Question: Please don't post the answer with picture, the content can't read at all, thanks a lot! Large Ltd. purchased 75% of Small Company on January

Please don't post the answer with picture, the content can't read at all, thanks a lot!

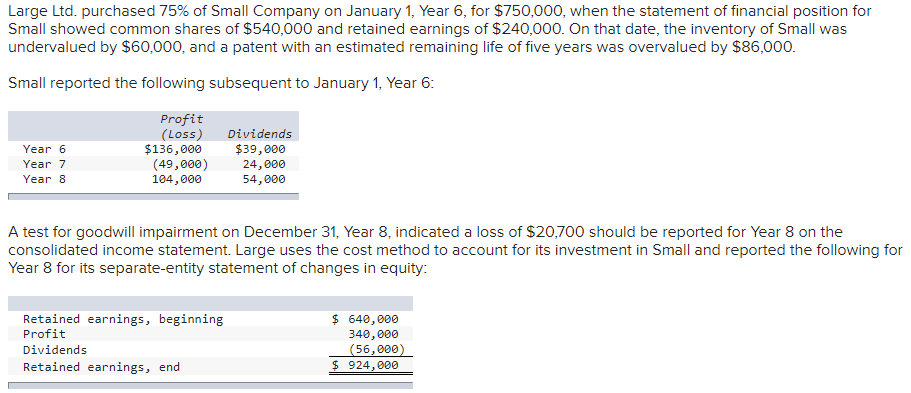

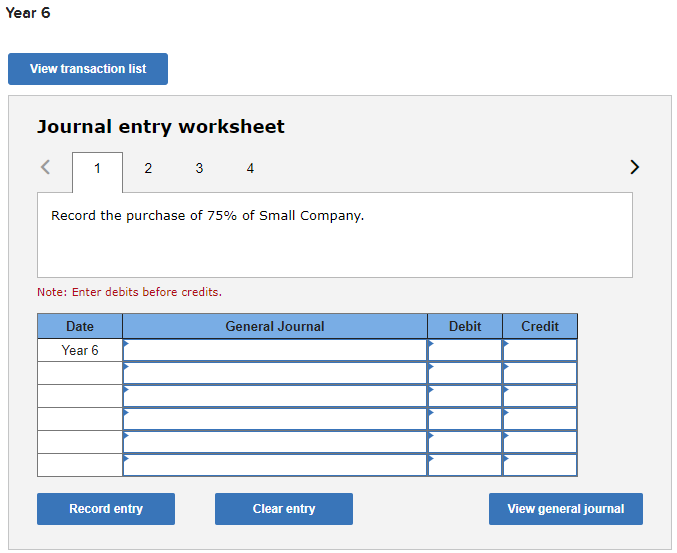

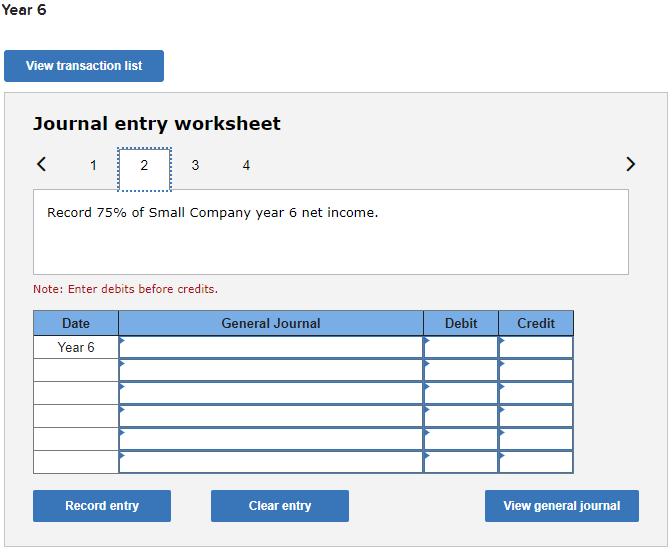

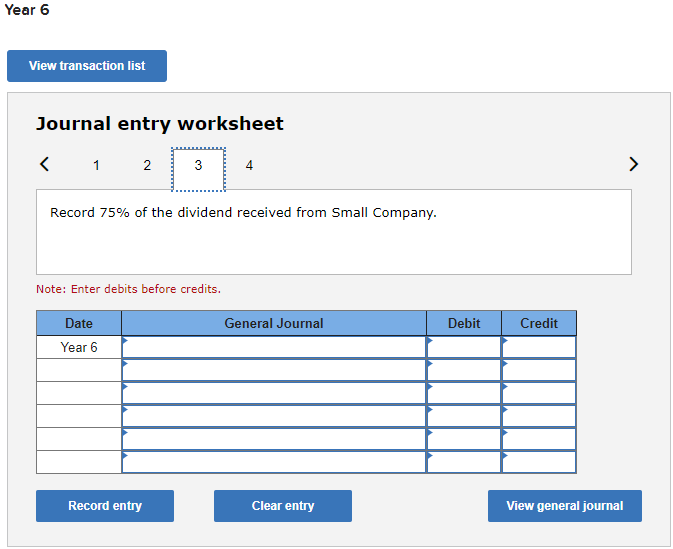

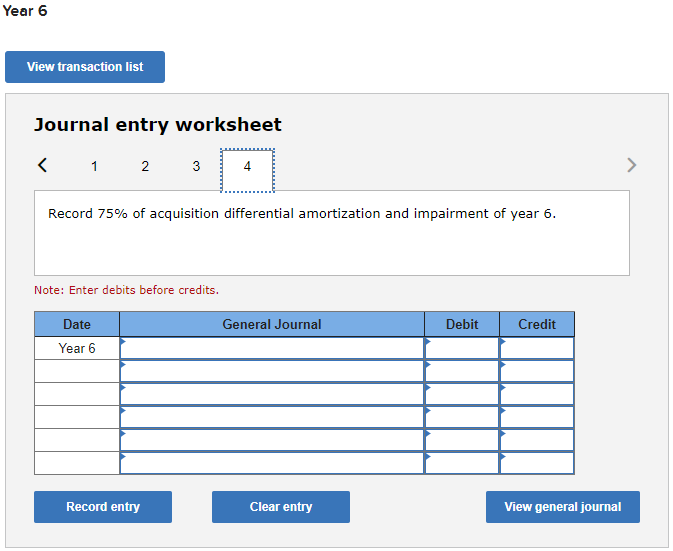

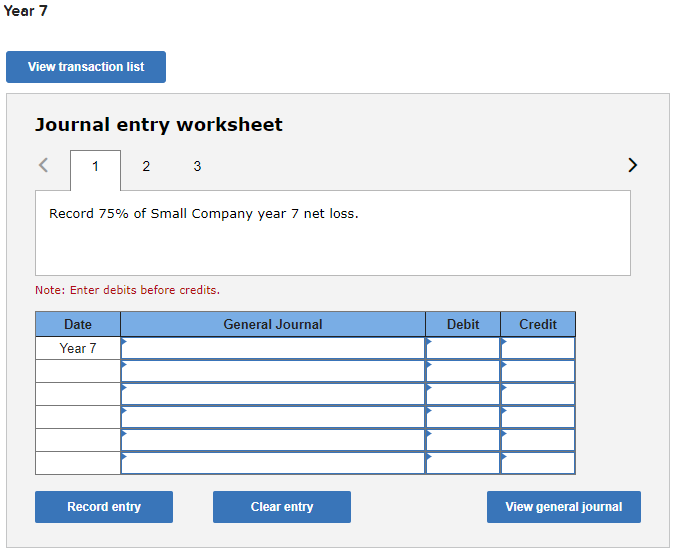

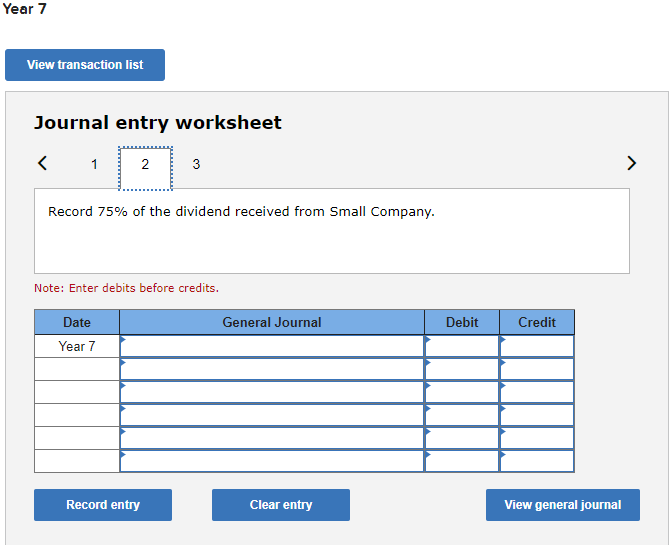

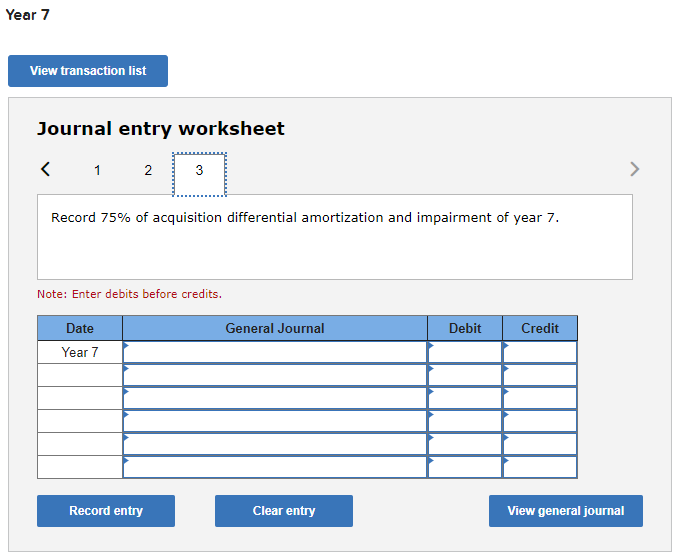

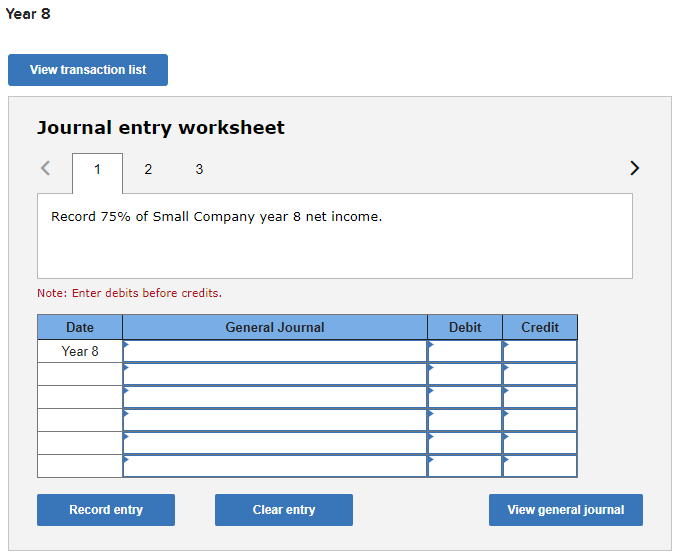

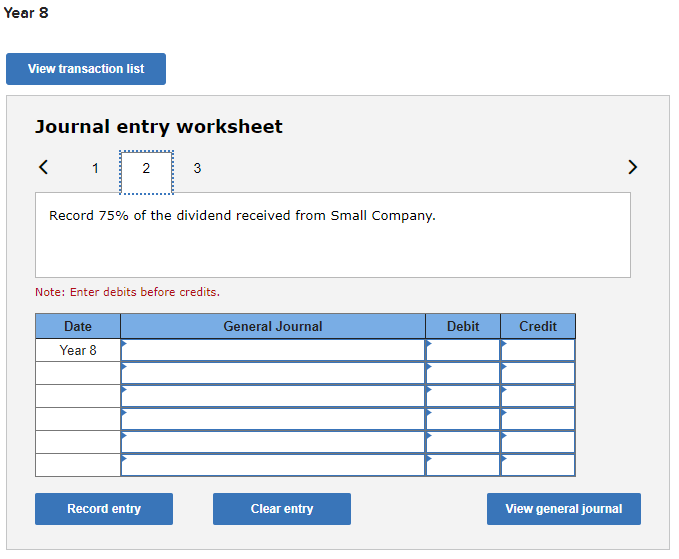

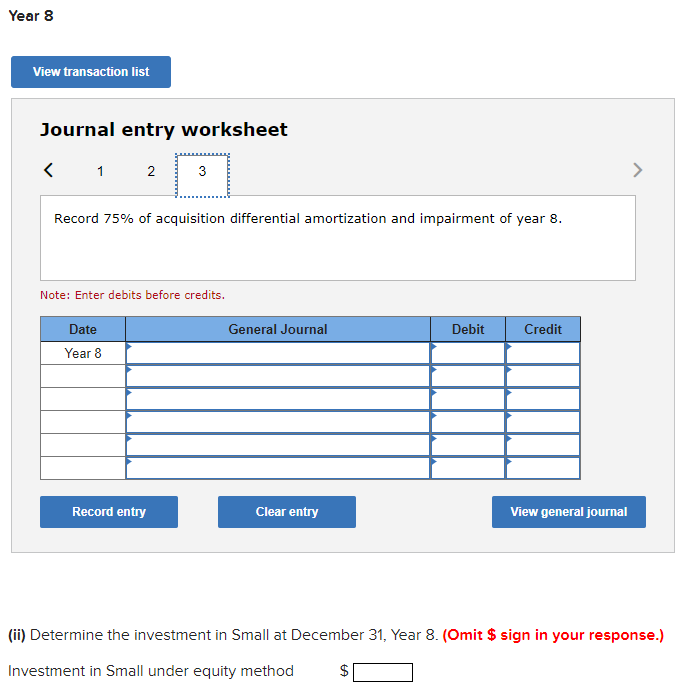

Large Ltd. purchased 75% of Small Company on January 1 , Year 6 , for $750,000, when the statement of financial position for Small showed common shares of $540,000 and retained earnings of $240,000. On that date, the inventory of Small was undervalued by $60,000, and a patent with an estimated remaining life of five years was overvalued by $86,000. Small reported the following subsequent to January 1 , Year 6 : A test for goodwill impairment on December 31 , Year 8 , indicated a loss of $20,700 should be reported for Year 8 on the consolidated income statement. Large uses the cost method to account for its investment in Small and reported the following for Year 8 for its separate-entity statement of changes in equity: Journal entry worksheet Record the purchase of 75% of Small Company. Note: Enter debits before credits. Journal entry worksheet 1 Record 75% of Small Company year 6 net income. Note: Enter debits before credits. Journal entry worksheet Record 75% of the dividend received from Small Company. Note: Enter debits before credits. Journal entry worksheet 75% of acquisition differential amortization and impairment of year 6 . Note: Enter debits before credits. Journal entry worksheet Record 75% of Small Company year 7 net loss. Note: Enter debits before credits. Journal entry worksheet Record 75% of the dividend received from Small Company. Note: Enter debits before credits. Journal entry worksheet Record 75% of acquisition differential amortization and impairment of year 7. Note: Enter debits before credits. Journal entry worksheet Record 75% of Small Company year 8 net income. Note: Enter debits before credits. Journal entry worksheet Record 75% of the dividend received from Small Company. Note: Enter debits before credits. Journal entry worksheet 1 Record 75% of acquisition differential amortization and impairment of year 8 . Note: Enter debits before credits. (ii) Determine the investment in Small at December 31, Year 8 . (Omit $ sign in your response.) Investment in Small under equity method $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts