Question: please do this in GAAP principal not in Indian format ok this is new one. please do it in GAAP principal ACCT 20 PROJECT #1

please do this in GAAP principal not in Indian format ok

this is new one. please do it in GAAP principal

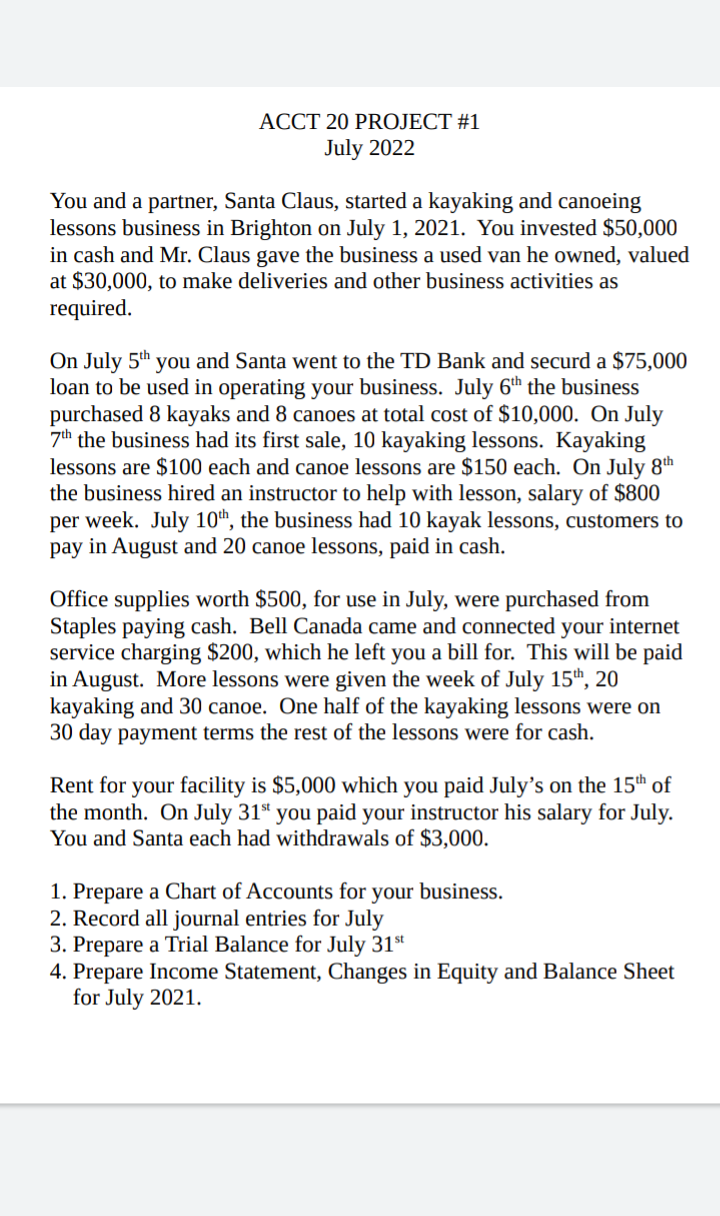

ACCT 20 PROJECT #1 July 2022 You and a partner, Santa Claus, started a kayaking and canoeing lessons business in Brighton on July 1, 2021. You invested $50,000 in cash and Mr. Claus gave the business a used van he owned, valued at $30,000, to make deliveries and other business activities as required. On July 5th you and Santa went to the TD Bank and securd a $75,000 loan to be used in operating your business. July 6th the business purchased 8 kayaks and 8 canoes at total cost of $10,000. On July 7th the business had its first sale, 10 kayaking lessons. Kayaking lessons are $100 each and canoe lessons are $150 each. On July 8th the business hired an instructor to help with lesson, salary of $800 per week. July 10th, the business had 10 kayak lessons, customers to pay in August and 20 canoe lessons, paid in cash. Office supplies worth $500, for use in July, were purchased from Staples paying cash. Bell Canada came and connected your internet service charging $200, which he left you a bill for. This will be paid in August. More lessons were given the week of July 15th,20 kayaking and 30 canoe. One half of the kayaking lessons were on 30 day payment terms the rest of the lessons were for cash. Rent for your facility is $5,000 which you paid July's on the 15th of the month. On July 31st you paid your instructor his salary for July. You and Santa each had withdrawals of $3,000. 1. Prepare a Chart of Accounts for your business. 2. Record all journal entries for July 3. Prepare a Trial Balance for July 31st 4. Prepare Income Statement, Changes in Equity and Balance Sheet for July 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts