Question: please do the journal enteries / debit / credit Laker Incorporated's fiscal year-end is December 31, 2024. The following is an adjusted trial balance as

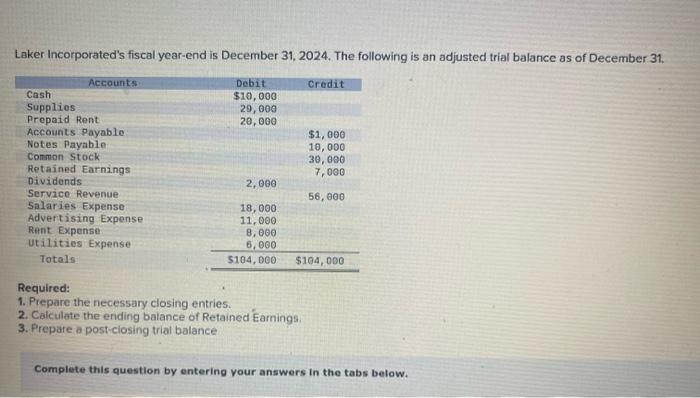

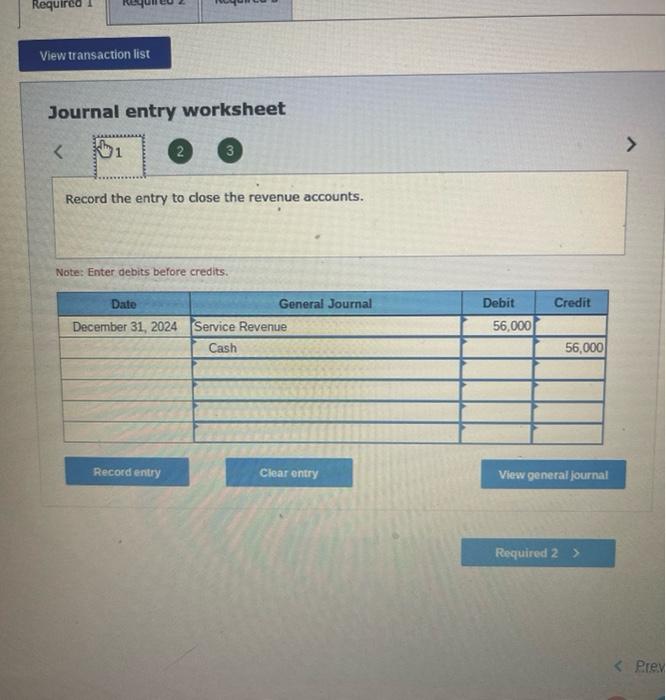

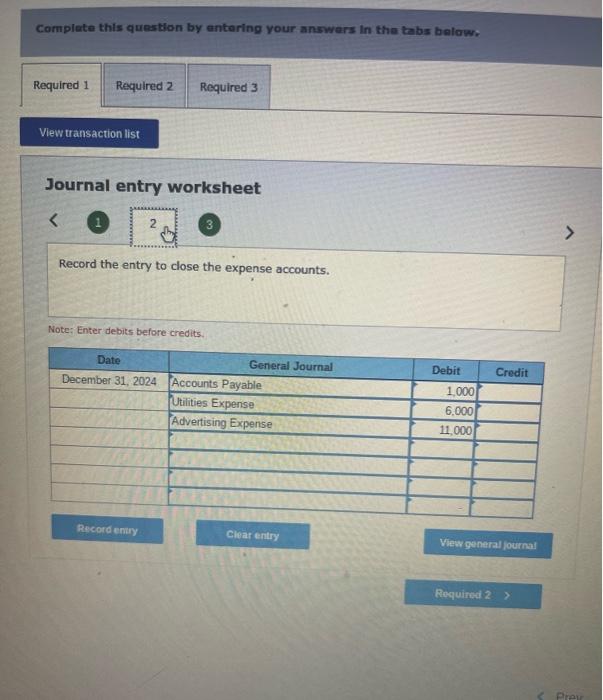

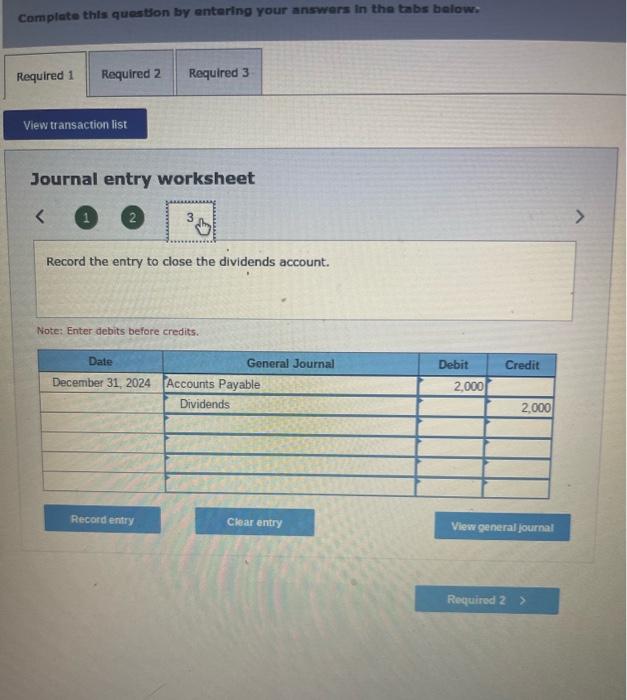

Laker Incorporated's fiscal year-end is December 31, 2024. The following is an adjusted trial balance as of December 31 , Required: 1. Prepare the necessary closing entries. 2. Calculate the ending balance of Retained Earnings. 3. Prepare a post-ciosing trial balance Complete this question by entering your answers in the tabs below. Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Complate this questlon by entaring your answers in the tabs below: Journal entry worksheet Record the entry to close the expense accounts. Note; Enter debits before credits. Camplate this queatbon by antaring your answers in tha tabs bolow: Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Laker Incorporated's fiscal year-end is December 31, 2024. The following is an adjusted trial balance as of December 31 , Required: 1. Prepare the necessary closing entries. 2. Calculate the ending balance of Retained Earnings. 3. Prepare a post-ciosing trial balance Complete this question by entering your answers in the tabs below. Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Complate this questlon by entaring your answers in the tabs below: Journal entry worksheet Record the entry to close the expense accounts. Note; Enter debits before credits. Camplate this queatbon by antaring your answers in tha tabs bolow: Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts