Question: please Don't give me the answer that already got in the chegg i need a full answer i have attached example answer, Full answer follow

please Don't give me the answer that already got in the chegg i need a full answer i have attached example answer, Full answer follow

please Don't give me the answer that already got in the chegg i need a full answer i have attached example answer, Full answer follow

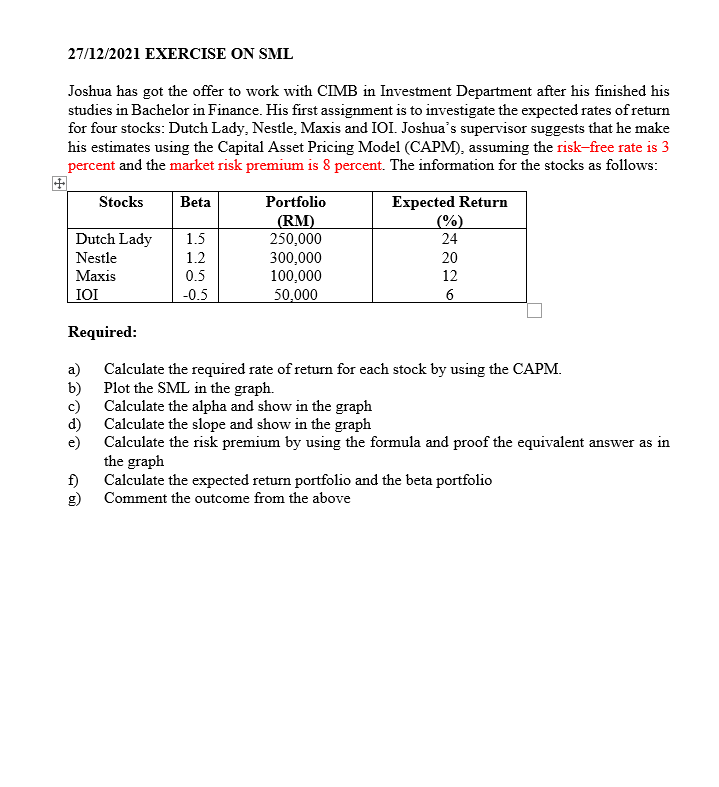

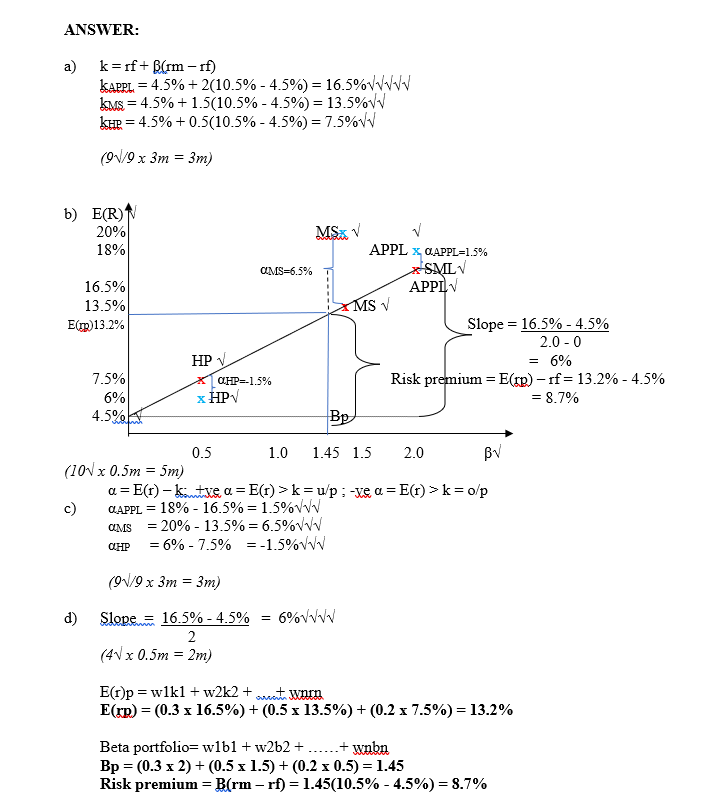

27/12/2021 EXERCISE ON SML Joshua has got the offer to work with CIMB in Investment Department after his finished his studies in Bachelor in Finance. His first assignment is to investigate the expected rates of return for four stocks: Dutch Lady, Nestle, Maxis and IOI. Joshua's supervisor suggests that he make his estimates using the Capital Asset Pricing Model (CAPM), assuming the risk-free rate is 3 percent and the market risk premium is 8 percent. The information for the stocks as follows: Stocks Beta Expected Return (%) 24 Dutch Lady Nestle Maxis 1.5 1.2 0.5 -0.5 Portfolio (RM) 250,000 300,000 100,000 50,000 20 12 6 Required: aboap ) ) c) d) e) Calculate the required rate of return for each stock by using the CAPM. Plot the SML in the graph. Calculate the alpha and show in the graph Calculate the slope and show in the graph Calculate the risk premium by using the formula and proof the equivalent answer as in the graph Calculate the expected return portfolio and the beta portfolio Comment the outcome from the above f) 19 ANSWER: a) k=rf + B(rm -rf) KAPPL = 4.5% + 2(10.5% -4.5%) = 16.5%WWWWW kus = 4.5% +1.5(10.5% - 4.5) = 13.5%/ khe = 4.5%+0.5(10.5% -4.5%) = 7.5%v (93/9 x 3m = 3m) b) E(R) 20% 18% 16.5% 13.5% Etmp) 13.2% MSV APPL x CLAPPL=1.5% OMS=6.5% XSMLV APPLV MS Slope = 16.5% -4.5% 2.0 - 0 HPV = 6% X CHP=-1.5% Risk premium = E() - rf= 13.2% -4.5% = 8.7% = = 7.5% 6% x HPV 4.5%! 8 1.0 Bv = 0.5 1.45 1.5 2.0 (100 x 0.5m = 5m) a=E(1)-kontse a = E(1) >k=u/p: -ve a=E() > kro/p c) CLAPPL = = 18% - 16.5% = 1.5% OLMS = 20% - 13.5% = 6.5% = 6% - 7.5% = -1.5% = CHP (93/9 x 3m = 3m) = d) 69% Slope = 16.5% - 4.5% = 2 (41 x 0.5m = 2m) E()p = wlkl + w2k2 + aunt wnrn. E(rp) = (0.3 x 16.5%) + (0.5 x 13.5%) +(0.2 x 7.5%) = 13.2% Beta portfolio=w1b1 + w262 + wnbn Bp = (0.3 x 2) + (0.5 x 1.5)+(0.2 x 0.5) = 1.45 Risk premium = B(rm -rf) = 1.45(10.5% -4.5%) = 8.7% e) Stocks Apple(0.25m) and Microsoft(0.25m) are undervalue(0.5m) stocks since they have positive alpha/the expected return above than SML(1m). While stock Hewlett Packardco. 5m) is overvalue(0.5m) stock since the alpha is negative/expected return below than SML(1m). Therefore, invest in stocks Apple(0.25m) and Microsoft(0.25m) and not to invest in HP(0.5m). (All points = 5m)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts