Question: Please do work by hand to get credit. Can't be done in excel Suppose that a portfolio is worth $1.937 Billion and the S&P500 Index

Please do work by hand to get credit. Can't be done in excel

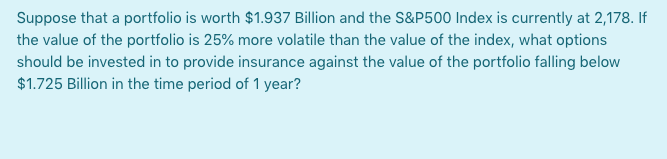

Suppose that a portfolio is worth $1.937 Billion and the S&P500 Index is currently at 2,178. If the value of the portfolio is 25% more volatile than the value of the index, what options should be invested in to provide insurance against the value of the portfolio falling below $1.725 Billion in the time period of 1 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts