Question: Please do the work by hand!! NO EXCELL 12. 7-12. A bowling alley costs $500,000 and has an estimated life of 10 years (SV10 =

Please do the work by hand!! NO EXCELL

Please do the work by hand!! NO EXCELL

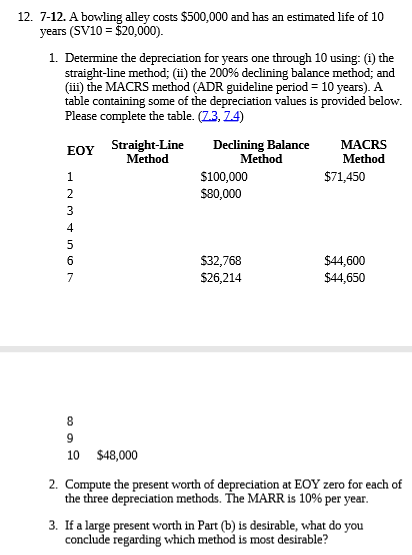

12. 7-12. A bowling alley costs $500,000 and has an estimated life of 10 years (SV10 = $20,000). 1. Determine the depreciation for years one through 10 using: (1) the straight-line method; (ii) the 200% declining balance method; and (111) the MACRS method (ADR guideline period = 10 years). A table containing some of the depreciation values is provided below. Please complete the table. (Z3,Z4) EOY Straight-Line Declining Balance Declining R MACRS Method Method Method $100,000 $71,450 $80,000 VU WN $32,768 $26,214 $44,600 $44,650 10 $48,000 2. Compute the present worth of depreciation at EOY zero for each of the three depreciation methods. The MARR is 10% per year. 3. If a large present worth in Part (b) is desirable, what do you conclude regarding which method is most desirable? 12. 7-12. A bowling alley costs $500,000 and has an estimated life of 10 years (SV10 = $20,000). 1. Determine the depreciation for years one through 10 using: (1) the straight-line method; (ii) the 200% declining balance method; and (111) the MACRS method (ADR guideline period = 10 years). A table containing some of the depreciation values is provided below. Please complete the table. (Z3,Z4) EOY Straight-Line Declining Balance Declining R MACRS Method Method Method $100,000 $71,450 $80,000 VU WN $32,768 $26,214 $44,600 $44,650 10 $48,000 2. Compute the present worth of depreciation at EOY zero for each of the three depreciation methods. The MARR is 10% per year. 3. If a large present worth in Part (b) is desirable, what do you conclude regarding which method is most desirable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts