Question: Please do this in Excel and show the formulas. The income statement for the year ended December 31, 20x1, as well as the balance sheets

Please do this in Excel and show the formulas.

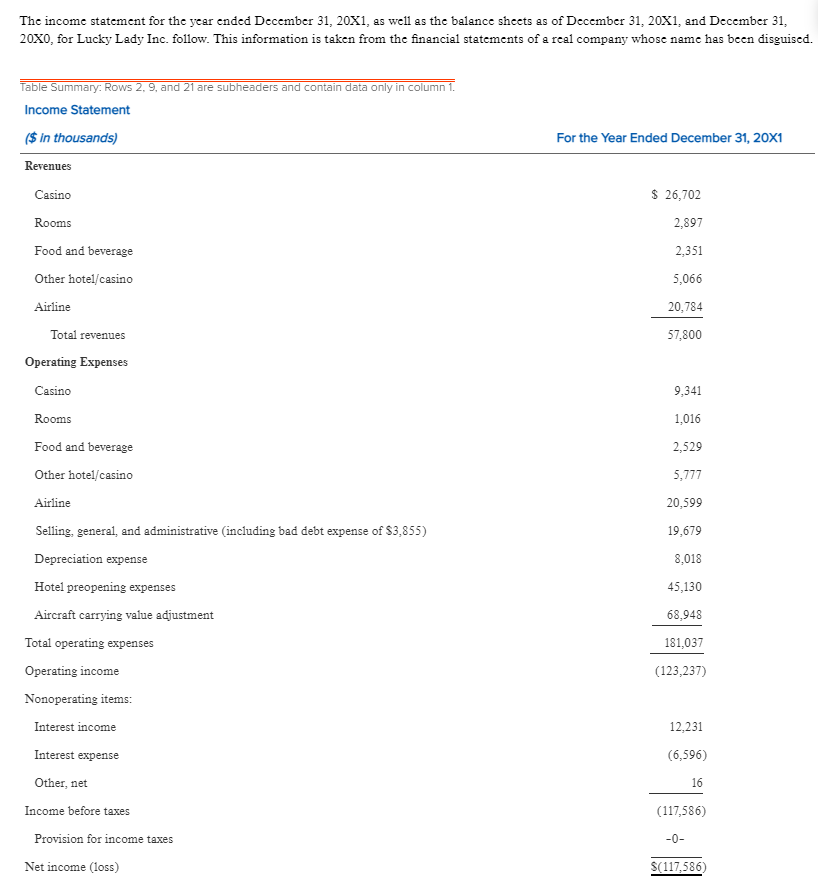

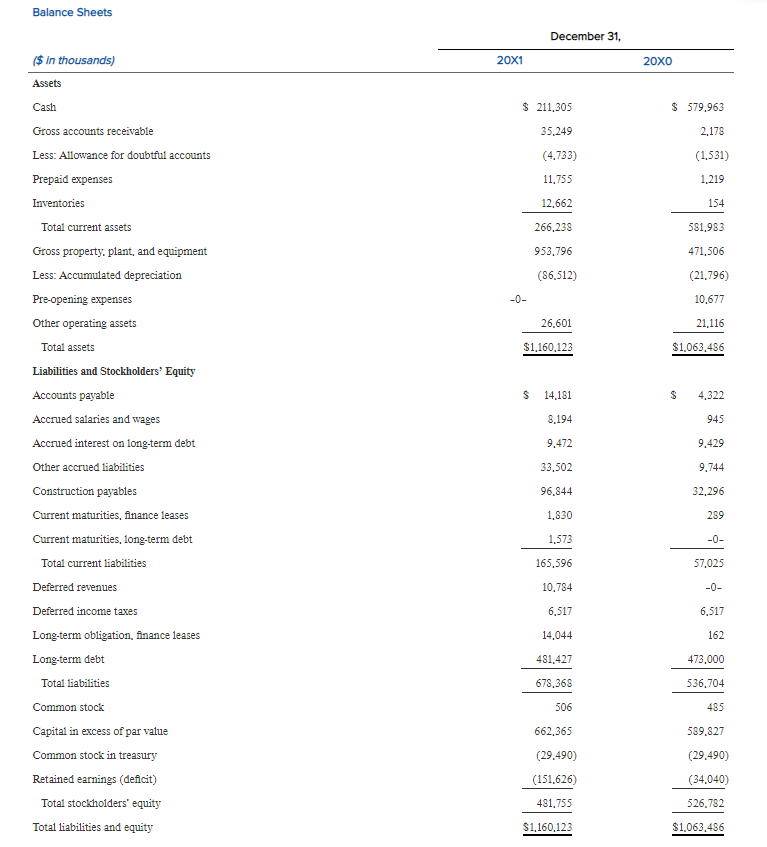

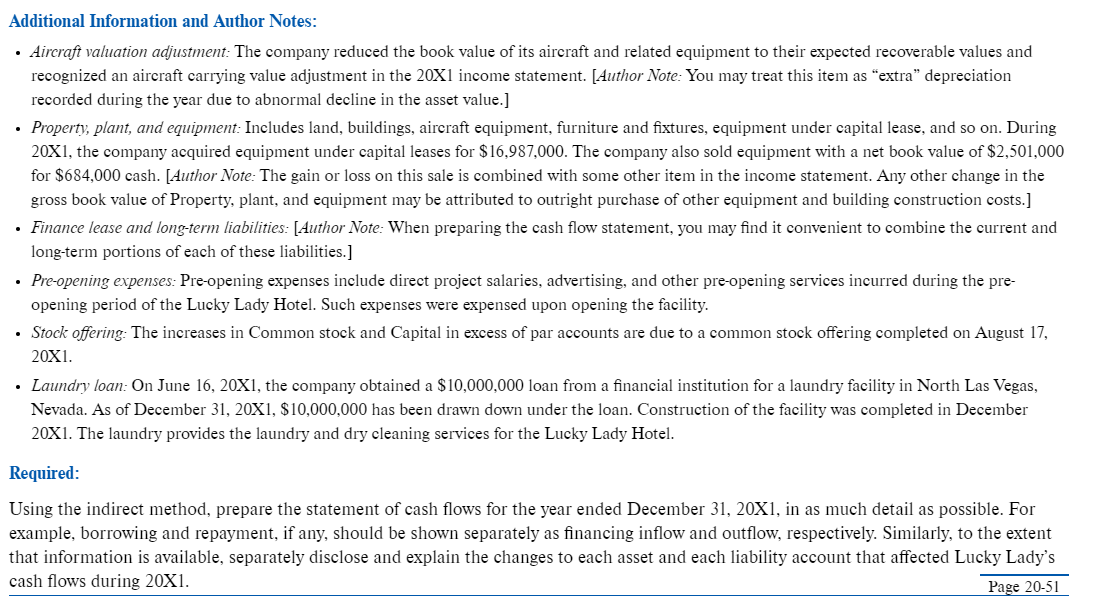

The income statement for the year ended December 31, 20x1, as well as the balance sheets as of December 31, 20X1, and December 31, 20x0, for Lucky Lady Inc. follow. This information is taken from the financial statements of a real company whose name has been disguised. Table Summary: Rows 2, 9, and 21 are subheaders and contain data only in column 1. Income Statement ($ in thousands) Revenues For the Year Ended December 31, 20X1 Casino $ 26,702 Rooms 2,897 2,351 5,066 20,784 57,800 Food and beverage Other hotel/casino Airline Total revenues Operating Expenses Casino Rooms Food and beverage Other hotel/casino 9,341 1,016 2,529 5,777 Airline 20,599 19,679 8,018 45,130 68,948 181,037 (123,237) Selling, general, and administrative (including bad debt expense of $3,855) Depreciation expense Hotel preopening expenses Aircraft carrying value adjustment Total operating expenses Operating income Nonoperating items: Interest income Interest expense Other, net Income before taxes Provision for income taxes 12,231 (6,596) 16 (117,586) -0- Net income (Loss) $(117,586) Balance Sheets December 31, ($ in thousands) 20X1 20x0 Assets Cash $ 211,305 $ 579,963 35,249 2,178 Gross accounts receivable Less: Allowance for doubtful accounts Prepaid expenses (4.733) (1.531) 11.755 1,219 Inventories 12,662 154 Total current assets 266,238 581,983 953.796 471,506 (86,512) (21.796) 10,677 26,601 21.116 $1,160,123 $1.063.486 S 14.181 $ 4,322 8.194 945 9,472 9,429 Gross property, plant, and equipment Less: Accumulated depreciation Pre-opening expenses Other operating assets Total assets Liabilities and Stockholders' Equity Accounts payable Accrued salaries and wages Accrued interest on long-term debt Other accrued liabilities Construction payables Current maturities, finance leases Current maturities, long-term debt Total current liabilities Deferred revenues Deferred income taxes Long-term obligation, finance leases Long-term debt 33,502 9.744 96.844 32,296 1.830 289 1,573 -0- 165,596 57,025 10.784 -0- 6.517 6.517 14.044 162 481.427 473.000 Total liabilities 678,368 536.704 506 485 662,365 589.827 (29.490) Common stock Capital in excess of par value Common stock in treasury Retained earnings (deficit) Total stockholders' equity Total liabilities and equity (29.490) (34,040) (151,626) 481.755 526.782 $1,160,123 $1,063,486 Additional Information and Author Notes: Aircraft valuation adjustment: The company reduced the book value of its aircraft and related equipment to their expected recoverable values and recognized an aircraft carrying value adjustment in the 20X1 income statement. (Author Note: You may treat this item as "extra" depreciation recorded during the year due to abnormal decline in the asset value.] Property, plant, and equipment: Includes land, buildings, aircraft equipment, furniture and fixtures, equipment under capital lease, and so on. During 20X1, the company acquired equipment under capital leases for $ 16,987,000. The company also sold equipment with a net book value of $2,501,000 for $684,000 cash. (Author Note: The gain or loss on this sale is combined with some other item in the income statement. Any other change in the gross book value of Property, plant, and equipment may be attributed to outright purchase of other equipment and building construction costs.] Finance lease and long-term liabilities: [Author Note: When preparing the cash flow statement, you may find it convenient to combine the current and long-term portions of each of these liabilities.] Pre-opening expenses: Pre-opening expenses include direct project salaries, advertising, and other pre-opening services incurred during the pre- opening period of the Lucky Lady Hotel. Such expenses were expensed upon opening the facility. Stock offering: The increases in Common stock and Capital in excess of par accounts are due to a common stock offering completed on August 17, 20X1. Laundry loan: On June 16, 20X1, the company obtained a $10,000,000 loan from a financial institution for a laundry facility in North Las Vegas, Nevada. As of December 31, 20X1, $10,000,000 has been drawn down under the loan. Construction of the facility was completed in December 20X1. The laundry provides the laundry and dry cleaning services for the Lucky Lady Hotel. Required: Using the indirect method, prepare the statement of cash flows for the year ended December 31, 20X1, in as much detail as possible. For example, borrowing and repayment, if any, should be shown separately as financing inflow and outflow, respectively. Similarly, to the extent that information is available, separately disclose and explain the changes to each asset and each liability account that affected Lucky Lady's cash flows during 20X1. Page 20-51 The income statement for the year ended December 31, 20x1, as well as the balance sheets as of December 31, 20X1, and December 31, 20x0, for Lucky Lady Inc. follow. This information is taken from the financial statements of a real company whose name has been disguised. Table Summary: Rows 2, 9, and 21 are subheaders and contain data only in column 1. Income Statement ($ in thousands) Revenues For the Year Ended December 31, 20X1 Casino $ 26,702 Rooms 2,897 2,351 5,066 20,784 57,800 Food and beverage Other hotel/casino Airline Total revenues Operating Expenses Casino Rooms Food and beverage Other hotel/casino 9,341 1,016 2,529 5,777 Airline 20,599 19,679 8,018 45,130 68,948 181,037 (123,237) Selling, general, and administrative (including bad debt expense of $3,855) Depreciation expense Hotel preopening expenses Aircraft carrying value adjustment Total operating expenses Operating income Nonoperating items: Interest income Interest expense Other, net Income before taxes Provision for income taxes 12,231 (6,596) 16 (117,586) -0- Net income (Loss) $(117,586) Balance Sheets December 31, ($ in thousands) 20X1 20x0 Assets Cash $ 211,305 $ 579,963 35,249 2,178 Gross accounts receivable Less: Allowance for doubtful accounts Prepaid expenses (4.733) (1.531) 11.755 1,219 Inventories 12,662 154 Total current assets 266,238 581,983 953.796 471,506 (86,512) (21.796) 10,677 26,601 21.116 $1,160,123 $1.063.486 S 14.181 $ 4,322 8.194 945 9,472 9,429 Gross property, plant, and equipment Less: Accumulated depreciation Pre-opening expenses Other operating assets Total assets Liabilities and Stockholders' Equity Accounts payable Accrued salaries and wages Accrued interest on long-term debt Other accrued liabilities Construction payables Current maturities, finance leases Current maturities, long-term debt Total current liabilities Deferred revenues Deferred income taxes Long-term obligation, finance leases Long-term debt 33,502 9.744 96.844 32,296 1.830 289 1,573 -0- 165,596 57,025 10.784 -0- 6.517 6.517 14.044 162 481.427 473.000 Total liabilities 678,368 536.704 506 485 662,365 589.827 (29.490) Common stock Capital in excess of par value Common stock in treasury Retained earnings (deficit) Total stockholders' equity Total liabilities and equity (29.490) (34,040) (151,626) 481.755 526.782 $1,160,123 $1,063,486 Additional Information and Author Notes: Aircraft valuation adjustment: The company reduced the book value of its aircraft and related equipment to their expected recoverable values and recognized an aircraft carrying value adjustment in the 20X1 income statement. (Author Note: You may treat this item as "extra" depreciation recorded during the year due to abnormal decline in the asset value.] Property, plant, and equipment: Includes land, buildings, aircraft equipment, furniture and fixtures, equipment under capital lease, and so on. During 20X1, the company acquired equipment under capital leases for $ 16,987,000. The company also sold equipment with a net book value of $2,501,000 for $684,000 cash. (Author Note: The gain or loss on this sale is combined with some other item in the income statement. Any other change in the gross book value of Property, plant, and equipment may be attributed to outright purchase of other equipment and building construction costs.] Finance lease and long-term liabilities: [Author Note: When preparing the cash flow statement, you may find it convenient to combine the current and long-term portions of each of these liabilities.] Pre-opening expenses: Pre-opening expenses include direct project salaries, advertising, and other pre-opening services incurred during the pre- opening period of the Lucky Lady Hotel. Such expenses were expensed upon opening the facility. Stock offering: The increases in Common stock and Capital in excess of par accounts are due to a common stock offering completed on August 17, 20X1. Laundry loan: On June 16, 20X1, the company obtained a $10,000,000 loan from a financial institution for a laundry facility in North Las Vegas, Nevada. As of December 31, 20X1, $10,000,000 has been drawn down under the loan. Construction of the facility was completed in December 20X1. The laundry provides the laundry and dry cleaning services for the Lucky Lady Hotel. Required: Using the indirect method, prepare the statement of cash flows for the year ended December 31, 20X1, in as much detail as possible. For example, borrowing and repayment, if any, should be shown separately as financing inflow and outflow, respectively. Similarly, to the extent that information is available, separately disclose and explain the changes to each asset and each liability account that affected Lucky Lady's cash flows during 20X1. Page 20-51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts