Question: Please do this in excel and show excel formulas 1. USD will not pay any dividends for the next 30 years. Beginning in year

Please do this in excel and show excel formulas

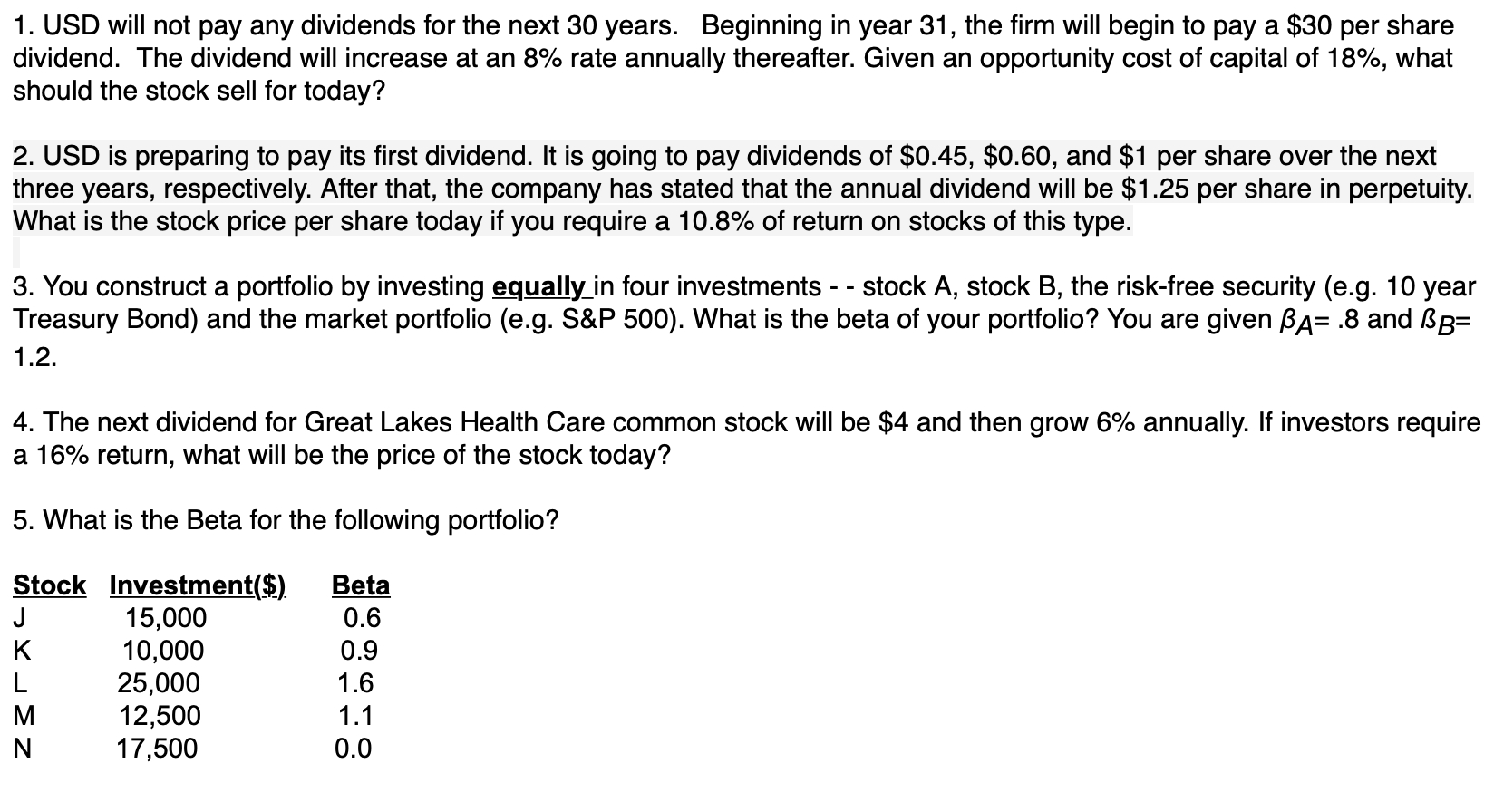

" 1. USD will not pay any dividends for the next 30 years. Beginning in year 31, the firm will begin to pay a $30 per share dividend. The dividend will increase at an 8% rate annually thereafter. Given an opportunity cost of capital of 18%, what should the stock sell for today? 2. USD is preparing to pay its first dividend. It is going to pay dividends of $0.45, $0.60, and $1 per share over the next three years, respectively. After that, the company has stated that the annual dividend will be $1.25 per share in perpetuity. What is the stock price per share today if you require a 10.8% of return on stocks of this type. 3. You construct a portfolio by investing equally_in four investments -- stock A, stock B, the risk-free security (e.g. 10 year Treasury Bond) and the market portfolio (e.g. S&P 500). What is the beta of your portfolio? You are given BA=.8 and BB= 1.2. 4. The next dividend for Great Lakes Health Care common stock will be $4 and then grow 6% annually. If investors require a 16% return, what will be the price of the stock today? 5. What is the Beta for the following portfolio? ZZTRO Stock Investment($). J 15,000 K 10,000 L 25,000 M 12,500 N 17,500 Beta 0.6 0.9 1.6 1.1 0.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts