Question: Please do the Question 2 Residential buildings 2. Mid- Quarter vs. Half-Year Convention. (Obi. 1) A calendar-year taxpayer acquired four new machines in 2016 on

Please do the Question 2

Please do the Question 2

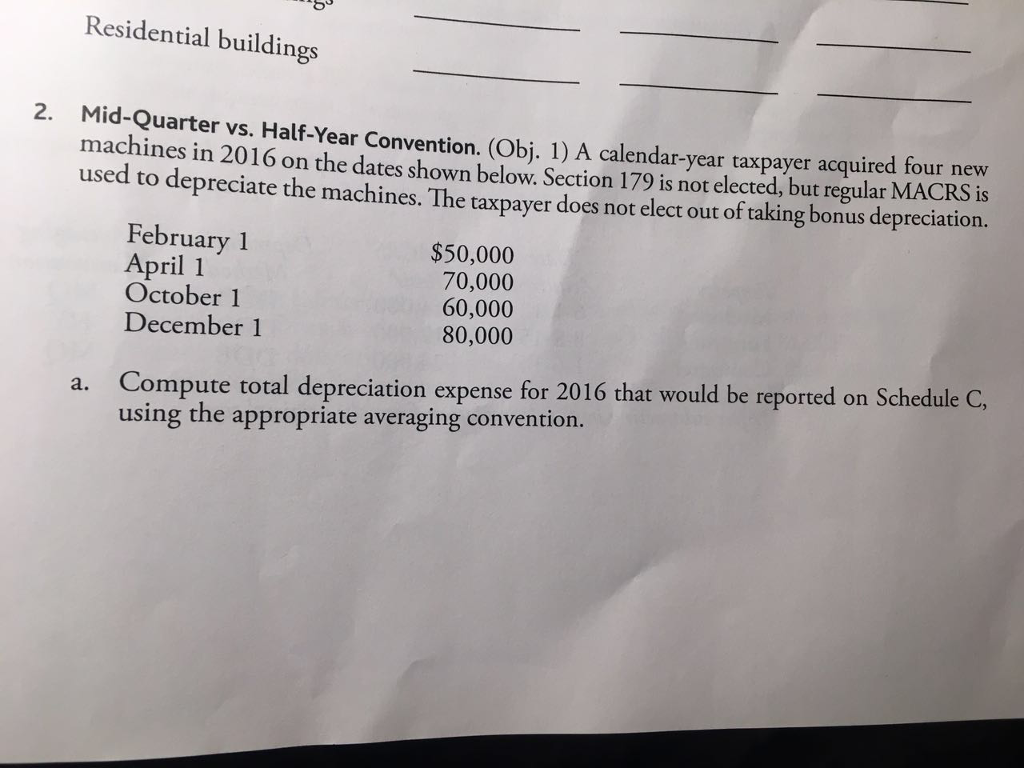

Residential buildings 2. Mid- Quarter vs. Half-Year Convention. (Obi. 1) A calendar-year taxpayer acquired four new machines in 2016 on the dates shown below. Section 179 is not electd, but regular MACRS is used to depreciate the machines. The taxpayer does not elect out of taking bonus depreciation. February 1 April 1 October1 December 1 $50,000 70,000 60,000 80,000 a. Compute total depreciation expense for 2016 that would be reported on Schedule C using the appropriate averaging convention

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock