Question: please do the question without Excel. please show your work. c. Explain why your answers in (a) and (b) are ditterent. 13. Problems with IRR

please do the question without Excel. please show your work.

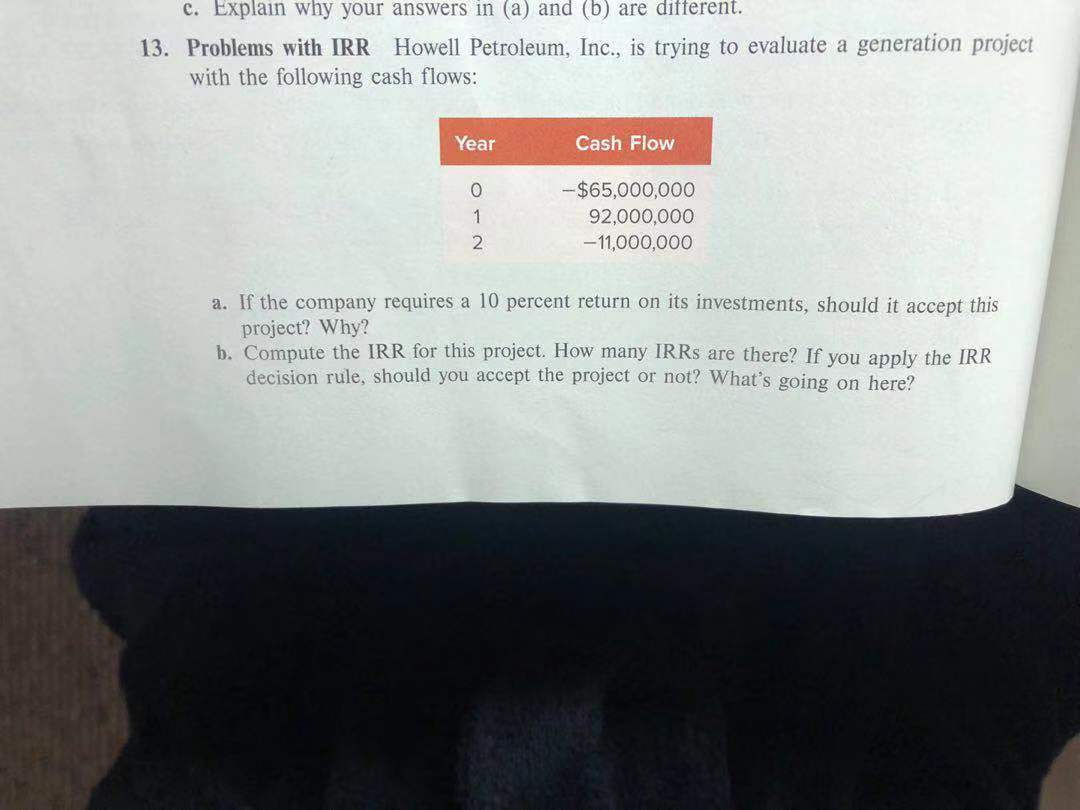

c. Explain why your answers in (a) and (b) are ditterent. 13. Problems with IRR Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Year Cash Flow - $65,000,000 92,000,000 - 11,000,000 a. If the company requires a 10 percent return on its investments, should it accept this project? Why? b. Compute the IRR for this project. How many IRRs are there? If you apply the IRR decision rule, should you accept the project or not? What's going on here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts