Question: Please do this question. 0.3 inn * The Interest rate en Euro denominated assets maturing in one yeaf is 10% and the interest rate on

Please do this question.

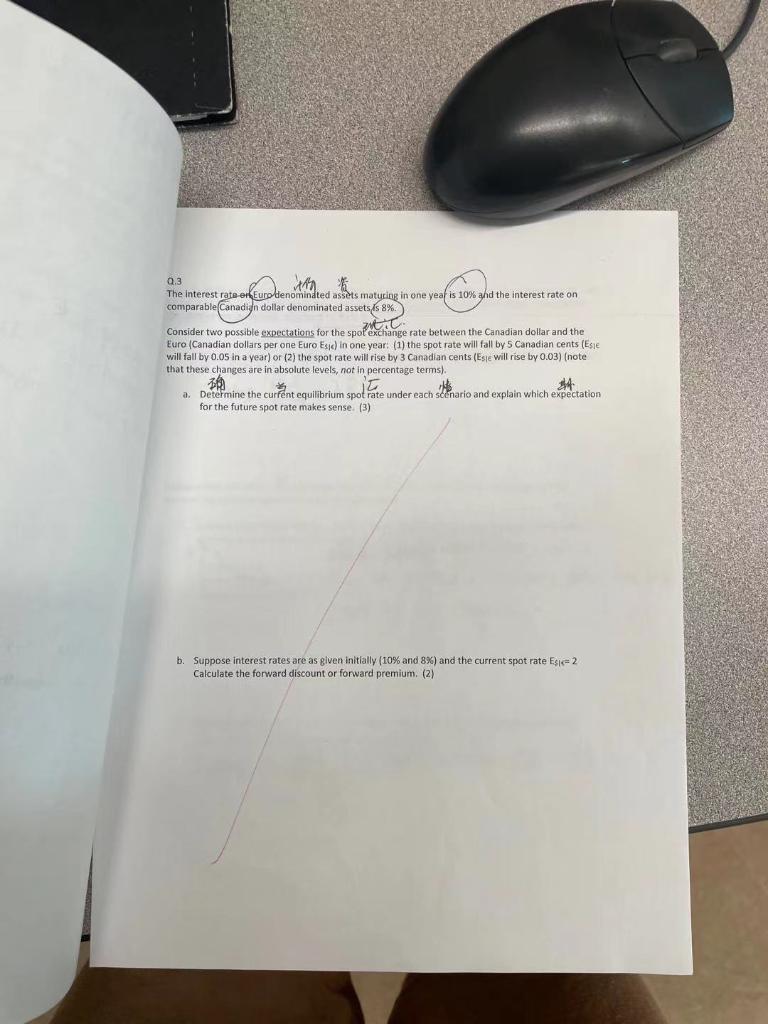

0.3 inn * The Interest rate en Euro denominated assets maturing in one yeaf is 10% and the interest rate on comparable(Canadign dollar denominated assetss 8% cic Consider two possible expectations for the spot exchange rate between the Canadian dollar and the Euro (Canadian dollars per one Euro Esc) in one year: (1) the spot rate will fall by 5 Canadian cents (Esie will fall by 0.05 in a year) or (2) the spot rate will rise by 3 Canadian cents (Esje will rise by 0.03) (note that these changes are in absolute levels, not in percentage terms). BB 4 a. Determine the current equilibrium spot fate under each stenario and explain which expectation for the future spot rate makes sense (3) b. Suppose interest rates are as given initially (10% and 8%) and the current spot rate Ess=2 Calculate the forward discount or forward premium. (2) 0.3 inn * The Interest rate en Euro denominated assets maturing in one yeaf is 10% and the interest rate on comparable(Canadign dollar denominated assetss 8% cic Consider two possible expectations for the spot exchange rate between the Canadian dollar and the Euro (Canadian dollars per one Euro Esc) in one year: (1) the spot rate will fall by 5 Canadian cents (Esie will fall by 0.05 in a year) or (2) the spot rate will rise by 3 Canadian cents (Esje will rise by 0.03) (note that these changes are in absolute levels, not in percentage terms). BB 4 a. Determine the current equilibrium spot fate under each stenario and explain which expectation for the future spot rate makes sense (3) b. Suppose interest rates are as given initially (10% and 8%) and the current spot rate Ess=2 Calculate the forward discount or forward premium. (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts