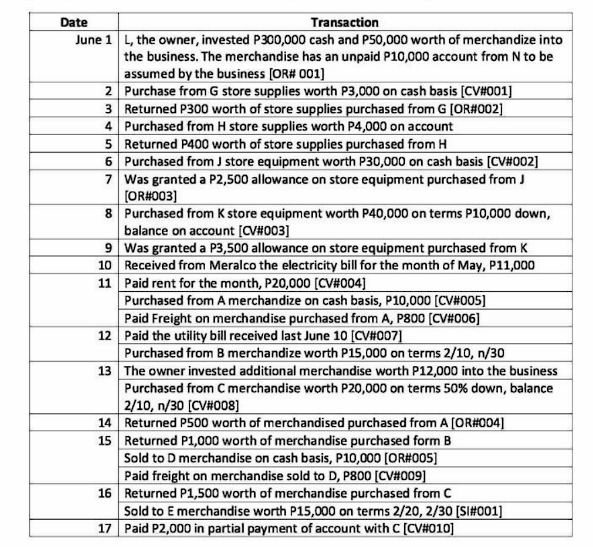

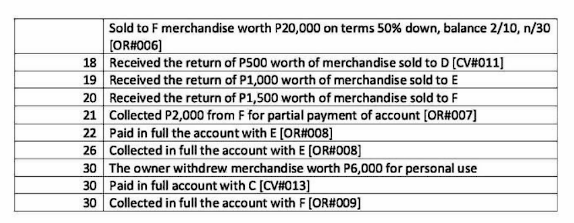

Question: PLEASE DO THE INSTRUCTIONS. Date Transaction June 1 |L, the owner, invested P300,000 cash and P50,000 worth of merchandise into the business. The merchandise has

PLEASE DO THE INSTRUCTIONS.

![business [OR# 001] 2 Purchase from G store supplies worth P3,000 on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673612f9e73ef_049673612f9a6333.jpg)

![cash basis [CV#001] 3 Returned P300 worth of store supplies purchased from](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673612faef397_050673612fad271e.jpg)

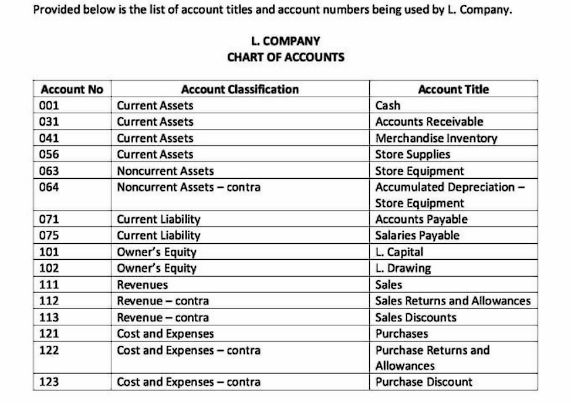

Date Transaction June 1 |L, the owner, invested P300,000 cash and P50,000 worth of merchandise into the business. The merchandise has an unpaid P10,000 account from N to be assumed by the business [OR# 001] 2 Purchase from G store supplies worth P3,000 on cash basis [CV#001] 3 Returned P300 worth of store supplies purchased from G [OR#002] 4 Purchased from H store supplies worth P4,000 on account 5 Returned P400 worth of store supplies purchased from H 6 Purchased from J store equipment worth P30,000 on cash basis [CV#002] 7 Was granted a P2,500 allowance on store equipment purchased from J [OR#003] Purchased from K store equipment worth P40,000 on terms P10,000 down, balance on account [CV#003] 9 Was granted a P3,500 allowance on store equipment purchased from K 10 Received from Meralco the electricity bill for the month of May, P11,000 11 Paid rent for the month, P20,000 [CV#004] Purchased from A merchandise on cash basis, P10,000 [CV#005] Paid Freight on merchandise purchased from A, P800 [CV#006] 12 Paid the utility bill received last June 10 [CV#007] Purchased from B merchandise worth P15,000 on terms 2/10, n/30 13 The owner invested additional merchandise worth P12,000 into the business Purchased from C merchandise worth P20,000 on terms 50% down, balance 2/10, n/30 [CV#008] 14 |Returned P500 worth of merchandised purchased from A [OR#004] 15 Returned P1,000 worth of merchandise purchased form B Sold to D merchandise on cash basis, P10,000 [OR#005] Paid freight on merchandise sold to D, P800 [CV#009] 16 Returned P1,500 worth of merchandise purchased from C Sold to E merchandise worth P15,000 on terms 2/20, 2/30 [SI#001] 17 Paid P2,000 in partial payment of account with C [CV#010]Sold to F merchandise worth P20,000 on terms 50% down, balance 2/10, n/30 [OR#006] 18 Received the return of P500 worth of merchandise sold to D [CV#011] 19 Received the return of P1,000 worth of merchandise sold to E 20 Received the return of P1,500 worth of merchandise sold to F 21 Collected P2,000 from F for partial payment of account [OR#007] 22 Paid in full the account with E [OR#008] 26 Collected in full the account with E [OR#008] 30 The owner withdrew merchandise worth P6,000 for personal use 30 Paid in full account with C [CV#013] 30 Collected in full the account with F [OR#009]Provided below is the list of account titles and account numbers being used by L. Company. L. COMPANY CHART OF ACCOUNTS Account No Account Classification Account Title 001 Current Assets Cash 031 Current Assets Accounts Receivable 041 Current Assets Merchandise Inventory 056 Current Assets Store Supplies 063 Noncurrent Assets Store Equipment 064 Noncurrent Assets - contra Accumulated Depreciation - Store Equipment 071 Current Liability Accounts Payable 075 Current Liability Salaries Payable 101 Owner's Equity L. Capital 102 Owner's Equity L. Drawing 111 Revenues Sales 112 Revenue - contra Sales Returns and Allowances 113 Revenue - contra Sales Discounts 121 Cost and Expenses Purchases 122 Cost and Expenses - contra Purchase Returns and Allowances 123 Cost and Expenses - contra Purchase Discount125 Cost and Expenses Freight-in 131 Cost and Expenses Utilities Expense 132 Cost and Expenses Salaries Expense 133 Cost and Expenses Rent Expense 137 Cost and Expenses Store Supplies and Expense 139 Cost and Expenses Freight-out 141 Cost and Expenses Depreciation Expense - Store Equipment 180 Others Income Summary Note: The chart shown here contains only selected accounts. The account number or codes does not necessarily have to start with "1" or "A" but should be chronologically arranged based on financial statements order (current asset, non-current asset, current liability, noncurrent liability, owner's equity, revenue, cost and expense, and others)INSTRUCTIONS: 1. Journalize the above transactions in the books of L. Company (the business) for the month of June 2019. The company uses special journals and a general journal. 2. Post the transactions to the appropriate subsidiary ledgers and general ledgers. 3. Prepare the Trial Balance for L. Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts