Question: please don't take the picture. Assignment Two The December 31, 2016 balance sheet of Sauder Company had Accounts Receivable of 500,000 and a credit balance

please don't take the picture.

please don't take the picture.

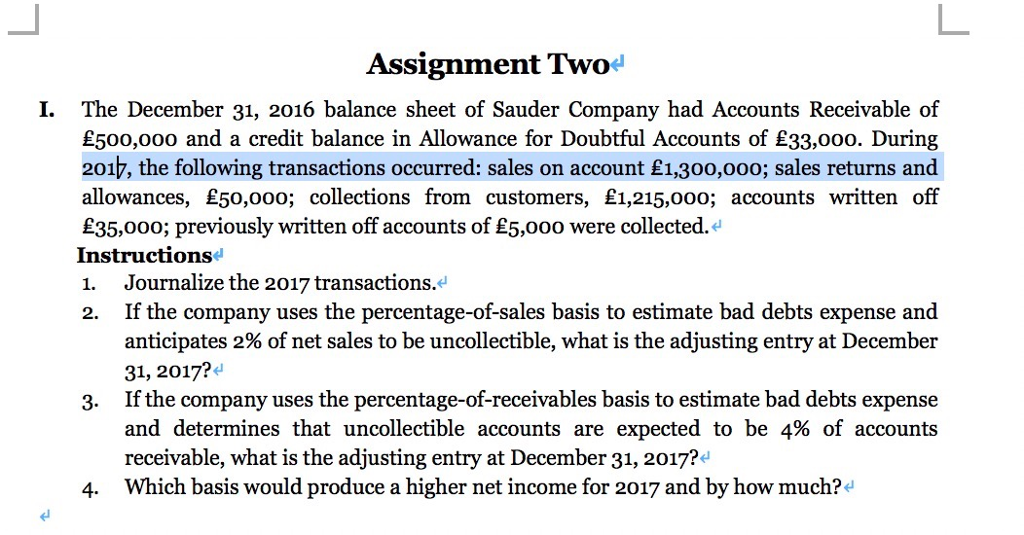

Assignment Two The December 31, 2016 balance sheet of Sauder Company had Accounts Receivable of 500,000 and a credit balance in Allowance for Doubtful Accounts of 33,00o. During 2017, the following transactions occurred: sales on account 1,300,000; sales returns and allowances, 50,00o; collections from customers, 1,215,000; accounts written off 35,000; previously written off accounts of 5,000o were collected.- Instructionse 1. Journalize the 2017 transactions. 2. If the company uses the percentage-of-sales basis to estimate bad debts expense and I. anticipates 2% of net sales to be uncollectible, what is the adjusting entry at December 31, 2017? 3. If the company uses the percentage-ofreceivables basis to estimate bad debts expense and determines that uncollectible accounts are expected to be 4% of accounts receivable, what is the adjusting entry at December 31, 2017?4 4. Which basis would produce a higher net income for 2017 and by how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts