Question: please do this assignment in the required format using the five steps mentioned about Show your work on Word (Show 5 steps as what we

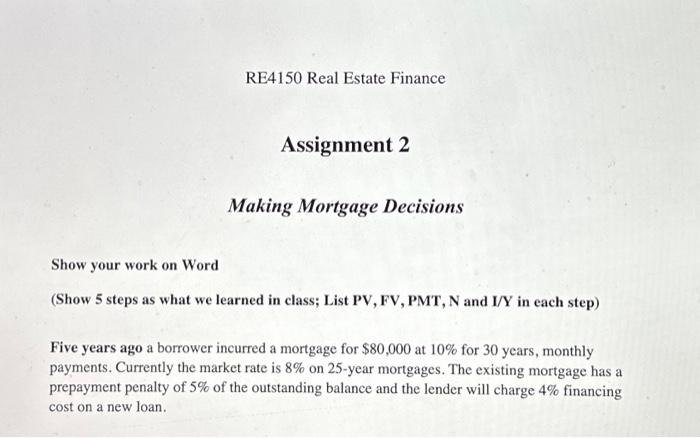

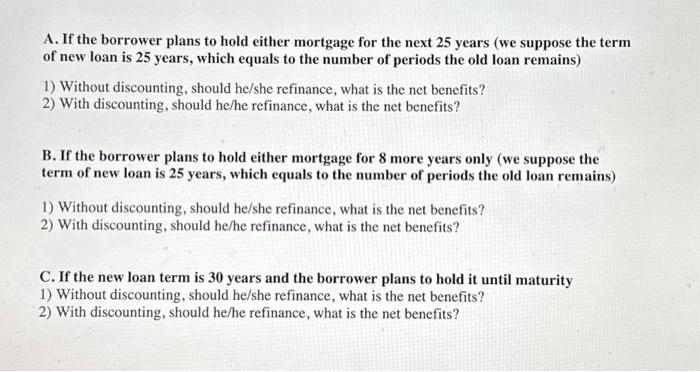

Show your work on Word (Show 5 steps as what we learned in class; List PV, FV, PMT, N and I/Y in each step) Five years ago a borrower incurred a mortgage for $80,000 at 10% for 30 years, monthly payments. Currently the market rate is 8% on 25 -year mortgages. The existing mortgage has a prepayment penalty of 5% of the outstanding balance and the lender will charge 4% financing cost on a new loan. A. If the borrower plans to hold either mortgage for the next 25 years (we suppose the term of new loan is 25 years, which equals to the number of periods the old loan remains) 1) Without discounting, should he/she refinance, what is the net benefits? 2) With discounting, should he/he refinance, what is the net benefits? B. If the borrower plans to hold either mortgage for 8 more years only (we suppose the term of new loan is 25 years, which equals to the number of periods the old loan remains) 1) Without discounting, should he/she refinance, what is the net benefits? 2) With discounting, should he/he refinance, what is the net benefits? C. If the new loan term is 30 years and the borrower plans to hold it until maturity 1) Without discounting, should he/she refinance, what is the net benefits? 2) With discounting, should he/he refinance, what is the net benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts