Question: please dont show work from excel. The CSI Corporation is looking to replace an existing printing press with one of two newer models that are

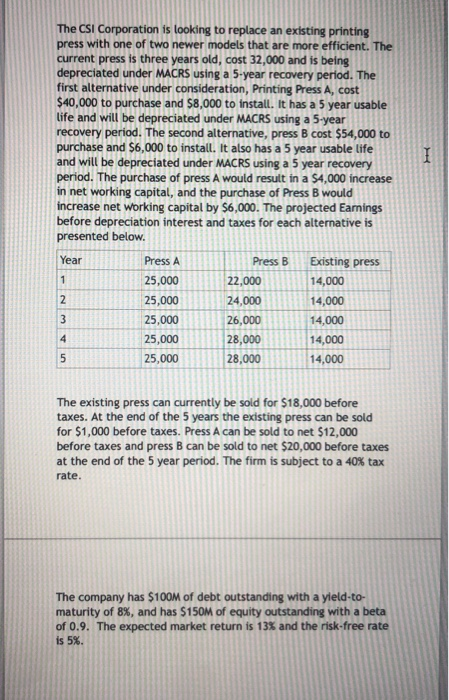

The CSI Corporation is looking to replace an existing printing press with one of two newer models that are more efficient. The current press is three years old, cost 32,000 and is being depreciated under MACRS using a 5-year recovery period. The first alternative under consideration, Printing Press A, cost $40,000 to purchase and $8,000 to install. It has a 5 year usable life and will be depreciated under MACRS using a 5-year recovery period. The second alternative, press B cost $54,000 to purchase and $6,000 to install. It also has a 5 year usable life and will be depreciated under MACRS using a 5 year recovery period. The purchase of press A would result in a $4,000 increase in net working capital, and the purchase of Press B would increase net working capital by $6,000. The projected Eamings before depreciation interest and taxes for each alternative is presented below. Year Press A Press B Existing press 25,000 22,000 25,000 14,000 25,000 14,000 25,000 14,000 25,000 28,000 4,000 14,000 The existing press can currently be sold for $18,000 before taxes. At the end of the 5 years the existing press can be sold for $1,000 before taxes. Press A can be sold to net $12,000 before taxes and press B can be sold to net $20,000 before taxes at the end of the 5 year period. The firm is subject to a 40% tax rate. The company has $100M of debt outstanding with a yield-to- maturity of 8%, and has $150M of equity outstanding with a beta of 0.9. The expected market return is 13% and the risk-free rate is 5%. The CSI Corporation is looking to replace an existing printing press with one of two newer models that are more efficient. The current press is three years old, cost 32,000 and is being depreciated under MACRS using a 5-year recovery period. The first alternative under consideration, Printing Press A, cost $40,000 to purchase and $8,000 to install. It has a 5 year usable life and will be depreciated under MACRS using a 5-year recovery period. The second alternative, press B cost $54,000 to purchase and $6,000 to install. It also has a 5 year usable life and will be depreciated under MACRS using a 5 year recovery period. The purchase of press A would result in a $4,000 increase in net working capital, and the purchase of Press B would increase net working capital by $6,000. The projected Eamings before depreciation interest and taxes for each alternative is presented below. Year Press A Press B Existing press 25,000 22,000 25,000 14,000 25,000 14,000 25,000 14,000 25,000 28,000 4,000 14,000 The existing press can currently be sold for $18,000 before taxes. At the end of the 5 years the existing press can be sold for $1,000 before taxes. Press A can be sold to net $12,000 before taxes and press B can be sold to net $20,000 before taxes at the end of the 5 year period. The firm is subject to a 40% tax rate. The company has $100M of debt outstanding with a yield-to- maturity of 8%, and has $150M of equity outstanding with a beta of 0.9. The expected market return is 13% and the risk-free rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts