Question: Please dont do the answer in a paper. Thanks The questions to be answered are: Question 1 (7 marks) (Note this question is based on

Please dont do the answer in a paper. Thanks

Please dont do the answer in a paper. Thanks

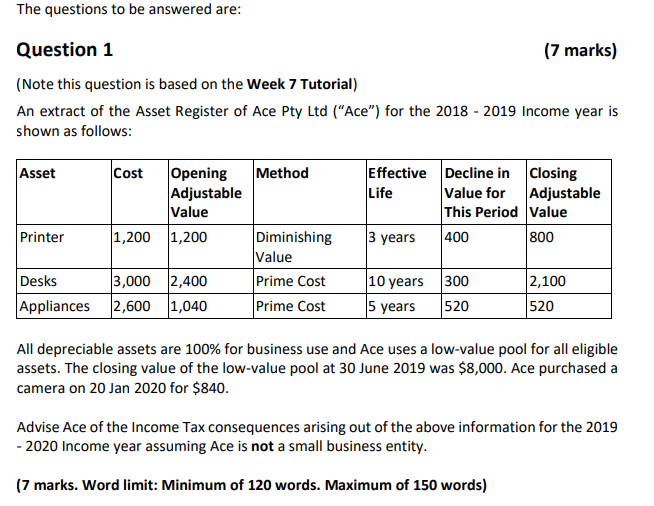

The questions to be answered are: Question 1 (7 marks) (Note this question is based on the Week 7 Tutorial) An extract of the Asset Register of Ace Pty Ltd ("Ace") for the 2018 - 2019 Income year is shown as follows: Asset Cost Method Opening Adjustable Value 1,200 1,200 Effective Decline in closing Life Value for Adjustable This Period Value 3 years 400 800 Printer Diminishing Value Prime Cost Prime Cost Desks 3,000 2,400 Appliances 2,600 1,040 10 years 300 5 years 520 2,100 520 All depreciable assets are 100% for business use and Ace uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2019 was $8,000. Ace purchased a camera on 20 Jan 2020 for $840. Advise Ace of the Income Tax consequences arising out of the above information for the 2019 - 2020 Income year assuming Ace is not a small business entity. (7 marks. Word limit: Minimum of 120 words. Maximum of 150 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts