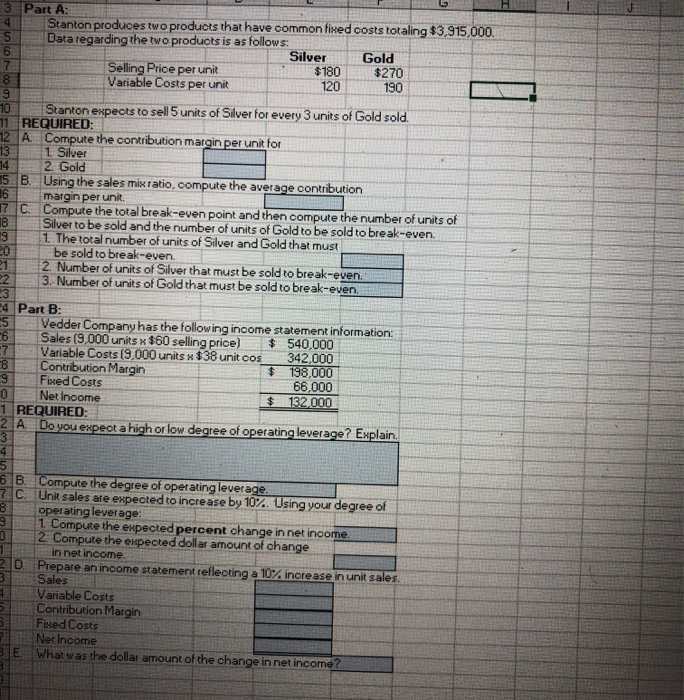

Question: please do the whole thing :) just need whats in the blue boxes :) ill thumb up ! 5 9 1 3 Part A 4

5 9 1 3 Part A 4 Stanton produces two products that have common fixed costs totaling $3,915,000 Data regarding the two products is as follows: 6 Silver Gold 7 Selling Price per unit $180 $270 8 Variable Costs per unit 120 190 9 10 Stanton expects to sell 5 units of Silver for every 3 units of Gold sold. 11 REQUIRED: 12 A Compute the contribution margin per unit for 13 1 Silver 14 2 Gold 15 B. Using the sales mix ratio, compute the average contribution 16 margin per unit. 17 C. Compute the total break-even point and then compute the number of units of 8 Silver to be sold and the number of units of Gold to be sold to break-even 1 The total number of units of Silver and Gold that must 20 be sold to break-even. 2. Number of units of Silver that must be sold to break-even. 3. Number of units of Gold that must be sold to break-even. 23 24 Part B: Vedder Company has the following income statement information: 6 Sales (9,000 units x $60 selling price) $ 540,000 27 Variable Costs (9,000 units x $38 unit cos 342,000 Contribution Margin $ 198,000 9 Fixed Costs 66,000 Net Income $ 132.000 1 REQUIRED: 2. A. Do you expect a high or low degree of operating leverage? Explain 3 4 5 6 B. Compute the degree of operating leverage. 7. C. Unikt sales are expected to increase by 10%. Using your degree of operating leverage: 1 Compute the expected percent change in net income. B 2. Compute the expected dollar amount of change in net income. 20. Prepare an income statement reflecting a 10% increase in unit sales. Sales Variable Costs Contribution Margin Fixed Costs Net Income BE What was the dollar amount of the change in net income? 00 0 8 9 3 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts