Question: Please do work neatly by hand so I can understand how to solve these in the future!:) 4. [3 points] Consider the following information that

Please do work neatly by hand so I can understand how to solve these in the future!:)

Please do work neatly by hand so I can understand how to solve these in the future!:)

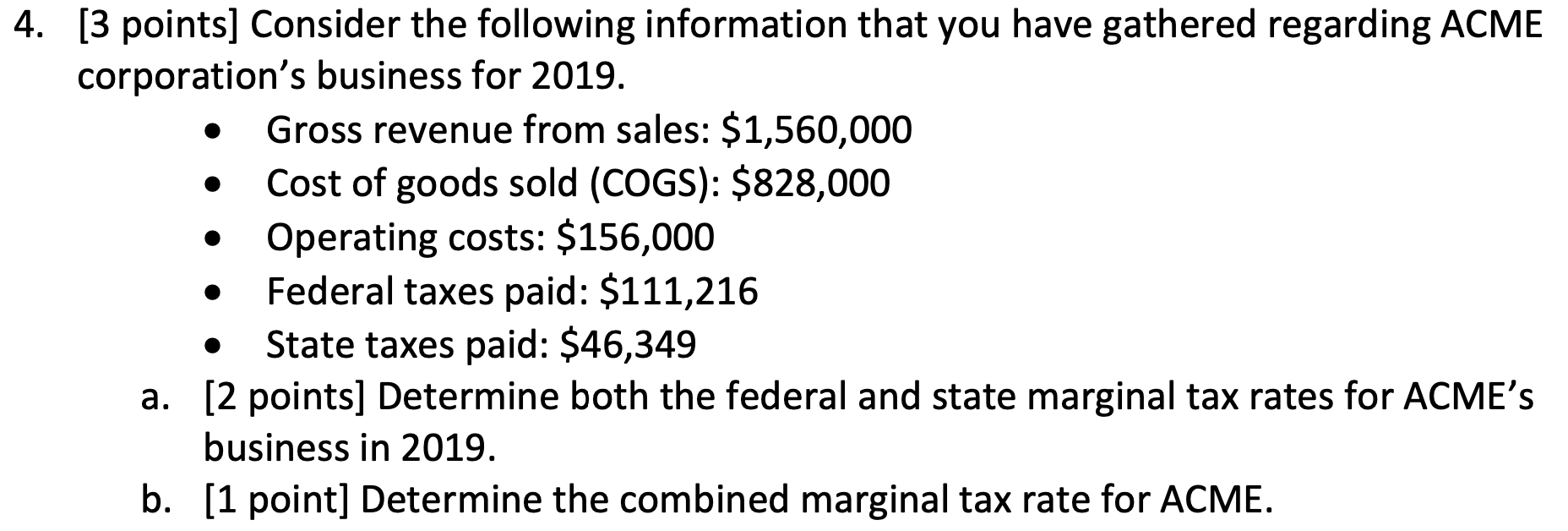

4. [3 points] Consider the following information that you have gathered regarding ACME corporation's business for 2019. Gross revenue from sales: $1,560,000 Cost of goods sold (COGS): $828,000 Operating costs: $156,000 Federal taxes paid: $111,216 State taxes paid: $46,349 a. [2 points] Determine both the federal and state marginal tax rates for ACME's business in 2019. b. [1 point] Determine the combined marginal tax rate for ACME

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock