Question: PLEASE DO THESE QUESTIONS ASAP, MAKE SURE TO SHOW ALL UR STEPS AND PLEASE PUT THE NUMBER OF THE QUESTION BESIDE ITS ANSWER. THANK U

PLEASE DO THESE QUESTIONS ASAP, MAKE SURE TO SHOW ALL UR STEPS AND PLEASE PUT THE NUMBER OF THE QUESTION BESIDE ITS ANSWER. THANK U

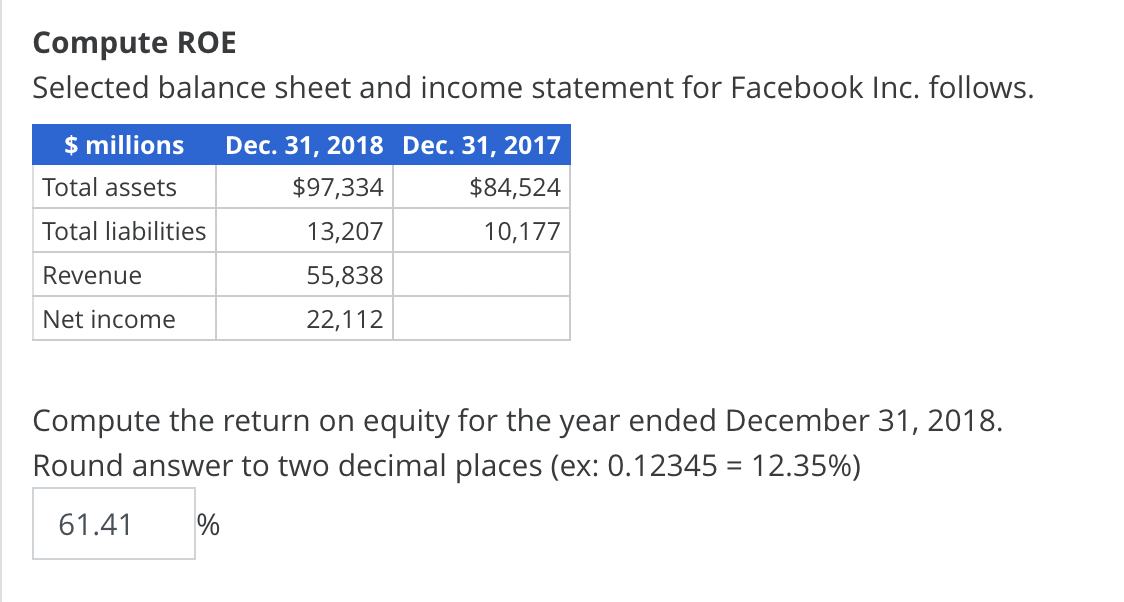

QUESTION 1:

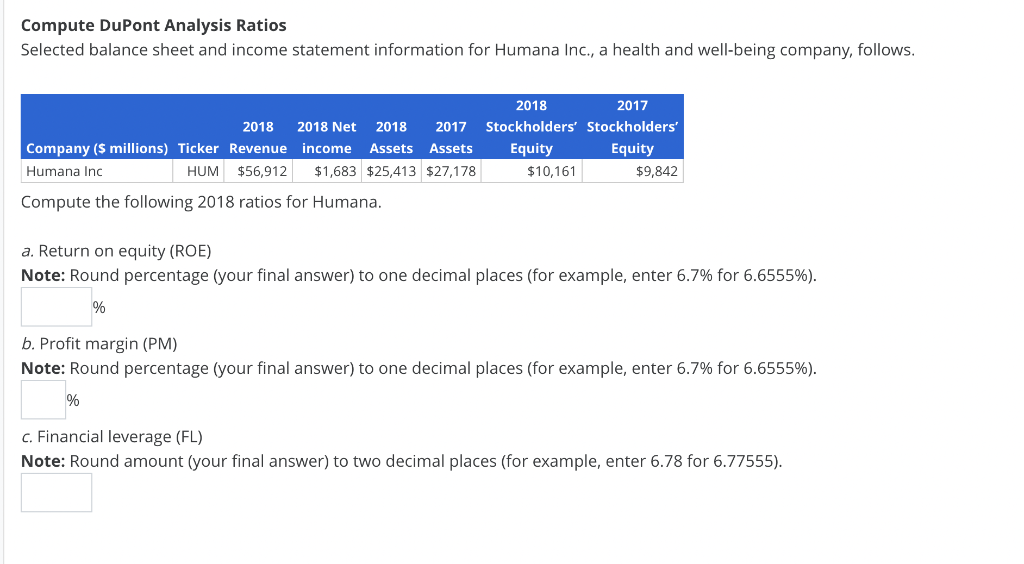

QUESTION 2:

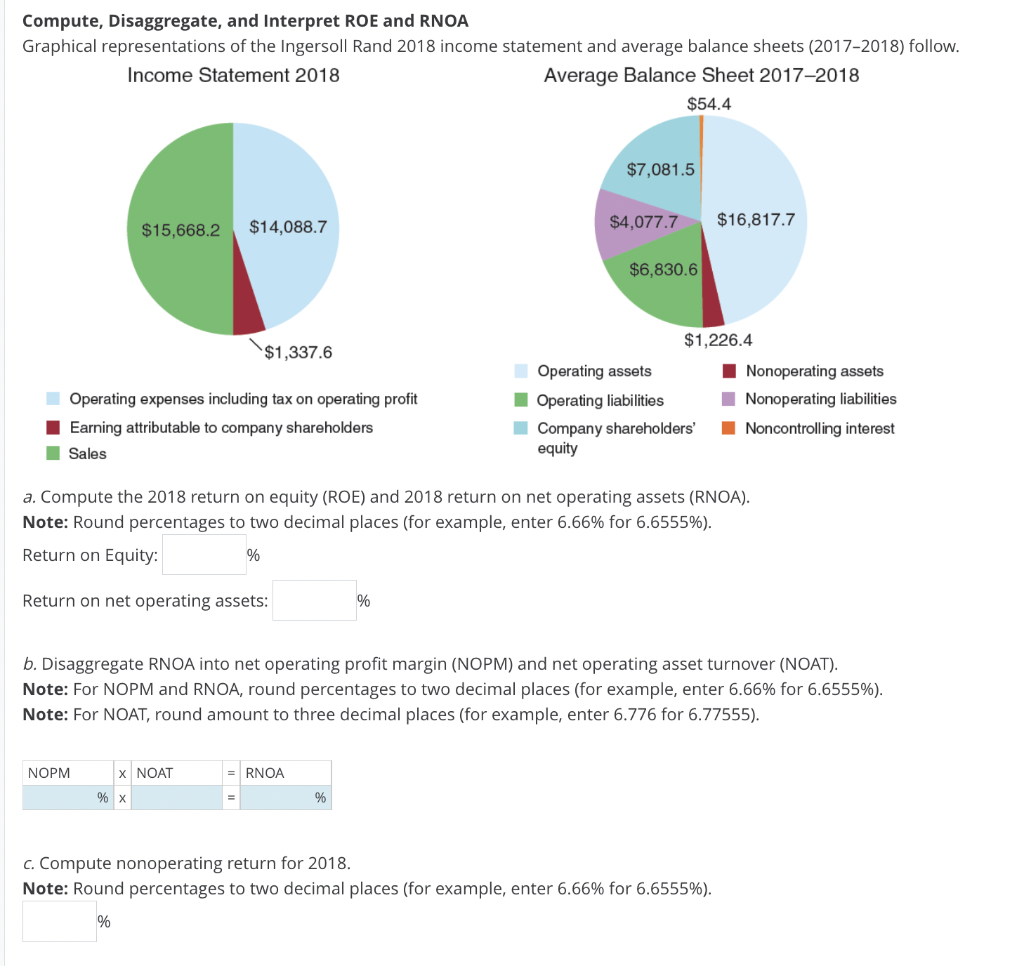

QUESTION 3:

PLEEEAAASSSEEE DO ALL THE QUESTIONS AND DO THEM CORRECTLY, MAKE SURE TO PUT THE NUMBER OF THE QUESTION BESIDE ITS ANSER AND SO IT ASAP PLEASE. THANKS

Compute ROE Selected balance sheet and income statement for Facebook Inc. follows. Compute the return on equity for the year ended December 31, 2018. Round answer to two decimal places (ex: 0.12345=12.35% ) 1/2 Compute DuPont Analysis Ratios Selected balance sheet and income statement information for Humana Inc., a health and well-being company, follows. Compute the following 2018 ratios for Humana. a. Return on equity (ROE) Note: Round percentage (your final answer) to one decimal places (for example, enter 6.7% for 6.6555% ). % b. Profit margin (PM) Note: Round percentage (your final answer) to one decimal places (for example, enter 6.7% for 6.6555% ). % c. Financial leverage ( FL) Note: Round amount (your final answer) to two decimal places (for example, enter 6.78 for 6.77555 ). Compute, Disaggregate, and Interpret ROE and RNOA Graphical representations of the Ingersoll Rand 2018 income statement and average balance sheets (2017-2018) follow. Income Statement 2018 Average Balance Sheet 2017-2018 a. Compute the 2018 return on equity (ROE) and 2018 return on net operating assets (RNOA). Note: Round percentages to two decimal places (for example, enter 6.66% for 6.6555% ). Return on Equity: % Return on net operating assets: % b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT). Note: For NOPM and RNOA, round percentages to two decimal places (for example, enter 6.66% for 6.6555% ). Note: For NOAT, round amount to three decimal places (for example, enter 6.776 for 6.77555 ). c. Compute nonoperating return for 2018 . Note: Round percentages to two decimal places (for example, enter 6.66\% for 6.6555% ). \% Compute ROE Selected balance sheet and income statement for Facebook Inc. follows. Compute the return on equity for the year ended December 31, 2018. Round answer to two decimal places (ex: 0.12345=12.35% ) 1/2 Compute DuPont Analysis Ratios Selected balance sheet and income statement information for Humana Inc., a health and well-being company, follows. Compute the following 2018 ratios for Humana. a. Return on equity (ROE) Note: Round percentage (your final answer) to one decimal places (for example, enter 6.7% for 6.6555% ). % b. Profit margin (PM) Note: Round percentage (your final answer) to one decimal places (for example, enter 6.7% for 6.6555% ). % c. Financial leverage ( FL) Note: Round amount (your final answer) to two decimal places (for example, enter 6.78 for 6.77555 ). Compute, Disaggregate, and Interpret ROE and RNOA Graphical representations of the Ingersoll Rand 2018 income statement and average balance sheets (2017-2018) follow. Income Statement 2018 Average Balance Sheet 2017-2018 a. Compute the 2018 return on equity (ROE) and 2018 return on net operating assets (RNOA). Note: Round percentages to two decimal places (for example, enter 6.66% for 6.6555% ). Return on Equity: % Return on net operating assets: % b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT). Note: For NOPM and RNOA, round percentages to two decimal places (for example, enter 6.66% for 6.6555% ). Note: For NOAT, round amount to three decimal places (for example, enter 6.776 for 6.77555 ). c. Compute nonoperating return for 2018 . Note: Round percentages to two decimal places (for example, enter 6.66\% for 6.6555% ). \%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts