Question: please, do this in a finance calculator 20. Let's say you enter into a contract to buy a house for $265,000. Let's also say you

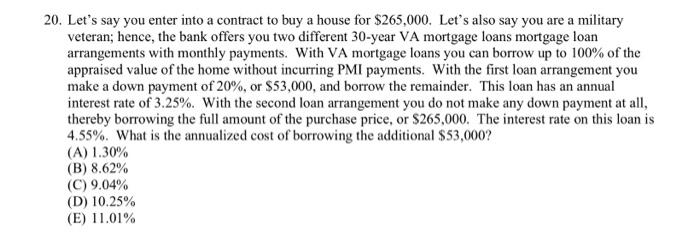

20. Let's say you enter into a contract to buy a house for $265,000. Let's also say you are a military veteran; hence, the bank offers you two different 30 -year VA mortgage loans mortgage loan arrangements with monthly payments. With VA mortgage loans you can borrow up to 100% of the appraised value of the home without incurring PMI payments. With the first loan arrangement you make a down payment of 20%, or $53,000, and borrow the remainder. This loan has an annual interest rate of 3.25%. With the second loan arrangement you do not make any down payment at all, thereby borrowing the full amount of the purchase price, or $265,000. The interest rate on this loan is 4.55%. What is the annualized cost of borrowing the additional $53,000 ? (A) 1.30% (B) 8.62% (C) 9.04% (D) 10.25% (E) 11.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts