Question: please do the journal entry Partial balance sheets and additional information are listed below for Funk Company. Funk Company Partial Balance Sheets as of December

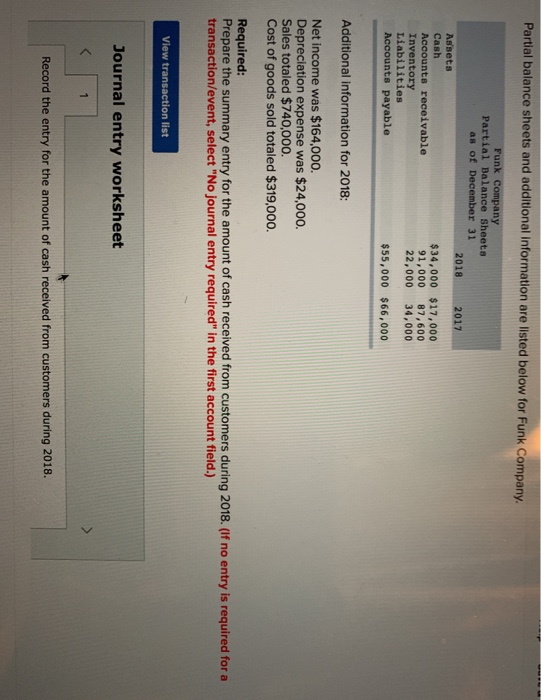

Partial balance sheets and additional information are listed below for Funk Company. Funk Company Partial Balance Sheets as of December 31 2018 2017 Assets $34,000 $17,000 91,000 22,000 Cash Accounts receivable 87,600 34,000 Inventory Liabilities Accounts payable $55,000 $66,000 Additional information for 2018: Net income was $164,000. Depreciation expense was $24,000. Sales totaled $740,000. Cost of goods sold totaled $319,000 Required: Prepare the summary entry for the amount of cash received from customers during 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the entry for the amount of cash received from customers during 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts