Question: please do this in excel and show the formulas as well ANN ARBOR MANUFACTURING Finance Expert is evaluating Ann Arbor Manufacturing Co., Ltd. (AAM), headquartered

please do this in excel and show the formulas as well

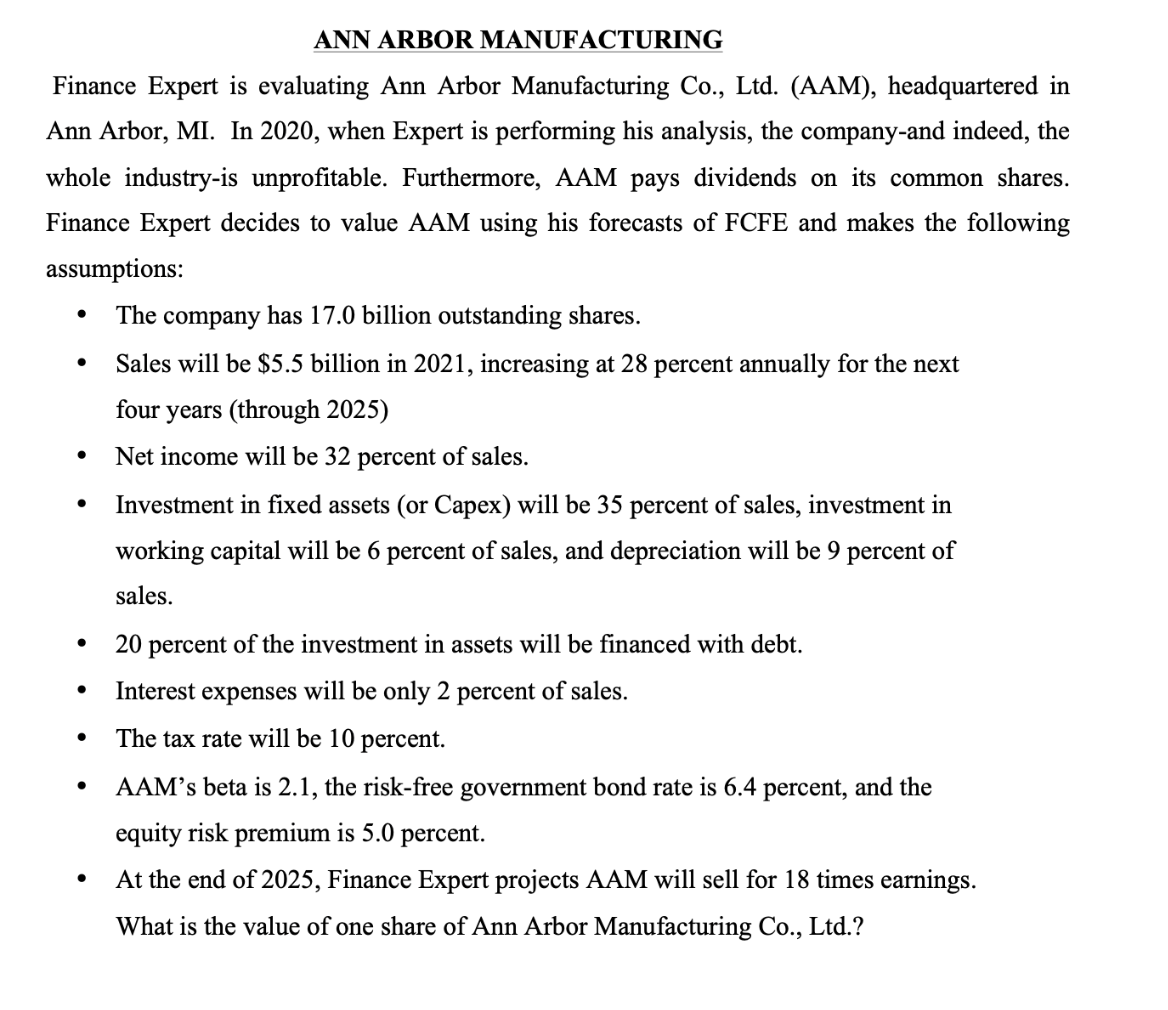

ANN ARBOR MANUFACTURING Finance Expert is evaluating Ann Arbor Manufacturing Co., Ltd. (AAM), headquartered Ann Arbor, MI. In 2020, when Expert is performing his analysis, the company-and indeed, whole industry-is unprofitable. Furthermore, AAM pays dividends on its common shar Finance Expert decides to value AAM using his forecasts of FCFE and makes the followi assumptions: - The company has 17.0 billion outstanding shares. - Sales will be $5.5 billion in 2021 , increasing at 28 percent annually for the next four years (through 2025) - Net income will be 32 percent of sales. - Investment in fixed assets (or Capex) will be 35 percent of sales, investment in working capital will be 6 percent of sales, and depreciation will be 9 percent of sales. - 20 percent of the investment in assets will be financed with debt. - Interest expenses will be only 2 percent of sales. - The tax rate will be 10 percent. - AAM's beta is 2.1, the risk-free government bond rate is 6.4 percent, and the equity risk premium is 5.0 percent. - At the end of 2025, Finance Expert projects AAM will sell for 18 times earnings. What is the value of one share of Ann Arbor Manufacturing Co., Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts