Question: Please do this assignment need urgent please L Assignment 12-1: It costs $780,000 to drill a natural gas well. Operating expenses will be 18% of

Please do this assignment need urgent please

Please do this assignment need urgent please

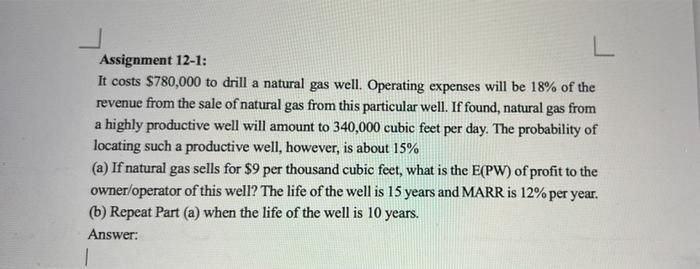

L Assignment 12-1: It costs $780,000 to drill a natural gas well. Operating expenses will be 18% of the revenue from the sale of natural gas from this particular well. If found, natural gas from a highly productive well will amount to 340,000 cubic feet per day. The probability of locating such a productive well, however, is about 15% (a) If natural gas sells for $9 per thousand cubic feet, what is the E(PW) of profit to the owner/operator of this well? The life of the well is 15 years and MARR is 12% per year. (b) Repeat Part (a) when the life of the well is 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts