Question: PLEASE DO WORK ON EXCEL AND SHOW FORMULA. THANKS. 5) You purchased a $450,000 home. You put down a 20% payment and financed the remaining

PLEASE DO WORK ON EXCEL AND SHOW FORMULA. THANKS.

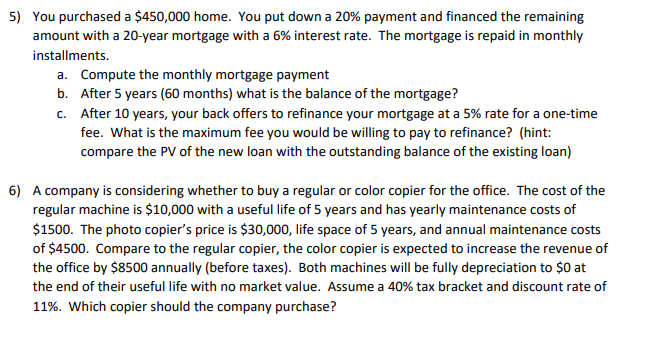

5) You purchased a $450,000 home. You put down a 20% payment and financed the remaining amount with a 20-year mortgage with a 6% interest rate. The mortgage is repaid in monthly installments. a. Compute the monthly mortgage payment b. After 5 years (60 months) what is the balance of the mortgage? C. After 10 years, your back offers to refinance your mortgage at a 5% rate for a one-time fee. What is the maximum fee you would be willing to pay to refinance? (hint: compare the PV of the new loan with the outstanding balance of the existing loan) 6) A company is considering whether to buy a regular or color copier for the office. The cost of the regular machine is $10,000 with a useful life of 5 years and has yearly maintenance costs of $1500. The photo copier's price is $30,000, life space of 5 years, and annual maintenance costs of $4500. Compare to the regular copier, the color copier is expected to increase the revenue of the office by $8500 annually (before taxes). Both machines will be fully depreciation to $0 at the end of their useful life with no market value. Assume a 40% tax bracket and discount rate of 11%. Which copier should the company purchase? 5) You purchased a $450,000 home. You put down a 20% payment and financed the remaining amount with a 20-year mortgage with a 6% interest rate. The mortgage is repaid in monthly installments. a. Compute the monthly mortgage payment b. After 5 years (60 months) what is the balance of the mortgage? C. After 10 years, your back offers to refinance your mortgage at a 5% rate for a one-time fee. What is the maximum fee you would be willing to pay to refinance? (hint: compare the PV of the new loan with the outstanding balance of the existing loan) 6) A company is considering whether to buy a regular or color copier for the office. The cost of the regular machine is $10,000 with a useful life of 5 years and has yearly maintenance costs of $1500. The photo copier's price is $30,000, life space of 5 years, and annual maintenance costs of $4500. Compare to the regular copier, the color copier is expected to increase the revenue of the office by $8500 annually (before taxes). Both machines will be fully depreciation to $0 at the end of their useful life with no market value. Assume a 40% tax bracket and discount rate of 11%. Which copier should the company purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts