Question: please do the ten journal entries for both years. (entry S A I D E) thanks..... Check Chapman Company obtains 100 percent of Abernethy Company's

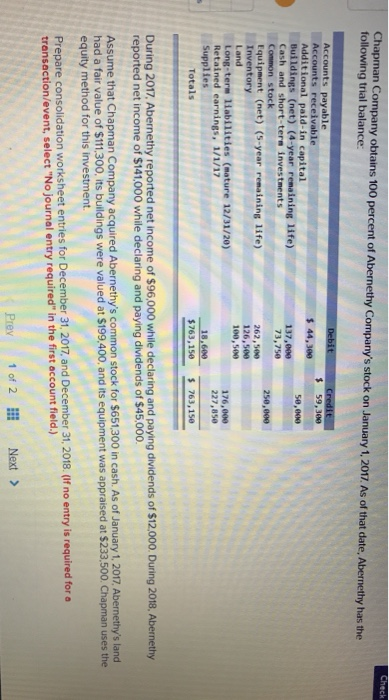

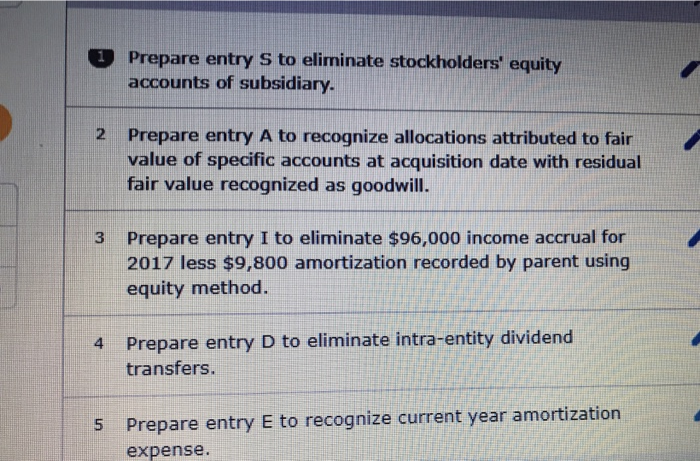

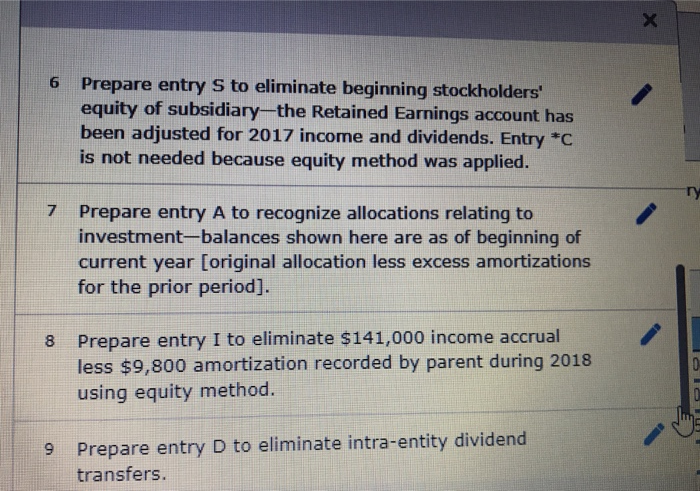

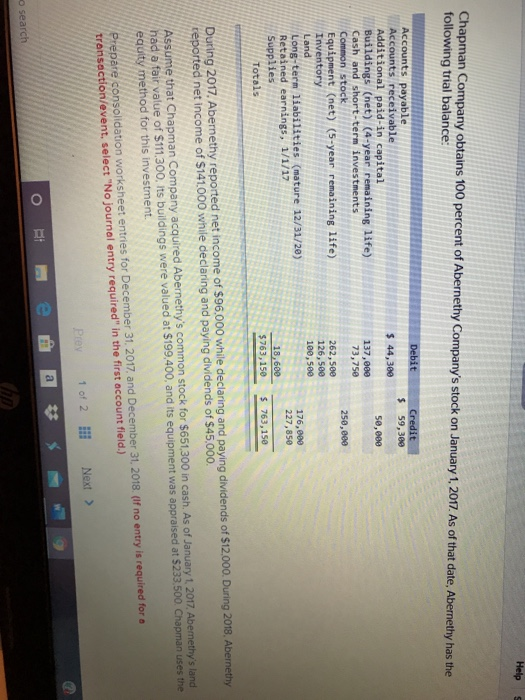

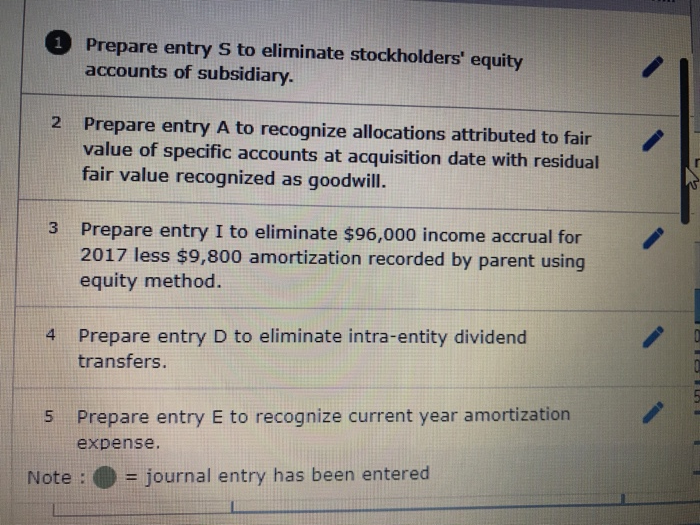

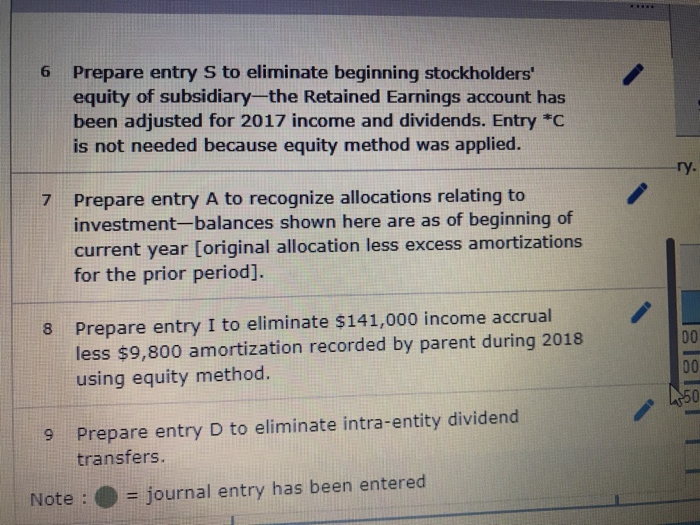

Check Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date. Abernethy has the following trial balance Credit 59,30 $ $ 44,300 50,000 137.ee 73,750 250,000 Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 262,569 126,500 100,500 176,000 227,850 18,600 $763,150 $763,150 During 2017, Abernethy reported net income of $96,000 while declaring and paying dividends of $12,000. During 2018, Abernethy reported net income of $141,000 while declaring and paying dividends of $45,000 Assume that Chapman Company acquired Abernethy's common stock for $651,300 in cash. As of January 1, 2017. Abernethy's land had a fair value of $111,300, its buildings were valued at $199,400, and its equipment was appraised at $233,500. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2017, and December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Prey 1 of 2 ! Next > Prepare entry s to eliminate stockholders' equity accounts of subsidiary. 2 Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. 3 Prepare entry I to eliminate $96,000 income accrual for 2017 less $9,800 amortization recorded by parent using equity method. 4 Prepare entry D to eliminate intra-entity dividend transfers. 5 Prepare entry E to recognize current year amortization expense. 6 Prepare entry S to eliminate beginning stockholders' equity of subsidiary-the Retained Earnings account has been adjusted for 2017 income and dividends. Entry *C is not needed because equity method was applied. Prepare entry A to recognize allocations relating to investment-balances shown here are as of beginning of current year (original allocation less excess amortizations for the prior period). 8 Prepare entry I to eliminate $141,000 income accrual less $9,800 amortization recorded by parent during 2018 using equity method. 9 Prepare entry D to eliminate intra-entity dividend transfers. 10 Prepare entry E to recognize current year amortization expense. Help Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date, Abernethy has the following trial balance: Debit Credit 59,380 $ $ 44,300 50,000 137,000 73,750 250,000 Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 262,500 126,500 100, 500 176,000 227,850 18,600 $763,150 $763,150 During 2017. Abernethy reported net income of $96,000 while declaring and paying dividends of $12,000. During 2018. Abernethy reported net income of $141.000 while declaring and paying dividends of $45,000. Assume that Chapman Company acquired Abernethy's common stock for $651.300 in cash. As of January 1, 2017. Abemethy's land had a fait value of $1,300. Its buildings were valued at $199.400, and its equipment was appraised at $233 500 Chapman uses me equity method for this investment. Prepare consolidation worksheet entries for December 31, 2017 and December 31, 2018. (If no entry is required for o transaction/event, select "No journal entry required in the first account field.) Prev 1 of 2 # Next > o search 1 Dr Prepare entry S to eliminate stockholders' equity accounts of subsidiary. 2 Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. Prepare entry I to eliminate $96,000 income accrual for 2017 less $9,800 amortization recorded by parent using equity method. 4. Prepare entry D to eliminate intra-entity dividend transfers. 5 Prepare entry E to recognize current year amortization expense. Note : = journal entry has been entered 6 D Prepare entry S to eliminate beginning stockholders' equity of subsidiary-the Retained Earnings account has been adjusted for 2017 income and dividends. Entry *C is not needed because equity method was applied. Prepare entry A to recognize allocations relating to investment-balances shown here are as of beginning of current year (original allocation less excess amortizations for the prior period]. 8 Prepare entry I to eliminate $141,000 income accrual less $9,800 amortization recorded by parent during 2018 using equity method. 18181 9 Prepare entry D to eliminate intra-entity dividend transfers. Note : = journal entry has been entered 10 Prepare entry E to recognize current year amortization expense. Note : = journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts