Question: PLEASE DONT USE EXCEL TO SOLVE!!!!! PLEASE SOLVE BY HAND SHOWING ALL WORK!!!!! THANK YOU!!!! 29. Consider a 3-year maturity annual 9% coupon paying bond

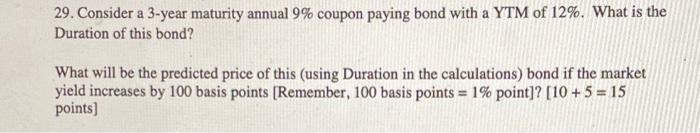

29. Consider a 3-year maturity annual 9% coupon paying bond with a YTM of 12%. What is the Duration of this bond? What will be the predicted price of this (using Duration in the calculations) bond if the market yield increases by 100 basis points (Remember, 100 basis points = 1% point)? [10 + 5 = 15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts