Question: Please don't use excel to calculate these, showing each step Question 7 (10 marks) a) Suppose that a March put option on a stock with

Please don't use excel to calculate these, showing each step

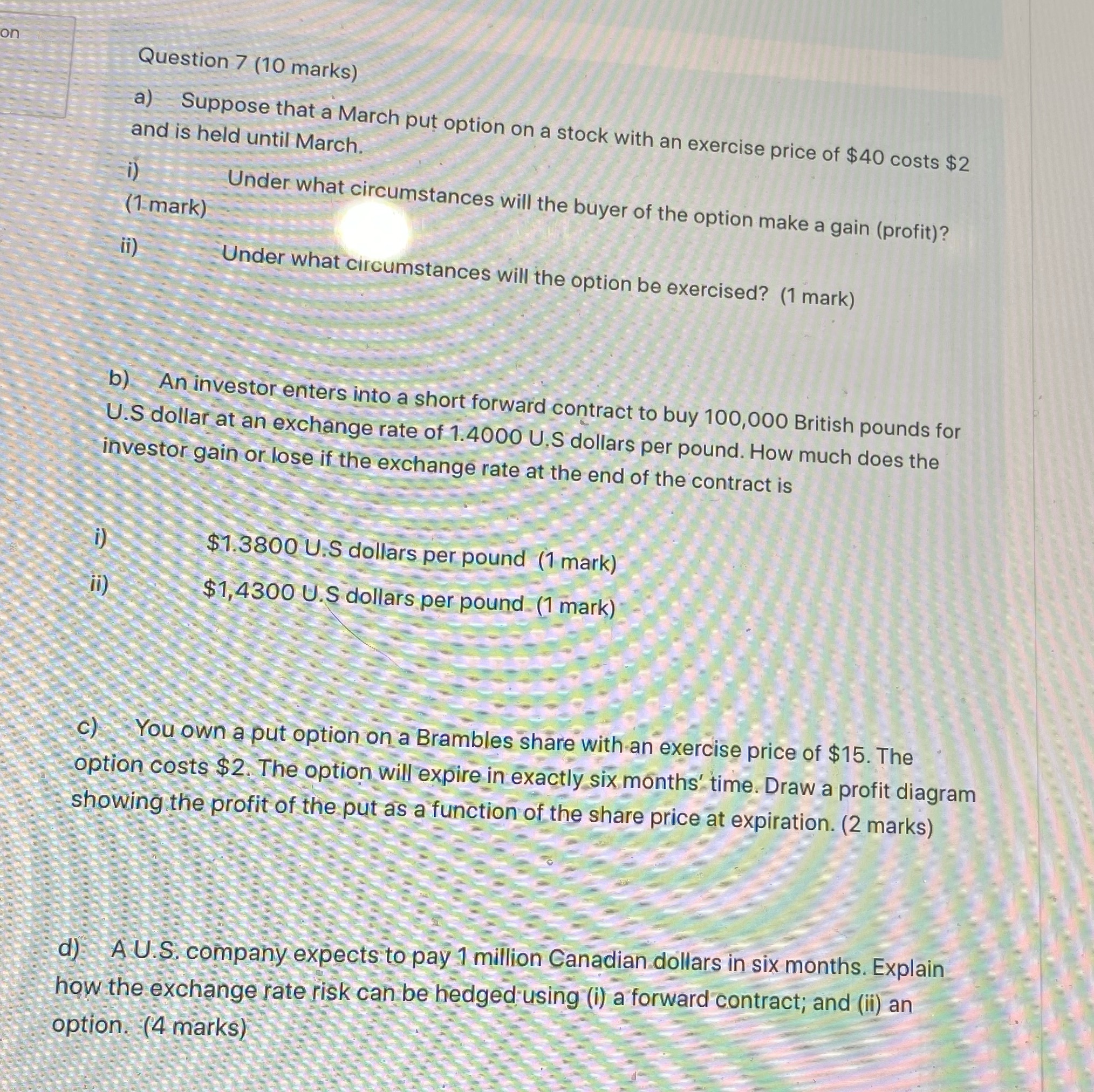

Question 7 (10 marks) a) Suppose that a March put option on a stock with an exercise price of $40 costs $2 and is held until March. i) Under what circumstances will the buyer of the option make a gain (profit)? (1 mark) ii) Under what circumstances will the option be exercised? (1 mark) b) An investor enters into a short forward contract to buy 100,000 British pounds for U.S dollar at an exchange rate of 1.4000 U.S dollars per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is $1.3800 U.S dollars per pound (1 mark) $1,4300 U.S dollars per pound (1 mark) c) You own a put option on a Brambles share with an exercise price of $15. The option costs $2. The option will expire in exactly six months' time. Draw a profit diagram showing the profit of the put as a function of the share price at expiration. (2 marks) d) A U.S. company expects to pay 1 million Canadian dollars in six months. Explain how the exchange rate risk can be hedged using (i) a forward contract; and (ii) an option. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts