Question: Please don't use excel to calculate these, showing each step Question 1 (15 marks) Use the following information to answer a) BHP Ltd S&P/ASX 200

Please don't use excel to calculate these, showing each step

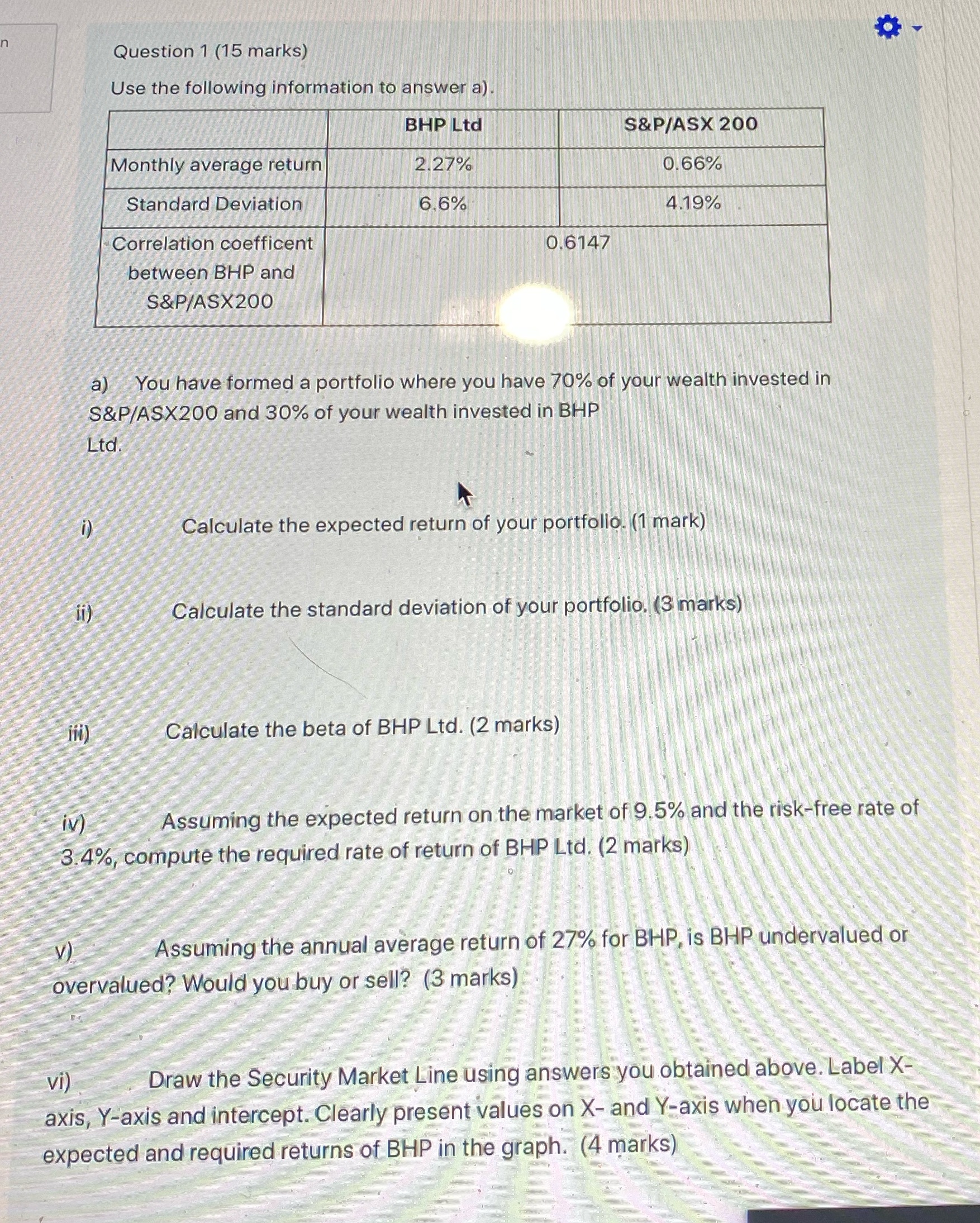

Question 1 (15 marks) Use the following information to answer a) BHP Ltd S&P/ASX 200 Monthly average return 2.27% 0.66% Standard Deviation 6.6% 4.19% Correlation coefficent 0.6147 between BHP and S&P/ASX200 a) You have formed a portfolio where you have 70% of your wealth invested in S&P/ASX200 and 30% of your wealth invested in BHP Ltd. Calculate the expected return of your portfolio. (1 mark) ii) Calculate the standard deviation of your portfolio. (3 marks) iii) Calculate the beta of BHP Ltd. (2 marks) iv) Assuming the expected return on the market of 9.5% and the risk-free rate of 3.4%, compute the required rate of return of BHP Lid. (2 marks) V ) Assuming the annual average return of 27% for BHP, is BHP undervalued or overvalued? Would you buy or sell? (3 marks) vi) Draw the Security Market Line using answers you obtained above. Label X- axis, Y-axis and intercept. Clearly present values on X- and Y-axis when you locate the expected and required returns of BHP in the graph. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts