Question: please dont solve in paper please solve all question since all related Question 03 The Income statement for two entities, Black Company and Bury Company,

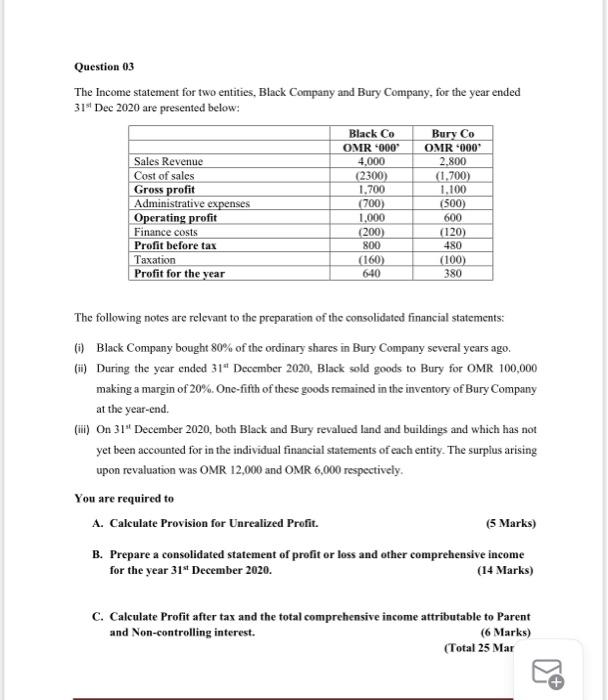

Question 03 The Income statement for two entities, Black Company and Bury Company, for the year ended 31" Dec 2020 are presented below: Black Co Bury Co OMR .000 OMR-000 Sales Revenue 4,000 2.800 Cost of sales (2300) (1.700) Gross profit 1.700 1.100 Administrative expenses (700) Operating profit 1.000 600 Finance costs (200) (120) Profit before tax 800 480 Taxation (160) (100) Profit for the year 640 380 (500) The following notes are relevant to the preparation of the consolidated financial statements: Black Company bought 80% of the ordinary shares in Bury Company several years ago. (ii) During the year ended 31" December 2020. Black sold goods to Bury for OMR 100,000 making a margin of 20%. One-fifth of these goods remained in the inventory of Bury Company at the year-end. (H) On 31" December 2020, both Black and Bury revalued land and buildings and which has not yet been accounted for in the individual financial statements of each entity. The surplus arising upon revaluation was OMR 12,000 and OMR 6,000 respectively. You are required to A. Calculate Provision for Unrealized Profit. (5 Marks) B. Prepare a consolidated statement of profit or loss and other comprehensive income for the year 31" December 2020. (14 Marks) C. Calculate Profit after tax and the total comprehensive income attributable to Parent and Non-controlling interest. (6 Marks) (Total 25 Mar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts