Question: please don't use excel Question 1 - 20 Marks) Consider the following 3 projects: Project Y Z Co $10,000 $5,000 $6,500 CF $1,200 $1,000 $1,300

please don't use excel

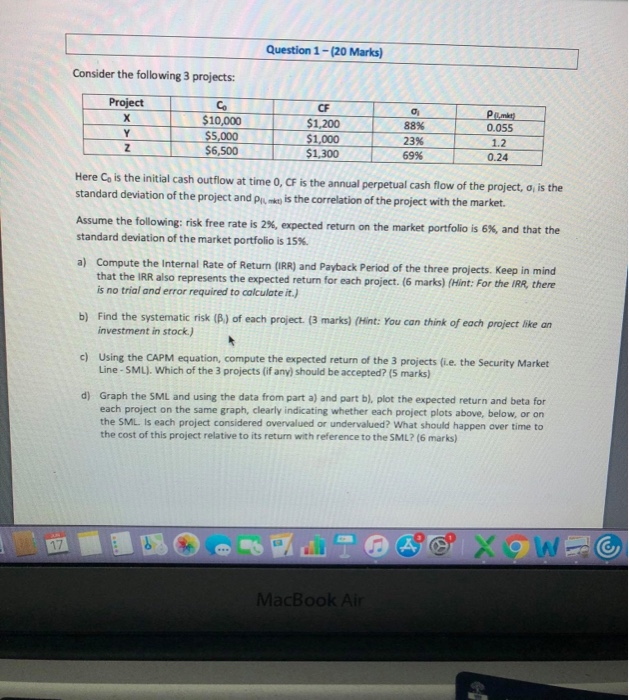

Question 1 - 20 Marks) Consider the following 3 projects: Project Y Z Co $10,000 $5,000 $6,500 CF $1,200 $1,000 $1,300 88% 23% 69% Pum! 0.055 1.2 0.24 Here Co is the initial cash outflow at time 0, CF is the annual perpetual cash flow of the project, is the standard deviation of the project and Pilnai is the correlation of the project with the market. Assume the following: risk free rate is 2%, expected return on the market portfolio is 6%, and that the standard deviation of the market portfolio is 15%. a) Compute the Internal Rate of Return (IRR) and Payback period of the three projects. Keep in mind that the IRR also represents the expected return for each project. (6 marks) (Hint: For the IRR, there is no trial and error required to calculate it.) b) Find the systematic risk (B) of each project. (3 marks) (Hint: You can think of each project like an investment in stock.) c) Using the CAPM equation, compute the expected return of the 3 projects i.e. the Security Market Line-SML). Which of the 3 projects (if any) should be accepted? (5 marks) d) Graph the SML and using the data from part a) and part b), plot the expected return and beta for each project on the same graph, clearly indicating whether each project plots above, below, or on the SML. Is each project considered overvalued or undervalued? What should happen over time to the cost of this project relative to its return with reference to the SML? (6 marks) X9W MacBook Air Question 1 - 20 Marks) Consider the following 3 projects: Project Y Z Co $10,000 $5,000 $6,500 CF $1,200 $1,000 $1,300 88% 23% 69% Pum! 0.055 1.2 0.24 Here Co is the initial cash outflow at time 0, CF is the annual perpetual cash flow of the project, is the standard deviation of the project and Pilnai is the correlation of the project with the market. Assume the following: risk free rate is 2%, expected return on the market portfolio is 6%, and that the standard deviation of the market portfolio is 15%. a) Compute the Internal Rate of Return (IRR) and Payback period of the three projects. Keep in mind that the IRR also represents the expected return for each project. (6 marks) (Hint: For the IRR, there is no trial and error required to calculate it.) b) Find the systematic risk (B) of each project. (3 marks) (Hint: You can think of each project like an investment in stock.) c) Using the CAPM equation, compute the expected return of the 3 projects i.e. the Security Market Line-SML). Which of the 3 projects (if any) should be accepted? (5 marks) d) Graph the SML and using the data from part a) and part b), plot the expected return and beta for each project on the same graph, clearly indicating whether each project plots above, below, or on the SML. Is each project considered overvalued or undervalued? What should happen over time to the cost of this project relative to its return with reference to the SML? (6 marks) X9W MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts