Question: please dont aswer from excel solutions I need handwritten formulas and solutions please! TCX, Inc. is an Indian electronics system integrator, developing a new product

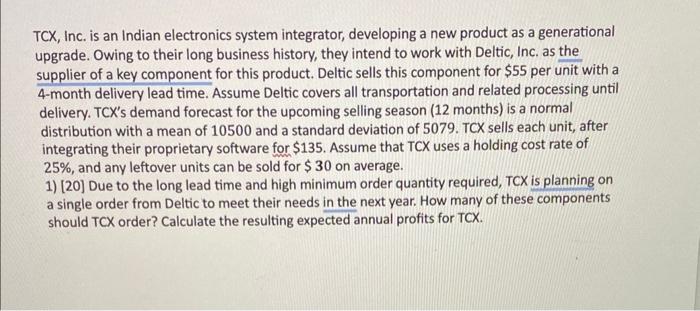

TCX, Inc. is an Indian electronics system integrator, developing a new product as a generational upgrade. Owing to their long business history, they intend to work with Deltic, Inc. as the supplier of a key component for this product. Deltic sells this component for $55 per unit with a 4-month delivery lead time. Assume Deltic covers all transportation and related processing until delivery. TCX's demand forecast for the upcoming selling season (12 months) is a normal distribution with a mean of 10500 and a standard deviation of 5079. TCX sells each unit, after integrating their proprietary software for $135. Assume that TCX uses a holding cost rate of 25%, and any leftover units can be sold for $30 on average. 1) [20] Due to the long lead time and high minimum order quantity required, TCX is planning on a single order from Deltic to meet their needs in the next year. How many of these components should TCX order? Calculate the resulting expected annual profits for TCX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts