Question: Please don't do in excel format. please do use formula. A financial manager is looking at two mutually exclusive investments offering returns as follows: A

Please don't do in excel format. please do use formula.

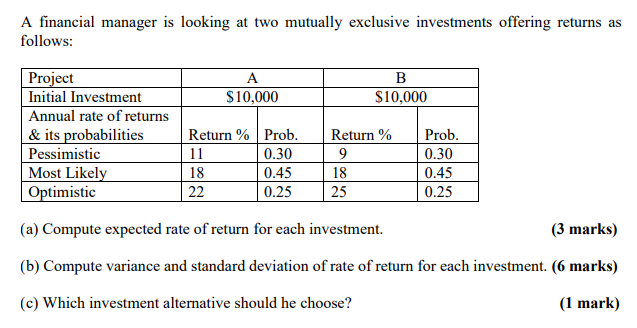

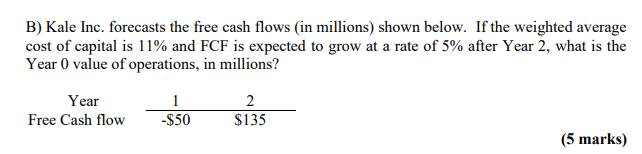

A financial manager is looking at two mutually exclusive investments offering returns as follows: A $10,000 B $10,000 Project Initial Investment Annual rate of returns & its probabilities Pessimistic Most Likely Optimistic Return % 9 Return % Prob. 11 0.30 18 0.45 22 0.25 Prob. 0.30 0.45 0.25 18 25 (a) Compute expected rate of return for each investment. (3 marks) (b) Compute variance and standard deviation of rate of return for each investment. (6 marks) (c) Which investment alternative should he choose? (1 mark) B) Kale Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Year 1 -$50 2 $135 Free Cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts