Question: Please don't copy wrong answer. Thank you so much Stock XYZ pays dividends of $2 every three months, namely at T = 2/12, T, =

Please don't copy wrong answer. Thank you so much

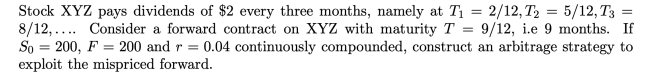

Stock XYZ pays dividends of $2 every three months, namely at T = 2/12, T, = 5/12, T3 = 8/12,.... Consider a forward contract on XYZ with maturity T = 9/12, i.e 9 months. If So = 200, F = 200 and r = 0.04 continuously compounded, construct an arbitrage strategy to exploit the mispriced forward. Stock XYZ pays dividends of $2 every three months, namely at T = 2/12, T, = 5/12, T3 = 8/12,.... Consider a forward contract on XYZ with maturity T = 9/12, i.e 9 months. If So = 200, F = 200 and r = 0.04 continuously compounded, construct an arbitrage strategy to exploit the mispriced forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts