Question: Please do work by hand to get credit. Can't be done in excel Suppose that the risk-free zero curve is flat at 6% per annum

Please do work by hand to get credit. Can't be done in excel

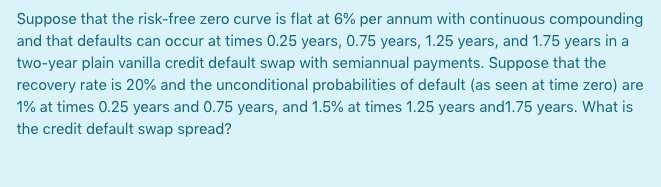

Suppose that the risk-free zero curve is flat at 6% per annum with continuous compounding and that defaults can occur at times 0.25 years, 0.75 years, 1.25 years, and 1.75 years in a two-year plain vanilla credit default swap with semiannual payments. Suppose that the recovery rate is 20% and the unconditional probabilities of default (as seen at time zero) are 1% at times 0.25 years and 0.75 years, and 1.5% at times 1.25 years and1.75 years. What is the credit default swap spread

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts