Question: please do this case study WITH SOME $200 BILLION in revenues in 2015, Arabian Eagle is one of the biggest conglomerates globally and the largest

please do this case study

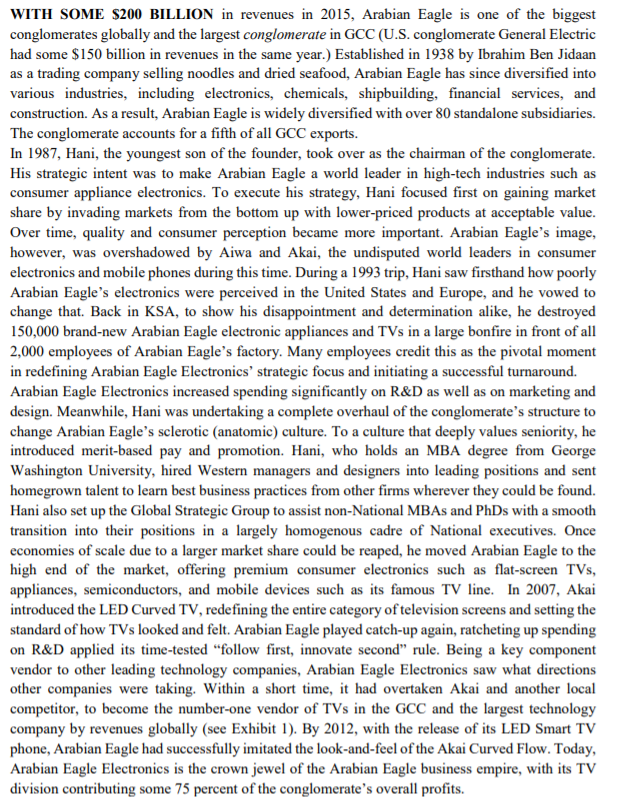

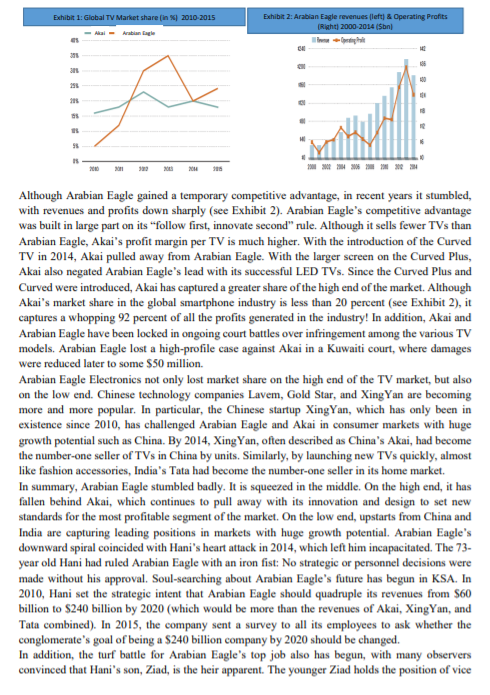

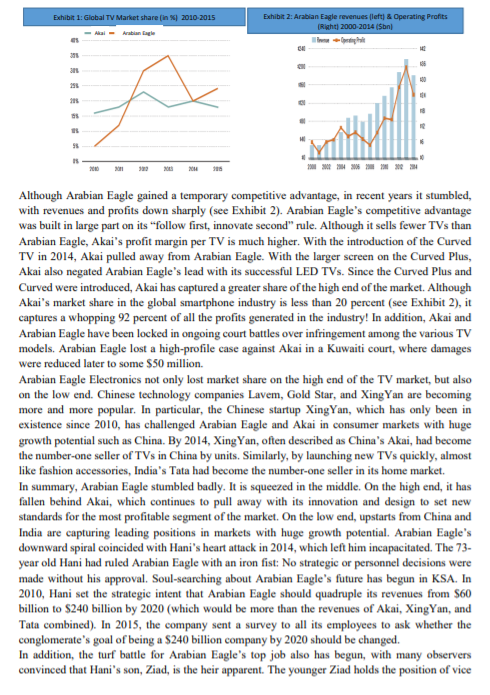

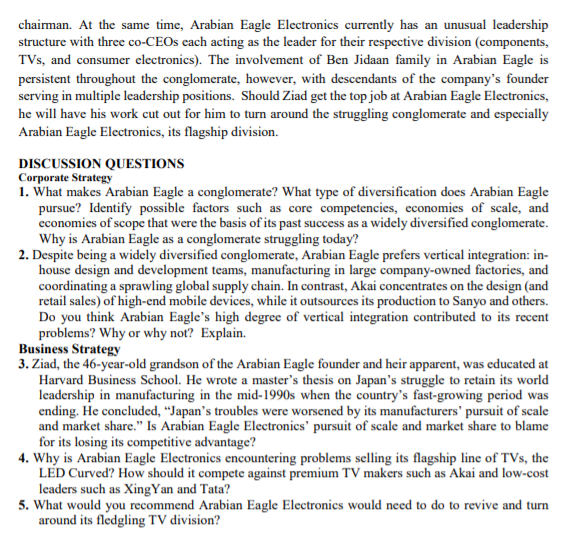

WITH SOME $200 BILLION in revenues in 2015, Arabian Eagle is one of the biggest conglomerates globally and the largest conglomerate in GCC (U.S. conglomerate General Electric had some $150 billion in revenues in the same year.) Established in 1938 by Ibrahim Ben Jidaan as a trading company selling noodles and dried seafood, Arabian Eagle has since diversified into various industries, including electronics, chemicals, shipbuilding, financial services, and construction. As a result, Arabian Eagle is widely diversified with over 80 standalone subsidiaries. The conglomerate accounts for a fifth of all GCC exports. In 1987, Hani, the youngest son of the founder, took over as the chairman of the conglomerate. His strategic intent was to make Arabian Eagle a world leader in high-tech industries such as consumer appliance electronics. To execute his strategy, Hani focused first on gaining market share by invading markets from the bottom up with lower-priced products at acceptable value. Over time, quality and consumer perception became more important. Arabian Eagle's image, however, was overshadowed by Aiwa and Akai, the undisputed world leaders in consumer electronics and mobile phones during this time. During a 1993 trip, Hani saw firsthand how poorly Arabian Eagle's electronics were perceived in the United States and Europe, and he vowed to change that. Back in KSA, to show his disappointment and determination alike, he destroyed 150,000 brand-new Arabian Eagle electronic appliances and TVs in a large bonfire in front of all 2,000 employees of Arabian Eagle's factory. Many employees credit this as the pivotal moment in redefining Arabian Eagle Electronics' strategic focus and initiating a successful turnaround. Arabian Eagle Electronics increased spending significantly on R&D as well as on marketing and design. Meanwhile, Hani was undertaking a complete overhaul of the conglomerate's structure to change Arabian Eagle's sclerotic (anatomic) culture. To a culture that deeply values seniority, he introduced merit-based pay and promotion. Hani, who holds an MBA degree from George Washington University, hired Western managers and designers into leading positions and sent homegrown talent to learn best business practices from other firms wherever they could be found. Hani also set up the Global Strategic Group to assist non-National MBAs and PhDs with a smooth transition into their positions in a largely homogenous cadre of National executives. Once economies of scale due to a larger market share could be reaped, he moved Arabian Eagle to the high end of the market, offering premium consumer electronics such as flat-screen TVs, appliances, semiconductors, and mobile devices such as its famous TV line. In 2007, Akai introduced the LED Curved TV, redefining the entire category of television screens and setting the standard of how TVs looked and felt. Arabian Eagle played catch-up again, ratcheting up spending on R&D applied its time-tested "follow first, innovate second" rule. Being a key component vendor to other leading technology companies, Arabian Eagle Electronics saw what directions other companies were taking. Within a short time, it had overtaken Akai and another local competitor, to become the number-one vendor of TVs in the GCC and the largest technology company by revenues globally (see Exhibit 1). By 2012, with the release of its LED Smart TV phone, Arabian Eagle had successfully imitated the look-and-feel of the Akai Curved Flow. Today, Arabian Eagle Electronics is the crown jewel of the Arabian Eagle business empire, with its TV division contributing some 75 percent of the conglomerate's overall profits. Exhibit 1: Global TV Market share (in %) 2010-2015 Exhibit 2: Arabian Eagle revenues left) & Operating profits (Right) 2000-2014 (Son Akai Arabiangle 311 311 251 215 os 95 2018 OM Although Arabian Eagle gained a temporary competitive advantage, in recent years it stumbled, with revenues and profits down sharply (see Exhibit 2). Arabian Eagle's competitive advantage was built in large part on its "follow first, innovate second" rule. Although it sells fewer TVs than Arabian Eagle, Akai's profit margin per TV is much higher. With the introduction of the Curved TV in 2014, Akai pulled away from Arabian Eagle. With the larger screen on the Curved Plus, Akai also negated Arabian Eagle's lead with its successful LED TVs. Since the Curved Plus and Curved were introduced, Akai has captured a greater share of the high end of the market. Although Akai's market share in the global smartphone industry is less than 20 percent (see Exhibit 2), it captures a whopping 92 percent of all the profits generated in the industry! In addition, Akai and Arabian Eagle have been locked in ongoing court battles over infringement among the various TV models. Arabian Eagle lost a high-profile case against Akai in a Kuwaiti court, where damages were reduced later to some $50 million. Arabian Eagle Electronics not only lost market share on the high end of the TV market, but also on the low end. Chinese technology companies Lavem, Gold Star, and XingYan are becoming more and more popular. In particular, the Chinese startup Xing Yan, which has only been in existence since 2010, has challenged Arabian Eagle and Akai in consumer markets with huge growth potential such as China. By 2014, Xing Yan, often described as China's Akai, had become the number one seller of TVs in China by units. Similarly, by launching new TVs quickly, almost like fashion accessories, India's Tata had become the number-one seller in its home market. In summary, Arabian Eagle stumbled badly. It is squeezed in the middle. On the high end, it has fallen behind Akai, which continues to pull away with its innovation and design to set new standards for the most profitable segment of the market. On the low end, upstarts from China and India are capturing leading positions in markets with huge growth potential. Arabian Eagle's downward spiral coincided with Hani's heart attack in 2014, which left him incapacitated. The 73- year old Hani had ruled Arabian Eagle with an iron fist: No strategic or personnel decisions were made without his approval. Soul-searching about Arabian Eagle's future has begun in KSA. In 2010, Hani set the strategic intent that Arabian Eagle should quadruple its revenues from $60 billion to $240 billion by 2020 (which would be more than the revenues of Akai, XingYan, and Tata combined). In 2015, the company sent a survey to all its employees to ask whether the conglomerate's goal of being a $240 billion company by 2020 should be changed. In addition, the turf battle for Arabian Eagle's top job also has begun, with many observers convinced that Hani's son, Ziad, is the heir apparent. The younger Ziad holds the position of vice chairman. At the same time, Arabian Eagle Electronics currently has an unusual leadership structure with three co-CEOs each acting as the leader for their respective division (components, TVs, and consumer electronics). The involvement of Ben Jidaan family in Arabian Eagle is persistent throughout the conglomerate, however, with descendants of the company's founder serving in multiple leadership positions. Should Ziad get the top job at Arabian Eagle Electronics, he will have his work cut out for him to turn around the struggling conglomerate and especially Arabian Eagle Electronics, its flagship division. DISCUSSION QUESTIONS Corporate Strategy 1. What makes Arabian Eagle a conglomerate? What type of diversification does Arabian Eagle pursue? Identify possible factors such as core competencies, economies of scale, and economies of scope that were the basis of its past success as a widely diversified conglomerate. Why is Arabian Eagle as a conglomerate struggling today? 2. Despite being a widely diversified conglomerate, Arabian Eagle prefers vertical integration: in- house design and development teams, manufacturing in large company-owned factories, and coordinating a sprawling global supply chain. In contrast, Akai concentrates on the design and retail sales) of high-end mobile devices, while it outsources its production to Sanyo and others. Do you think Arabian Eagle's high degree of vertical integration contributed to its recent problems? Why or why not? Explain. Business Strategy 3. Ziad, the 46-year-old grandson of the Arabian Eagle founder and heir apparent, was educated at Harvard Business School. He wrote a master's thesis on Japan's struggle to retain its world leadership in manufacturing in the mid-1990s when the country's fast-growing period was ending. He concluded, Japan's troubles were worsened by its manufacturers' pursuit of scale and market share." Is Arabian Eagle Electronics' pursuit of scale and market share to blame for its losing its competitive advantage? 4. Why is Arabian Eagle Electronics encountering problems selling its flagship line of TVs, the LED Curved? How should it compete against premium TV makers such as Akai and low-cost leaders such as XingYan and Tata? 5. What would you recommend Arabian Eagle Electronics would need to do to revive and turn around its fledgling TV division