Question: Please dont answer this if you are not sure . Its sinsitive. 6. A London-based importer of cheese owes EUR 13,500,000 to its Italian supplier

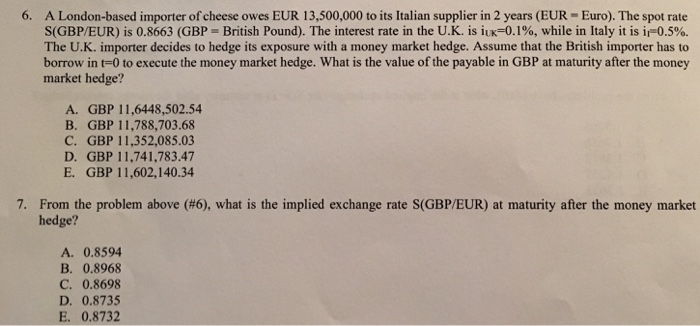

6. A London-based importer of cheese owes EUR 13,500,000 to its Italian supplier in 2 years (EUR-Euro). The spot rate S(GBP/EUR) is 0.8663 (GBP British Pound). The interest rate in the U.K. is LK-0.1%, while in Italy it is ir-0.5%. The U.K. importer decides to hedge its exposure with a money market hedge. Assume that the British importer has to borrow in t-0 to execute the money market hedge. What is the value of the payable in GBP at maturity after the money market hedge? A. GBP 11,6448,502.54 B. GBP 11,788,703.68 C. GBP 11,352,085.03 D. GBP 11,741,783.47 E. GBP 11,602,140.34 7. Frorm the problem above (#6), what is the implied exchange rate S(GBP/EUR) at maturity after the money market hedge? A. 0.8594 B. 0.8968 C. 0.8698 D. 0.8735 E. 0.8732

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts