Question: please do the same table for LIFO as well. read the requirments pic. Assume that R K Toys store purchased and sold a line of

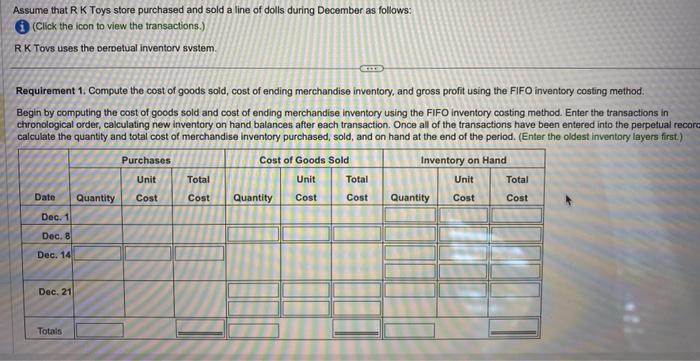

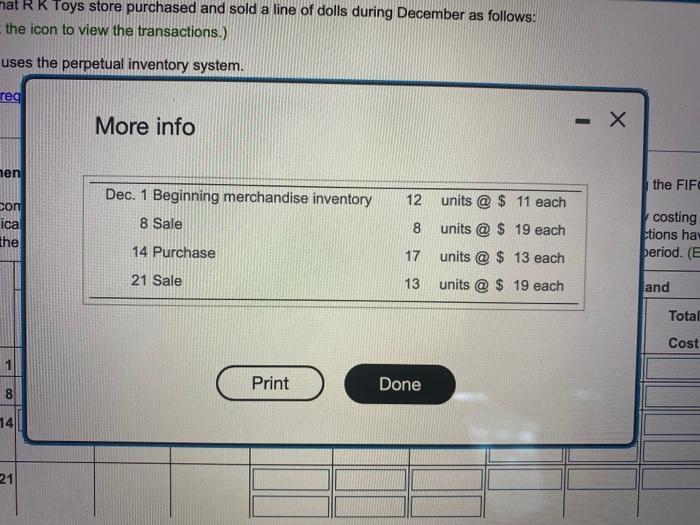

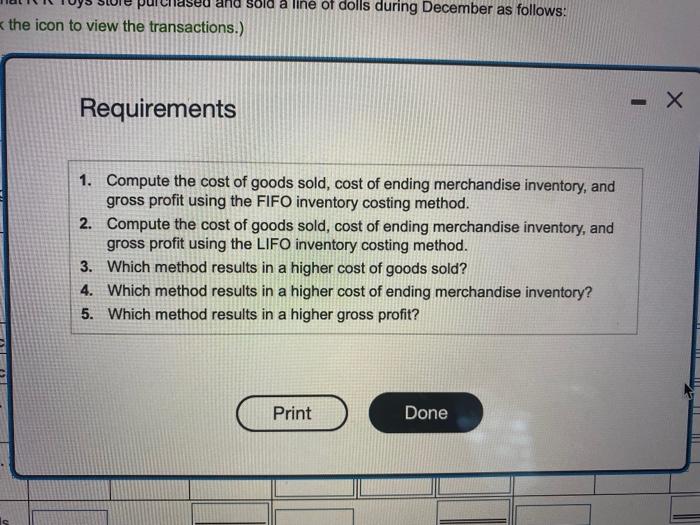

Assume that R K Toys store purchased and sold a line of dolls during December as follows: 1. (Click the icon to view the transactions.) RK Tovs uses the Derpetual inventorv svstem. Requirement 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method: Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual recon calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) nat R K Toys store purchased and sold a line of dolls during December as follows: the icon to view the transactions.) uses the perpetual inventory system. the icon to view the transactions.) Requirements 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? 4. Which method results in a higher cost of ending merchandise inventory? 5. Which method results in a higher gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts