Question: PLEASE DON'T COPY FROM CHEGG ANSWER I NEED NEW ANSWER QUESTION 4 (FE SEPT/OCT 2017) A speculator shorts 4 April Crude Palm Oil (CPO) futures

PLEASE DON'T COPY FROM CHEGG ANSWER I NEED NEW ANSWER

PLEASE DON'T COPY FROM CHEGG ANSWER I NEED NEW ANSWER

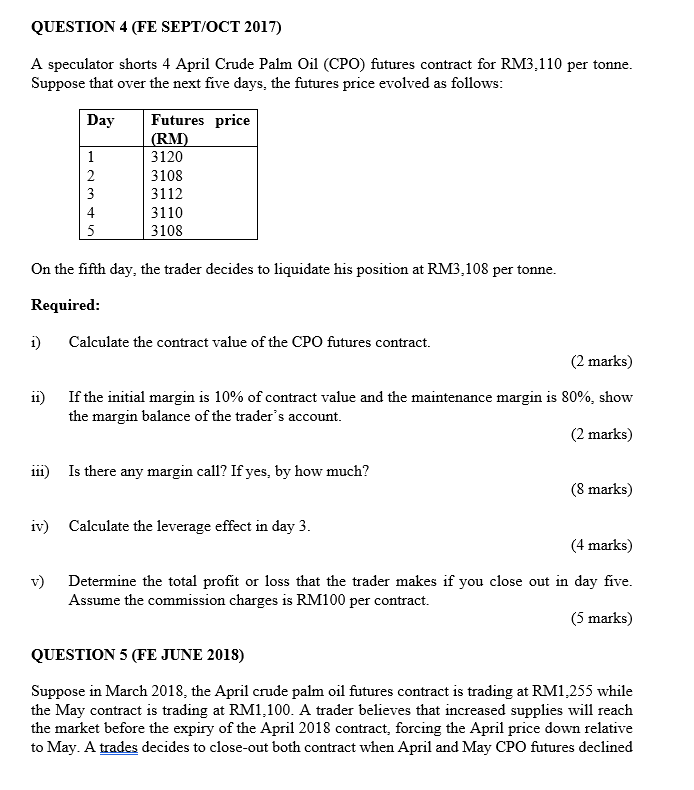

QUESTION 4 (FE SEPT/OCT 2017) A speculator shorts 4 April Crude Palm Oil (CPO) futures contract for RM3.110 per tonne. Suppose that over the next five days, the futures price evolved as follows: Day 1 2 3 4 5 Futures price (RM) 3120 3108 3112 3110 3108 + On the fifth day, the trader decides to liquidate his position at RM3,108 per tonne. Required: i) Calculate the contract value of the CPO futures contract. (2 marks) 11) If the initial margin is 10% of contract value and the maintenance margin is 80%, show the margin balance of the trader's account. (2 marks) Is there any margin call? If yes, by how much? (8 marks) 111) iv) Calculate the leverage effect in day 3. (4 marks) v) Determine the total profit or loss that the trader makes if you close out in day five. Assume the commission charges is RM100 per contract. (5 marks) QUESTION 5 (FE JUNE 2018) Suppose in March 2018, the April crude palm oil futures contract is trading at RM1,255 while the May contract is trading at RM1,100. A trader believes that increased supplies will reach the market before the expiry of the April 2018 contract, forcing the April price down relative to May. A trades decides to close-out both contract when April and May CPO futures declined QUESTION 4 (FE SEPT/OCT 2017) A speculator shorts 4 April Crude Palm Oil (CPO) futures contract for RM3.110 per tonne. Suppose that over the next five days, the futures price evolved as follows: Day 1 2 3 4 5 Futures price (RM) 3120 3108 3112 3110 3108 + On the fifth day, the trader decides to liquidate his position at RM3,108 per tonne. Required: i) Calculate the contract value of the CPO futures contract. (2 marks) 11) If the initial margin is 10% of contract value and the maintenance margin is 80%, show the margin balance of the trader's account. (2 marks) Is there any margin call? If yes, by how much? (8 marks) 111) iv) Calculate the leverage effect in day 3. (4 marks) v) Determine the total profit or loss that the trader makes if you close out in day five. Assume the commission charges is RM100 per contract. (5 marks) QUESTION 5 (FE JUNE 2018) Suppose in March 2018, the April crude palm oil futures contract is trading at RM1,255 while the May contract is trading at RM1,100. A trader believes that increased supplies will reach the market before the expiry of the April 2018 contract, forcing the April price down relative to May. A trades decides to close-out both contract when April and May CPO futures declined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts