21 days. Record the interest owing in the GL Bank Loan liability amount 3. Expense half a month (550) of the truck insurance used or expired. 4. Owner requested you to accrue an estimated liability of $1,000 for rent expense and $100 for phone and Internet expense. Source is Memo #1. Accruals do not require the recording of GST. 5. No depreciation expense will be recorded because the truck was not used in the business until close to the end of the month (ie, first use was on January 25). January 31 Review the DBL's trial balance and make sure that the balance sheet accounts represent "reality in terms of assets owned, liabilities owed, and common shares issued. January 31 Took Sunnybrook Estates' (customer) broken furniture to the dump. Issued Sales Invoice #1 to the customer for $500 plus GST with payment terms of Net 30 (l.e., customer will pay in February). Complete adjusting entries for: 1. Reconcile the GL Chequing Account to the bank statement below and make any necessary adjusting journal entries in Sage 50. 2. Accrue interest owing on the bank loan for 21 days. Record the interest owing in the GL Bank Loan liability amount 3. Expense half a month (550) of the truck Insurance used or expired. 4. Owner requested you to accrue an estimated liability of $1,000 for rent expense and $100 for phone and Internet expense. Source is Memo #1. Accruals do not require the recording of GST. 5. No depreciation expense will be recorded because the truck was not used in the business until close to the end of the month (ie, first use was on January 25). Review the DBL's trial balance and make sure that the balance sheet accounts represent "reality in terms of assets owned, liabilities owed, and common shares issued January 31 Withdrawals Date January 3 January January 10 January 17 January 31 Edmonton Credit Union Chequing Account Statement For month-ended January 31, 2022 Transaction Description Deposits Account Opened Deposit Slip #11 $10,000.00 Bank Loan Credit Memo #1 $50,000.00 Cheque 001 Service Charge Balance $0.00 $10,000.00 $60,000.00 $23,250.00 $23,245.00 $36,750.00 $5.00 Assignment #1 - Chapters 2 to 4 Transactions Change the session date to January 31, 2022. Enter the following transactions in Sage 50. You only need to enter journal entry level comments and not line level comments. All accounts to record these transactions exist in the General Ledger (.e., you should not create any more GL accounts). January 5 DBL issued 1,000 common shares for $10,000 cash which was deposited in the chequing account. Source is Deposit Slip #1. January 10 DBL borrowed $50,000 from its bank which was deposited in the chequing account. Interest rate of 5% per annum. Interest is to be paid on the 10th of every month and the principal is payable on demand. Source is CR Memo #1 January 15 DBL purchased a truck for $35,000 plus GST. Cheque #001 for $36,750 was written from the chequing account. January 23 DBL paid $1,200 (no GST) for insurance on the truck. Insurance coverage is effective January 15. Cheque #002 was mailed. January 25 Took Sunnybrook Estates' (customer) broken furniture to the dump. Issued Sales Invoice #1 to the customer for $500 plus GST with payment terms of Net 30 (l.e., customer will pay in February). January 31 Complete adjusting entries for: 1. Reconcile the GL Chequing Account to the bank statement below and make any necessary adjusting journal entries in Sage 50. 2. Accrue interest owing on the bank loan for 21 days. Record the interest owing in the GL Bank Loan liability amount 3. Expense half a month (550) of the truck insurance used or expired. 4. Owner requested you to accrue an estimated liability of $1,000 for rent expense and $100 for phone and Internet expense. Source is Memo #1. Accruals do not require the recording of GST. 5. No depreciation expense will be recorded because the truck was not used in the business until close to the end of the month (ie, first use was on January 25). January 31 Review the DBL's trial balance and make sure that the balance sheet accounts represent "reality in terms of assets owned, liabilities owed, and common shares issued. January 31 Took Sunnybrook Estates' (customer) broken furniture to the dump. Issued Sales Invoice #1 to the customer for $500 plus GST with payment terms of Net 30 (l.e., customer will pay in February). Complete adjusting entries for: 1. Reconcile the GL Chequing Account to the bank statement below and make any necessary adjusting journal entries in Sage 50. 2. Accrue interest owing on the bank loan for 21 days. Record the interest owing in the GL Bank Loan liability amount 3. Expense half a month (550) of the truck Insurance used or expired. 4. Owner requested you to accrue an estimated liability of $1,000 for rent expense and $100 for phone and Internet expense. Source is Memo #1. Accruals do not require the recording of GST. 5. No depreciation expense will be recorded because the truck was not used in the business until close to the end of the month (ie, first use was on January 25). Review the DBL's trial balance and make sure that the balance sheet accounts represent "reality in terms of assets owned, liabilities owed, and common shares issued January 31 Withdrawals Date January 3 January January 10 January 17 January 31 Edmonton Credit Union Chequing Account Statement For month-ended January 31, 2022 Transaction Description Deposits Account Opened Deposit Slip #11 $10,000.00 Bank Loan Credit Memo #1 $50,000.00 Cheque 001 Service Charge Balance $0.00 $10,000.00 $60,000.00 $23,250.00 $23,245.00 $36,750.00 $5.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts