Question: Please don't use excel to calculate these, showing each step Question 5 (11 marks) a) FIN222 Ltd owns assets that will be worth only $1,100

Please don't use excel to calculate these, showing each step

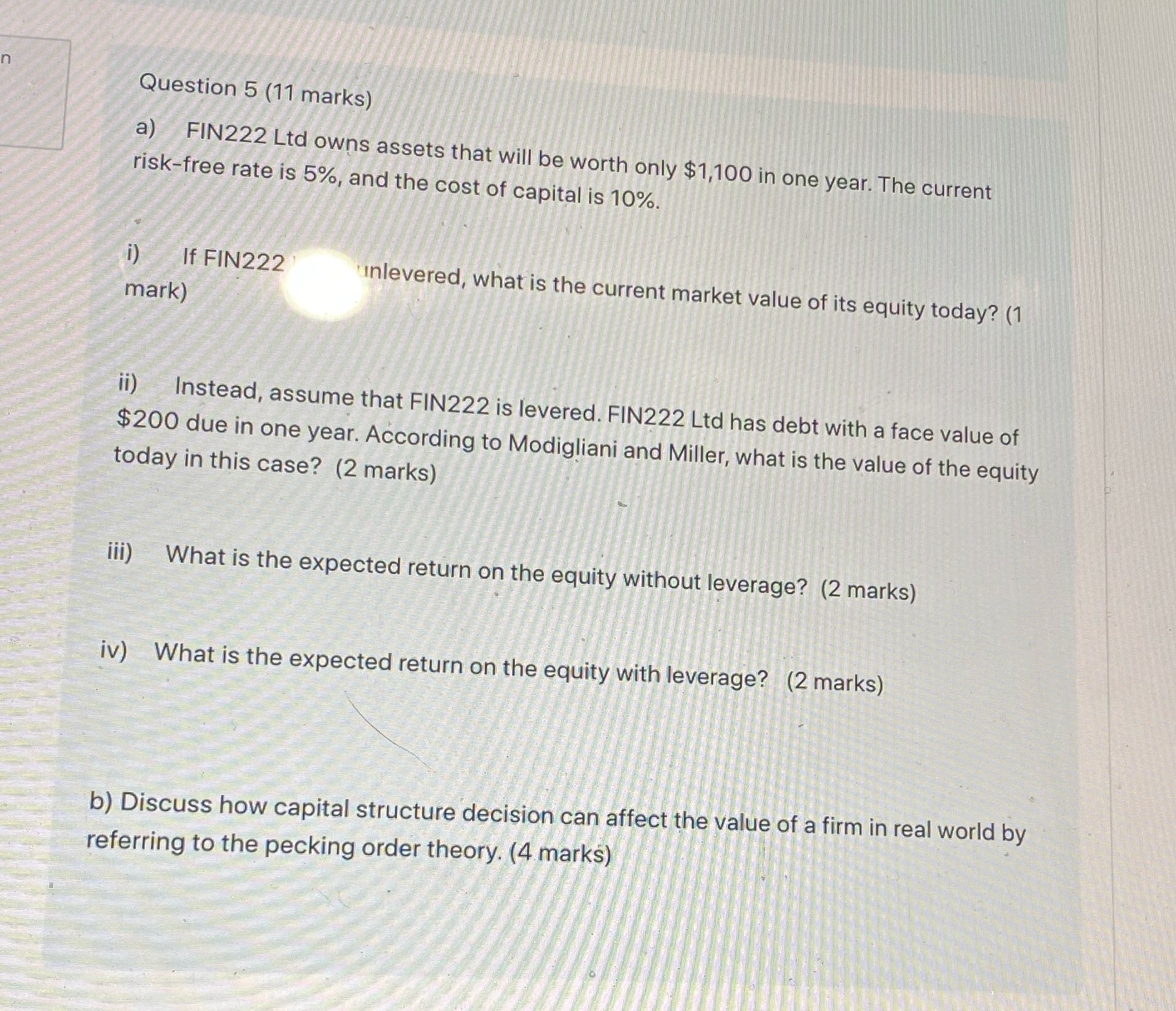

Question 5 (11 marks) a) FIN222 Ltd owns assets that will be worth only $1,100 in one year. The current risk-free rate is 5%, and the cost of capital is 10%. i) If FIN222 inlevered, what is the current market value of its equity today? (1 mark) ii) Instead, assume that FIN222 is levered. FIN222 Ltd has debt with a face value of $200 due in one year. According to Modigliani and Miller, what is the value of the equity today in this case? (2 marks) iii) What is the expected return on the equity without leverage? (2 marks) iv) What is the expected return on the equity with leverage? (2 marks) b) Discuss how capital structure decision can affect the value of a firm in real world by referring to the pecking order theory. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts