Question: please do the wrong place Question 3 Partially correct Mark 16.00 out of 20.00 P Flag question Identifiable Intangibles Brightcove, Inc. acquires Ciber, Inc. for

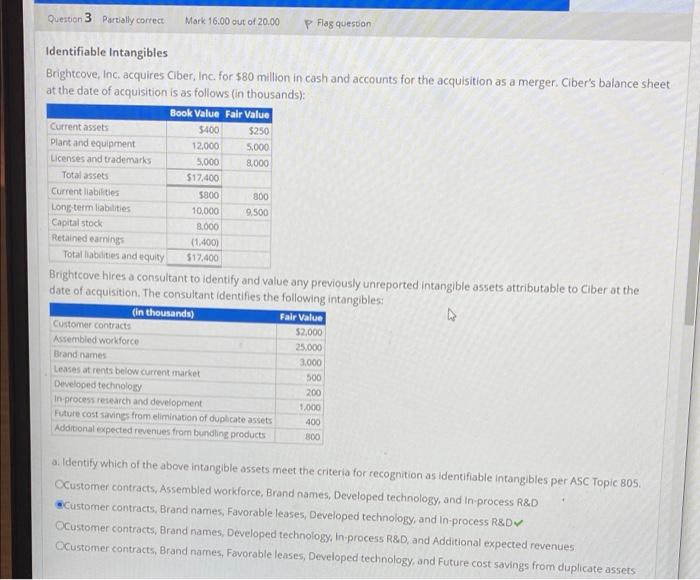

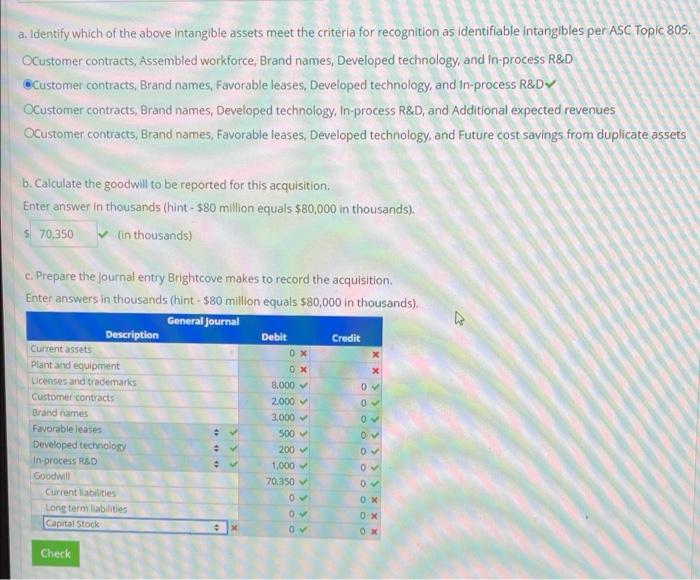

Question 3 Partially correct Mark 16.00 out of 20.00 P Flag question Identifiable Intangibles Brightcove, Inc. acquires Ciber, Inc. for $80 million in cash and accounts for the acquisition as a merger. Ciber's balance sheet at the date of acquisition is as follows (in thousands): Book Value Fair Value Current assets 5400 $250 plant and equipment 12,000 5.000 Licenses and trademarks 5,000 8,000 Total assets $17.400 Current liabilities 5800 800 Long-term liabilities 10,000 9.500 Capital stock 8.000 Retained earning (1,400) Total abilities and equity $17.400 Brightcove hires a consultant to identify and value any previously unreported intangible assets attributable to Ciber at the date of acquisition. The consultant identifies the following intangibles: (in thousands) Fair Value Customer contracts $2.000 Assembled workforce 25.000 Brand names 3.000 Leases trents below current market 500 Developed technology 200 In process research and development 1.000 Future cost savings from elimination of duplicate assets 400 Additional expected revenues from bunding products 800 a. Identify which of the above intangible assets meet the criteria for recognition as identifiable intangibles per ASC Topic 805 Customer contracts, Assembled workforce, Brand names, Developed technology, and in process R&D Customer contracts, Brand names, Favorable leases, Developed technology, and in-process R&D Customer contracts, Brand names, Developed technology, In-process R&D, and Additional expected revenues OCustomer contracts, Brand names, Favorable leases, Developed technology, and Future cost savings from duplicate assets a. Identify which of the above intangible assets meet the criteria for recognition as identifiable intangibles per ASC Topic 805, Ocustomer contracts, Assembled workforce, Brand names, Developed technology, and in-process R&D Customer contracts, Brand names, Favorable leases, Developed technology, and in-process R&DV Ocustomer contracts, Brand names, Developed technology, In-process R&D, and Additional expected revenues Ocustomer contracts, Brand names, Favorable leases, Developed technology, and Future cost savings from duplicate assets b. Calculate the goodwill to be reported for this acquisition Enter answer in thousands (hint - $80 million equals $80,000 in thousands). $ 70,350 (in thousands) c. Prepare the journal entry Brightcove makes to record the acquisition Enter answers in thousands (hint - $80 million equals $80,000 in thousands) General Journal Description Debit Credit Current assets 0 x plant and equipment OX Licenses and trademarks 8.000 07 Customer contracts 2.000 0 Brand names 3.000 0 Favorable leases 500 Developed technology 200 07 In-process R&D 1,000 0 Goodwill 70.350 07 Current abilities 0 0 x Long term liabilities 0 OX Capital Stock 0 OX 0 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts