Question: Please don't use ChatGPT - please show your work- handwritten would be preferable. Also, please round to 4 decimal points. ? 6a. Given that current

Please don't use ChatGPT - please show your work- handwritten would be preferable. Also, please round to 4 decimal points. ?

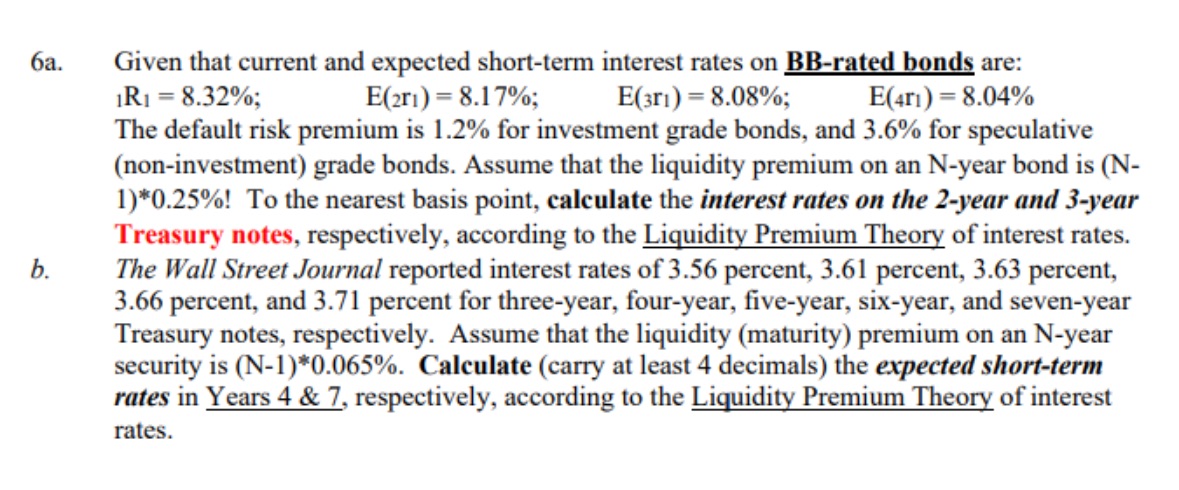

6a. Given that current and expected short-term interest rates on BB-rated bonds are: IRI = 8.32%; E(251) = 8.17%; E(31) = 8.08%; E(41) = 8.04% The default risk premium is 1.2% for investment grade bonds, and 3.6% for speculative (non-investment) grade bonds. Assume that the liquidity premium on an N-year bond is (N- 1)*0.25%! To the nearest basis point, calculate the interest rates on the 2-year and 3-year Treasury notes, respectively, according to the Liquidity Premium Theory of interest rates. b. The Wall Street Journal reported interest rates of 3.56 percent, 3.61 percent, 3.63 percent, 3.66 percent, and 3.71 percent for three-year, four-year, five-year, six-year, and seven-year Treasury notes, respectively. Assume that the liquidity (maturity) premium on an N-year security is (N-1)*0.065%. Calculate (carry at least 4 decimals) the expected short-term rates in Years 4 & 7, respectively, according to the Liquidity Premium Theory of interest rates