Question: Please don't use excel or at least post write formula 2. Year A 0 -400,000 1 55,000 2 55,000 3 55,000 4 225,000 5 225,000

Please don't use excel or at least post write formula

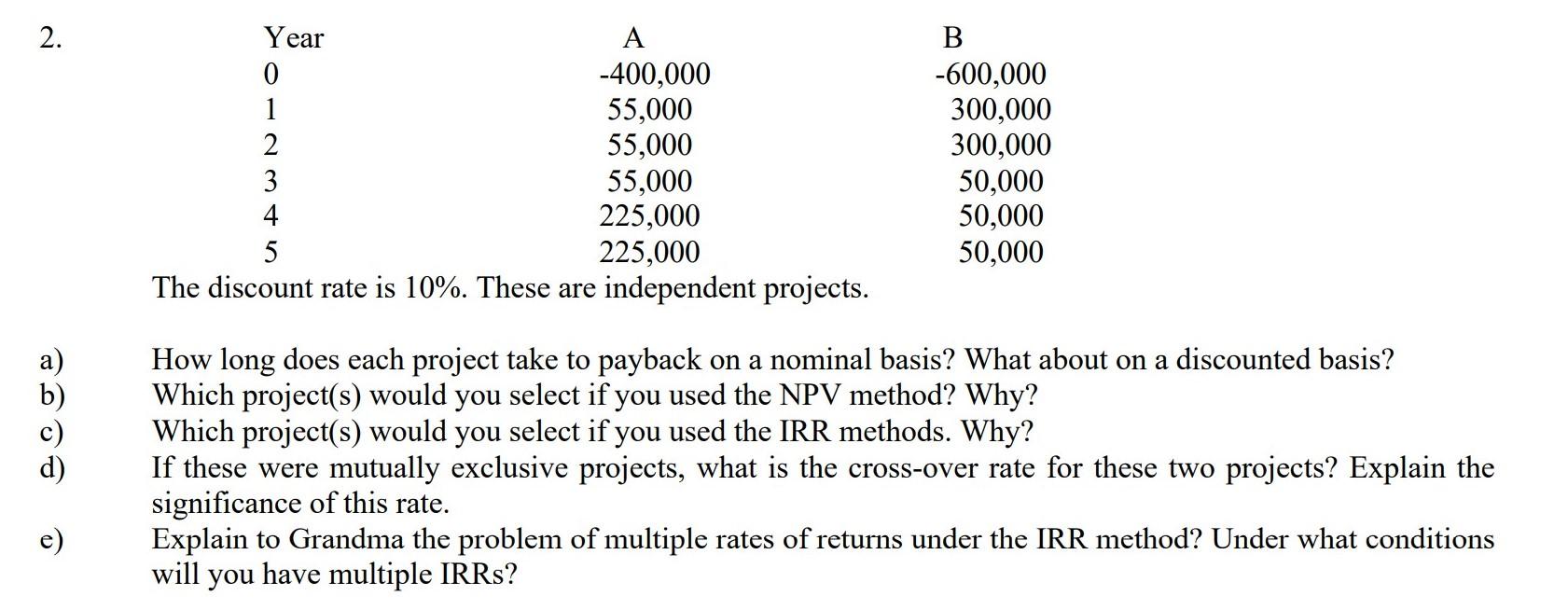

2. Year A 0 -400,000 1 55,000 2 55,000 3 55,000 4 225,000 5 225,000 The discount rate is 10%. These are independent projects. B -600,000 300,000 300,000 50,000 50,000 50,000 a) How long does each project take to payback on a nominal basis? What about on a discounted basis? Which project(s) would you select if you used the NPV method? Why? Which project(s) would you select if you used the IRR methods. Why? If these were mutually exclusive projects, what is the cross-over rate for these two projects? Explain the significance of this rate. Explain to Grandma the problem of multiple rates of returns under the IRR method? Under what conditions will you have multiple IRRs? e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts