Question: Please do this ASAP! I will upvote. Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than sixty days

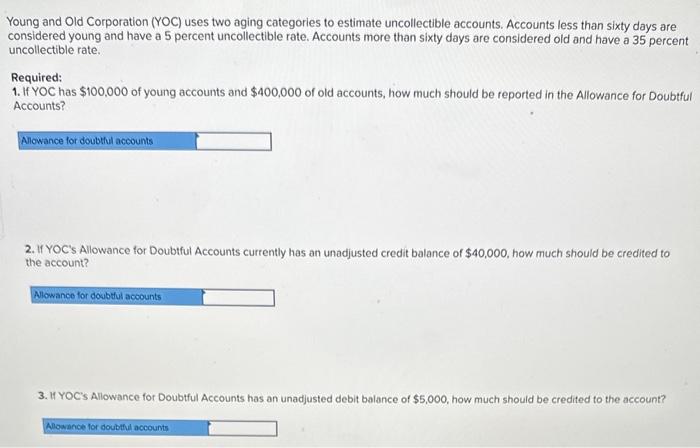

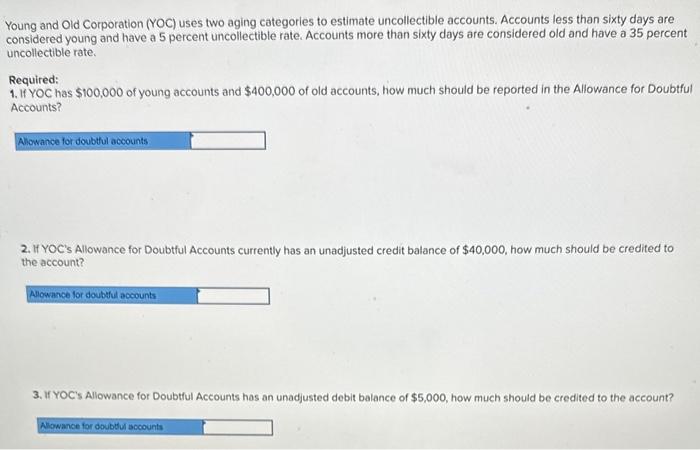

Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than sixty days are considered young and have a 5 percent uncollectible rate. Accounts more than sixty days are considered old and have a 35 percent uncollectible rate. Required: 1. If YOC has $100,000 of young accounts and $400,000 of old accounts, how much should be reported in the Allowance for Doubtful Accounts? 2. If YOC's Allowance for Doubtful Accounts currently has an unadjusted credit balance of $40,000, how much should be credited to the account? 3. If YOC's Allowance for Doubtful Accounts has an unadjusted debit balance of $5,000, how much should be credited to the account? Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than sixty days are considered young and have a 5 percent uncollectible rate. Accounts more than sixty days are considered old and have a 35 percent uncollectible rate. Required: 1. If YOC has $100,000 of young accounts and $400,000 of old accounts, how much should be reported in the Allowance for Doubtful Accounts? 2. If YOC's Allowance for Doubtful Accounts currently has an unadjusted credit balance of $40,000, how much should be credited to the account? 3. If YOC's Allowance for Doubtful Accounts has an unadjusted debit balance of $5,000, how much should be credited to the account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts