Question: Please don't copy the answer that has already been posted before Assume that BAPS, a US-based parent company is considering the establishment of a subsidiary

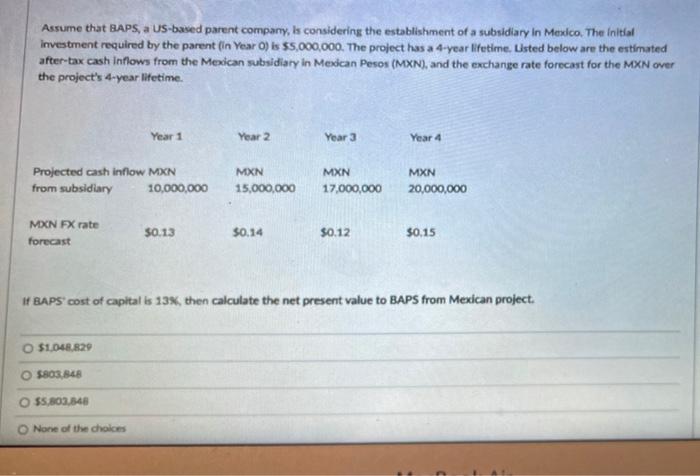

Assume that BAPS, a US-based parent company is considering the establishment of a subsidiary in Mexico. The initial Investment required by the parent (in Year) is $5,000,000. The project has a 4-year lifetime. Listed below are the estimated after-tax cash inflows from the Mexican subsidiary in Mexican Peso (MXN), and the exchange rate forecast for the MXN over the project's 4-year lifetime. Year 1 Year 2 Year 3 Year 4 Projected cash inflow MXN from subsidiary 10,000,000 MXN 15,000,000 MXN 17,000,000 MXN 20,000,000 MXN FX rate forecast 50.13 $0.14 $0.12 50.15 I BAPS cost of capital is 13%, then calculate the net present value to BAPS from Mexican project. O $1.048.829 O $803, 848 $5.803,348 None of the choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts