Question: Please dont use ChatGPT! On December 31, for GAAP purposes, Clubs Inc. reported a balance of $40,000 in a warranty liability for anticipated costs to

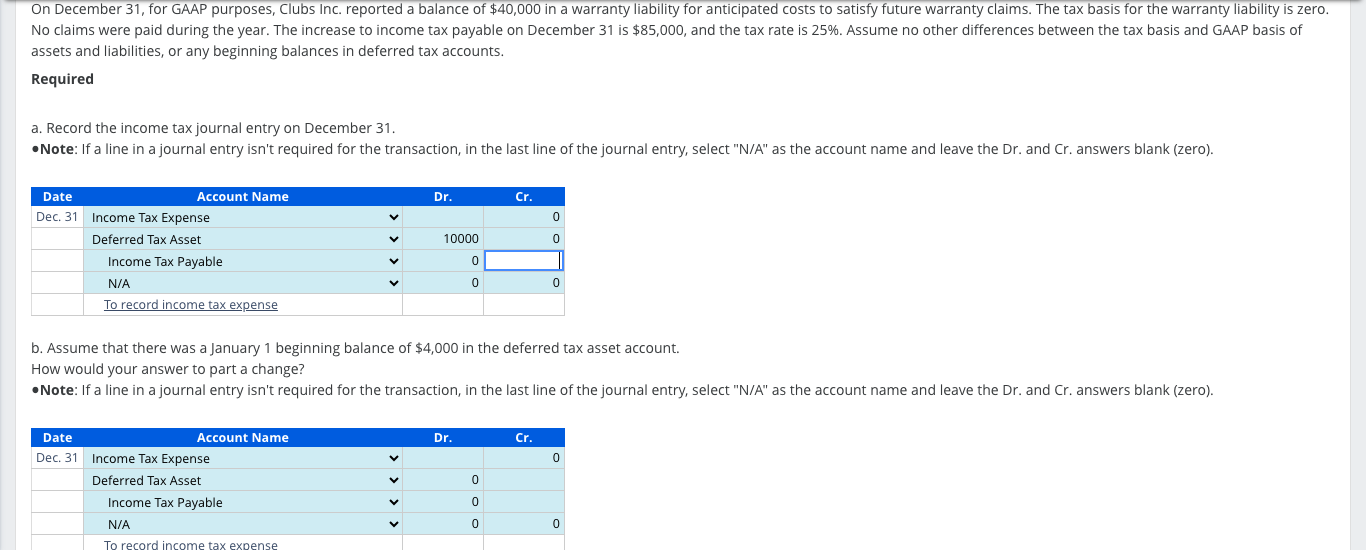

On December 31, for GAAP purposes, Clubs Inc. reported a balance of $40,000 in a warranty liability for anticipated costs to satisfy future warranty claims. The tax basis for the warranty liability is zero. No clams were paid during the year. The increase to income tax payable on December 31 is $85,000, and the tax rate IS 25%. Assume no other differences between the tax basis and GAAP basis of assets and liabilities, or any beginning balances in deferred tax accounts. Required a. Record the income tax journal entry on December 31 . Note: If a line in a journal entry isn't required for the transaction, in the last line of the journal entry, select "N/A' as the account name and leave the Dr. and Cr. answers blank (zero). Date Dec. 31 Account Name Income Tax Expense Deferred Tax Asset Income Tax Payable To record income tax expense 10000 b. Assume that there was a January 1 beginning balance of $4,000 in the deferred tax asset account. How would your answer to part a change? Note: If a line in a journal entry isn't required for the transaction, in the last line of the journal entry, select "N/A' as the account name and leave the Dr. and Cr. answers blank (zero). Date Dec. 31 Account Name Income Tax Expense Deferred Tax Asset Income Tax Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts